Global Aerospace Adhesives & Sealants (Solvent-borne, Water-borne, Hot-melt) Market Research Report 2021

Aerospace Adhesives & Sealants Market

Dublin, March 10, 2022 (GLOBE NEWSWIRE) -- The "Aerospace Adhesives & Sealants Market Share, Size, Trends, Industry Analysis Report, By Resin; By Aircraft; By Technology; By Application; By Region; Segment Forecast, 2021 - 2028" report has been added to ResearchAndMarkets.com's offering.

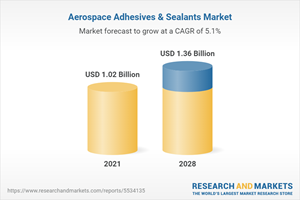

The global aerospace adhesives & sealants market size is expected to reach USD 1.36 billion by 2028

The gradual push towards lightweight airframes has expanded the usage of carbon-fiber composites in large aerospace structural applications such as fuselage, wings, and control surfaces. This intends to push the industry for adhesives and composite parts that cannot be riveted with metal fastening systems and are preferably being assembled and bonded using adhesive.

The epoxy resin segment remains the workhorse of the market driven by its high load-bearing capability, excellent chemical resistance, and extreme glass transition temperature resistance. It is also highly compatible with carbon-epoxy composite parts, which dominate aerospace composite applications. These extensive characteristics of epoxy resins are attributed to driving the market demand for epoxy resin-based adhesive & sealants during the forecast period.

North America to retain its gigantic share in the global demand driven by its ever-increasing push in escalating usage of high-end composite materials and adhesives and sealants in new and upcoming aircraft platforms. Boeing's B777x, an upcoming wide-body aircraft, has incorporated carbon-epoxy prepreg composite materials into its primary structures such as empennage, floor beams, and in its wings, which is believed to be the world's largest composite wing so far.

This is likely to s- U.Stantiate penetration of the bonding solutions which are the prime bonding solutions for composite-based parts and structures. The region's leadership is also backed by its dominance in military aircraft and business jet production. Industry participants such as 3M, Huntsman International LLC., PPG Industries Inc., Henkel AG & Co., Cytec Solvay Group, Bostic, Hexcel Corporation, DowDuPont, H.B. Fuller, Lord Corporation are some of the key players competing in the global demand.

Major adhesive suppliers have been launching technologically advanced products to serve the market with a unique set of offerings. In June 2021, Solvay SA announced the launch of new AeroPaste 1000, 1009, 1100 adhesive pastes to increase part assembly efficiency, process flexibility thereby enabling rapid assembly and automation.

Key Topics Covered:

1. Introduction

1.1. Report Description

1.2. Stakeholders

2. Executive Summary

2.1. Market Highlights

3. Research Methodology

3.1. Overview

3.2. Data Products

4. Aerospace Adhesives & Sealants Market Insights

4.1. Aerospace Adhesives & Sealants Market - Industry snapshot

4.2. Aerospace Adhesives & Sealants Market Dynamics

4.2.1. Drivers and Opportunities

4.2.1.1. Investment in research & development

4.2.1.2. Rising passenger traffic with increasing disposable income

4.2.2. Restraints and Challenges

4.2.2.1. Regulatory and compliance constraints

4.2.3. Porter's Five Forces Analysis

4.2.4. PESTLE Analysis

4.2.5. Aerospace Adhesives & Sealants Market Industry trends

4.2.6. COVID-19 Impact Analysis

5. Aerospace Adhesives & Sealants Market Assessment by Resin

5.1. Key Findings

5.2. Introduction

5.2.1. Global Aerospace Adhesives & Sealants Market, by Resin, 2016 - 2028 (USD Billion)

5.3. Epoxy

5.4. Polyurethane

5.5. Silicone

6. Aerospace Adhesives & Sealants Market Assessment by Aircraft

6.1. Key Findings

6.2. Introduction

6.2.1. Global Aerospace Adhesives & Sealants Market, by Aircraft, 2016 - 2028 (USD Billion)

6.3. Commercial Aircraft

6.4. Regional Transportation Aircraft

6.5. General Aviation

6.6. Military Aircraft

6.7. Spacecraft

7. Global Aerospace Adhesives & Sealants Market, by Technology

7.1. Key Findings

7.1.1. Global Aerospace Adhesives & Sealants Market, by Technology, 2016 - 2028 (USD Billion)

7.2. Solvent-borne

7.3. Water-borne

7.4. Hot-melt

7.4.1. Global Aerospace Adhesives & Sealants Market, by Hot-melt, By Region, 2016 - 2028 (USD Billion)

8. Global Aerospace Adhesives & Sealants Market, by Application

8.1. Key Findings

8.2. Introduction

8.2.1. Global Aerospace Adhesives & Sealants Market, by Application, 2016 - 2028 (USD Billion)

8.3. Structural

8.4. Non-Structural

9. Aerospace Adhesives & Sealants Market Assessment by Geography

9.1. Key findings

9.2. Introduction

9.2.1. Aerospace Adhesives & Sealants Market Assessment, By Geography, 2016 - 2028 (USD Billion)

10. Competitive Landscape

10.1. Expansion and Acquisition Analysis

10.1.1. Expansion

10.1.2. Acquisitions

10.2. Partnerships/Collaborations/Agreements/Exhibitions

11. Company Profiles

11.1. Company Overview

11.2. Financial Performance

11.3. Product Benchmarking

11.4. Recent Developments

3M

Beacon Adhesives

Bostik (Arkema)

Cytec Solvay Group

Delo Industrial Adhesives

DowDuPont

Dymax Corporation

General Sealants

H. B. Fuller

Henkel AG & Co. KGaA

Hernon Manufacturing

Hexcel Corporation

Huntsman Corporation

Hylomar Limited

Illinois Tool Works Inc.

L&L Products

Lord Corporation

Master Bond

Parson Adhesives

Permabond

PPG Industries

Scigrip Adhesives

Sika AG

The Reynolds Company

Uniseal

For more information about this report visit https://www.researchandmarkets.com/r/dy2n5x

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance