Global $512 Billion Healthcare Contract Manufacturing Markets to 2030 - Changing Regulatory Landscape Coupled with Rising Offshoring to Emerging Countries

Global Healthcare Contract Manufacturing Market

Dublin, June 16, 2022 (GLOBE NEWSWIRE) -- The "Healthcare Contract Manufacturing Market Size, Share & Trends Analysis Report by Type (Medical Devices, Pharmaceutical), by Region (North America, Europe, Asia Pacific, Latin America, MEA), and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

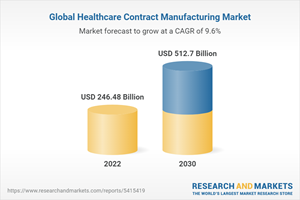

The global healthcare contract manufacturing market size is expected to reach USD 512.7 billion by 2030, expanding at a CAGR of 9.6%

The changing regulatory landscape coupled with rising offshoring to emerging countries is anticipated to propel the healthcare contract manufacturing market growth over the forecast period.

Many companies witnessed losses in sales and operating profit during the COVID-19 pandemic. As per Jabil, Inc., COVID-19 has increased expenses, primarily related to additional labor costs and procurement of PPE for employees globally, and has caused a reduction in factory utilization due to travel disruptions and restrictions.

Due to the emergence of infections, such as COVD-19 many organizations are attempting to accelerate production to meet the growing demand. Thus, these companies are appointing healthcare CMOs to speed up their production processes, as well as reduce their overall costs to meet the increasing demand for medical products.

The worldwide effort to develop a vaccine and therapeutic agent against COVID-19 has created the greatest opportunity for many large as well as small CMOs as the pharmaceutical companies are manufacturing vaccine doses on large scale. Hence we can say that the pandemic has had a positive impact on this industry.

Increasing demand for advanced products is another major factor driving the industry scale. Original equipment manufacturers (OEMs) are outsourcing the manufacturing activities of medical devices to third parties, mainly in developing countries to gain economic benefits.

Furthermore, these regions are witnessing rising cases of chronic conditions such as heart disorders, thereby positively affecting the market growth. Changes in reimbursement schemes are some of the major factors anticipated to increase the adoption of cost containment measures by OEMs.

For instance, to prevent reimbursement issues from impacting financing goals, device manufacturers are developing a well-planned reimbursement strategy in parallel with their regulatory and clinical strategies in the early phases of product development.

Healthcare Contract Manufacturing Market Report Highlights

The pharmaceutical segment dominated the market with a share of 74.8% in 2021 owing to a low manufacturing budget and highly sophisticated contract manufacturing service offerings.

The medical devices segment is expected to be the fastest-growing segment with a CAGR of 11.7% owing to increasing pressure on OEMs to reduce costs and enhance the timeline for taking a product to market.

Cardiology is the dominant segment in the medical device contract manufacturing market owing to the rising demand for cardiovascular devices as a result of the increasing prevalence of associated heart conditions.

Asia Pacific is the dominant region with a share of 45.7% in 2021 and is expected to witness lucrative growth owing to the presence of a large number of service providers, lower costs and growing demand for medical devices in the region.

Market Dynamics

Market Driver Analysis

Implementation of international standards by contract manufacturers

Drug shortage driving the demand for pharmaceutical development

Commercial success of biologics for clinical use

Market Restraint Analysis

Regulatory and legal compliance

Threat of information loss

Industry Challenges

Managing relationships

Contract Manufacturing Market Analysis Tools

Porter's Five Forces Analysis

PESTEL Analysis

Major Deals & Strategic Alliances Analysis

Mergers and acquisitions

Geographic expansion

Partnership

Impact of Covid-19 on Healthcare Contract Manufacturing Market

Company Profiles

Nordson Medical

Integer Holdings Corporation

Jabil Inc.

Viant

Flex Ltd.

Celestica Inc.

Sanmina Corporation

Plexus Corp.

Phillips Medisize

West Pharmaceutical Services, Inc.

Synecco

Catalent, Inc

For more information about this report visit https://www.researchandmarkets.com/r/if8pjx

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance