Global Aerospace and Defense Telemetry Market Analysis Report 2022-2027: Opportunities in the Development of Low-Cost and Miniaturized Telemetry Systems & Demand for High Rate of Data Transmission

Aerospace and Defense Telemetry Market

Dublin, June 14, 2022 (GLOBE NEWSWIRE) -- The "Aerospace and Defense Telemetry Market by Platform (Ground, Airborne, Marine, Space, Weapons, UAVs), Technology (Wired and Wireless Telemetry), Component ( Receiver, Transmitter, Antenna, Processors), Application, Region - Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

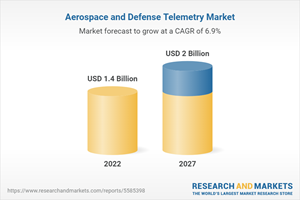

The Aerospace and Defense Telemetry Market is estimated to be USD 1.4 billion in 2022 and is projected to reach USD 2.0 billion by 2027, at a CAGR of 6.9% from 2022 to 2027.

Factors such as increase in airspace modernization programs, demand for high rate data transmission, and development of low-cost miniaturized telemetry systems are driving factors assisting the growth of the aerospace and defense telemetry market.

L3Harris Technologies (US), Airbus (Netherlands), General Dynamics (US), Honeywell International Inc (US), and Maxar Technologies (US) are among the leading players operating in the aerospace & defense telemetry platform market.

These players have spread their business across various countries includes North America, Europe, Asia Pacific, and Rest of the World. COVID-19 has affected the aerospace and defense telemetry market growth to some extent, and this varies from country to country.

UAVs: The fastest-growing segment of the aerospace and defense telemetry market, by the platform

Based on platform, the aerospace and defense telemetry market has been segmented into ground, airborne, marine, space, weapons, and UAVs. The UAVs segment is projected to grow at the highest CAGR during the forecast period.

Wireless telemetry: The fastest-growing segment of the aerospace and defense telemetry market, by technology

The wireless telemetry segment is projected to grow at the highest CAGR. The growth can be attributed due to the high rate of adoption of wireless telemetry due to the ease of usage and maintenance.

Receiver: The fastest-growing and leading segment of the aerospace and defense telemetry market, by component

The defense segment of the aerospace and defense telemetry market has been classified into different components. The growth of the component segment of the aerospace and defense telemetry market can be attributed to the increased use of various technologically advanced receivers for receiving the large set of data through signalsfrom several parts of the world across multiple platforms.

North America: The largest contributing region in the aerospace and defense telemetry market

The aerospace and defense telemetry market in the North American region has been studied for the US and Canada. North American countries are awarding a number of contracts to major players of the aerospace and defense telemetry market for the delivery of telemetry system, and components, thus driving the growth of the aerospace and defense telemetry market in the region.

Premium Insights

Increasing Demand for UAVs and Satellites Drives Market Growth

Ground Platform to Command Market from 2018 to 2027

Commercial Subsegment to Dominate Market from 2018 to 2027

Wireless Technology to Lead Market from 2018 to 2027

India Projected to be Fastest-Growing Market from 2022 to 2027

Industry Trends

Technology Trends

Multi-Material 3D Printing of Components

Miniaturization of Antennas

Development of Active Electronically Scanned Array (Aesa)

Optoelectronic Solutions

Military Analog to Digital Converters (Adc) in Telemetry Systems

Increasing Use of Open Architecture Software

Advanced Computer Operated Radio Frequency

Increase in Use of Software-Defined Radio

Technology Analysis

Use Case Analysis

Ultra-Rugged Inertial Measurement Units

Next-Generation Digital Cabin Pressure Control and Monitoring System for Aircraft

Impact of Megatrends

Development of Smart Antennas

Multi-Band, Multi-Mission (Mbmm) Antenna

Hybrid Beamforming Methods

Market Dynamics

Drivers

Increase in Airspace Modernization Programs

Increasing Demand for Military UAVs

Emergence of Modern Warfare Systems

Development of Compact Telemetry Systems for UAVs

Customized Satcom-On-The-Move Solutions for Unmanned Ground Vehicles

Increasing Defense Budget of Countries

Restraints

Long Product Certification Duration

High Development and Maintenance Cost of Infrastructure

Opportunities

Development of Low-Cost and Miniaturized Telemetry Systems

Demand for High Rate of Data Transmission

Challenges

Lack of Skilled Workforce

Electromagnetic Compatibility Challenges in Military Vehicles

System Requirement and Design Constraints

Trends/Disruption Impacting Customer Business

Revenue Shift and New Revenue Pockets for Aerospace & Defense Telemetry Manufacturers

Revenue Shift for Aerospace & Defense Telemetry Market Players

Aerospace & Defense Telemetry Market Ecosystem

Prominent Companies

Private and Small Enterprises

Market Ecosystem

Patent Analysis

Innovation & Patent Registration, 2013-2021

Company Profiles

Airbus

BAE Systems

Cobham Advanced Electronic Solutions

Collins Aerospace

Curtiss-Wright Corporation

General Dynamics Corporation

Honeywell International Inc.

Jda Systems

Kongsberg

L3Harris Technologies

Lockheed Martin Corporation

Maxar Technologies

Norsat International Inc.

Rami

Rohde & Schwarz

Ruag International Holding Ltd.

Safran Group

Spectrum Antenna & Avionics Systems (P) Limited

Te Connectivity Ltd.

Tecom Industries, Inc

Thales Group

Ultra Electronics

Verdant Telemetry & Antenna Systems

Viasat Inc.

For more information about this report visit https://www.researchandmarkets.com/r/1tau7c

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance