Gladstone Capital Corp (GLAD) Reports Mixed Q2 Earnings; Misses on EPS but Gains in Net Asset Value

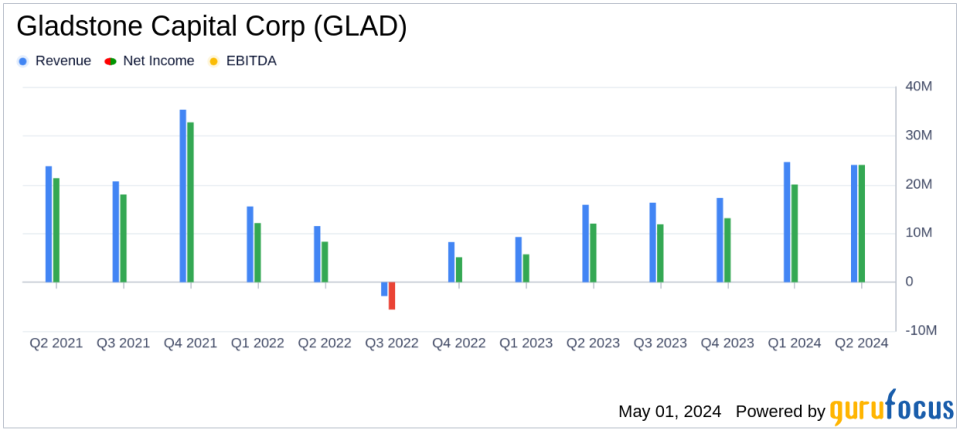

Revenue: Reported at $23.997 million for the quarter ended March 31, 2024, falling short of the estimated $24.14 million.

Net Investment Income: Totaled $10.777 million, below the estimated $12.07 million for the quarter.

Earnings Per Share (EPS): Recorded at $0.25, significantly below the estimated $0.56.

Net Increase in Net Assets: Amounted to $23.632 million from operations, indicating a robust quarter-over-quarter growth of 18.2%.

Total Investments: Valued at $791.588 million at fair value as of March 31, 2024, reflecting a 5.5% increase from the previous quarter.

Net Asset Value Per Share: Increased to $9.90, up 3.0% from $9.61 at the end of the previous quarter.

Weighted Average Yield: On interest-bearing investments rose slightly to 14.0%, compared to 13.9% in the previous quarter.

Gladstone Capital Corp (NASDAQ:GLAD) disclosed its financial results for the second quarter ended March 31, 2024, in its recent 8-K filing. The company, a key player in the asset management sector, reported a mixed financial performance, with a notable miss on the estimated earnings per share but an increase in net asset value per share.

Gladstone Capital Corp, an externally managed investment company, focuses on debt securities of established businesses. The company aims to provide stable earnings and cash flow to support its financial obligations and shareholder distributions, while seeking long-term capital appreciation through equity investments.

Quarterly Financial Performance

For the quarter ending March 31, 2024, GLAD reported total investment income of $23.997 million, a slight increase of 3.3% from the previous quarter. This rise was primarily driven by an increase in interest income, which went up by $0.7 million due to a higher weighted average principal balance of interest-bearing investments. Despite this, total expenses rose by 17.1% to $13.220 million, largely due to a $1.4 million increase in the net base management fee and reduced portfolio company fee credits.

Net investment income stood at $10.777 million, or $0.25 per share, falling short of the analyst's estimate of $0.56 per share. This represents a decrease of 9.7% compared to the previous quarter. However, the net asset value per common share increased from $9.61 to $9.90, reflecting a 3.0% growth, driven by $10.7 million of net unrealized appreciation recognized during the quarter.

Capital and Investment Activities

The company's total investments at fair value increased by 5.5% to $791.588 million as of March 31, 2024. This increase is indicative of the companys ongoing efforts to expand its investment portfolio and enhance shareholder value. However, total repayments and net proceeds saw a decline of 31.4%, amounting to $15.146 million.

Subsequent Events and Shareholder Distributions

Subsequent to the quarter end, GLAD announced distributions per common share totaling $0.495 for the second quarter of 2024. This consistency in distributions underscores the company's commitment to returning value to its shareholders despite fluctuating earnings.

Conference Call and Investor Communications

GLAD will hold an earnings release conference call to discuss the detailed quarterly results and provide further insights into its operational strategies and financial planning. The company remains transparent in its communications, offering both telephonic and online access to its discussions, ensuring stakeholders are well-informed of its financial health and strategic directions.

In summary, while Gladstone Capital Corp faced challenges in meeting the EPS estimates, its strategic investments and management of assets have led to an increase in overall net asset value, reflecting potential for long-term growth. Investors are encouraged to review the detailed financial statements and notes in the companys Form 10-Q to gain deeper insights into its operations and financial strategies.

Explore the complete 8-K earnings release (here) from Gladstone Capital Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance