Global $37.1 Bn Clinical Trials Support Services Markets to 2030: Increasing Number of CROs Providing Services & Rising Demand for Clinical Trials in Emerging Markets

Global Clinical Trials Support Services Market

Dublin, June 16, 2022 (GLOBE NEWSWIRE) -- The "Clinical Trials Support Services Market Size, Share & Trends Analysis Report by Service (Clinical Trial Site Management, Patient Recruitment Management), by Phase, by Sponsor, by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

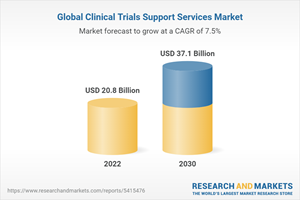

The global clinical trials support services market is expected to reach USD 37.1 billion by 2030, registering a CAGR of 7.5%

Increasing the number of CROs offering clinical trial support services, and huge investment in research & development by the pharmaceutical and biopharmaceutical companies are the key factors driving the market growth.

The industry felt the impact of the COVID-19 pandemic. The pandemic disrupted the supply chain to a severe extent in 2020. However, it also revealed ways to grow, either through M&A or through the adoption of digital technologies in clinical research.

Clinical trials encounter some concerning statistics, such as 85% of the clinical trials fail to recruit enough participants, 80% are delayed due to recruiting challenges, and the rate of dropout of participants is increasing. However, to overcome this, a patient retention strategy that is engaging and gives clarity is required.

It is critical to ensure that the informed consent materials are simple to grasp. According to a CISCRP study, 35% of trial participants who later dropped out stated that informed consent was difficult to comprehend. An average American is 7th to 8th grade educated, and it is critical to guarantee and analyze the material's readability before submitting it to the Institutional Review Board (IRB).

Adoption of virtual clinical trials across the clinical trials support services industry is one of the major factors that has boosted revenue growth post-pandemic. An increasing number of clinical research organizations are focusing on the adoption of virtual technologies to streamline their clinical research services.

According to the latest Annual CRO Report by the Veeva Unified Clinical Operations Survey, CROs are making significant advancements to speed up and modernize clinical trials.

Findings from Veeva Systems reflect that CROs have taken decisive action to streamline trial execution by adopting new technologies and digital strategies that replace manual processes, eradicate information siloes, and enable trial collaborations.

Clinical Trials Support Services Market Report Highlights

The clinical trial site management segment dominated the market with a revenue share of more than 43.9% in 2021. High cost associated with site monitoring and site recruitment is one the key factors for the largest share.

The phase III segment accounted for the maximum revenue share of 53.9% in the global market in 2021. Phase III clinical trials are highly expensive due to the involvement of huge subjects. The failure rate in this phase is the highest as the sample size and study design require complex dosing at an optimum level.

Pharmaceutical & biopharmaceutical companies dominated the market with the largest market share of 70.1% in 2021. Increasing R&D investments and the introduction of new drugs are primarily driving the segment market.

Asia Pacific is projected to be the registered fastest-growing CAGR of 8.5% during the forecast period.

Market Dynamics

Market Driver Analysis

High R&D Spending Of Pharmaceutical & Biotechnology Companies

Increasing Number Of Cros Providing Services

Rising Demand For Clinical Trials In Emerging Markets

Market Restraint Analysis

Absence Of Medical Infrastructure and Hi-Tech Instruments

Lack Of Adequate Regulatory Framework For Conducting Clinical Trials In Some Countries

Penetration & Growth Prospect Mapping

Porter's Five Forces Analysis

Pestel Analysis

Companies Mentioned

Charles River Laboratories International, Inc.

Wuxi Apptec, Inc

Iqvia Holdings, Inc

Syneos Health, Inc.

Eurofins Scientific

Ppd, Inc. (Pharmaceutical Product Development)

Icon plc

Laboratory Corporation of America Holdings (Labcorp)

Alcura

Parexel International Corporation

For more information about this report visit https://www.researchandmarkets.com/r/tkneta

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance