Global Artificial Intelligence in Manufacturing Market Report 2022 to 2028: Players Include Google, Micron Technology, Siemens and General Electric

Global Artificial Intelligence in Manufacturing Market

Dublin, Nov. 22, 2022 (GLOBE NEWSWIRE) -- The "Global Artificial Intelligence in Manufacturing Market Size, Share & Industry Trends Analysis Report by Offering, Application, Technology, Industry, Regional Outlook and Forecast, 2022-2028" report has been added to ResearchAndMarkets.com's offering.

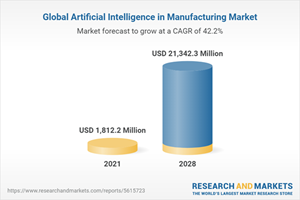

The Global Artificial Intelligence in Manufacturing Market is expected to reach $21.3 billion by 2028, rising at a market growth of 42.2% CAGR during the forecast period.

In recent years, artificial intelligence has become one of the fastest-growing technology. AI is linked to human intellect and shares similar traits like language comprehension, thinking, learning, problem solving, and so on. In the development and revision of such a technology, manufacturers in the market face huge underlying intellectual obstacles. AI is at the heart of the market's next-generation software technologies.

The implementation of artificial intelligence in the manufacturing sector is growing due to increased automation in the manufacturing industry and increased demand for big data integration. Moreover, the artificial intelligence in manufacturing market is being driven by the increased use of machine vision cameras in industrial applications such as machinery inspection, material movement, field service, and quality control.

Furthermore, leading market players are employing a variety of methods, such as product launch and product innovation, to increase their current product portfolio and maintain competition in the quickly expanding AI industry. Oracle, for example, released new artificial intelligence-based apps for supply chain, manufacturing, and other professionals in October 2017. IBM released Watson Assistant, an AI-powered business assistant, in 2018. This product is an artificial intelligence-enabled smart enterprise assistant.

Artificial intelligence (AI) in manufacturing supply chains can forecast demand trends for items across time, socioeconomic segments, and geographical marketplaces. Prominent corporations are incorporating AI into their systems in order to boost client happiness. For example, GE launched the Brilliant Manufacturing Suite to enable customers to create their Brilliant Factory concept.

Moreover, the use of automation and big data in the manufacturing business reduces risks throughout manufacturing processes and allows customers to receive rapid responses, improving the customer experience. However, some human vocations are projected to be replaced by AI-based technological systems in the near future.

COVID-19 Impact Analysis

To stop the spread of the COVID-19 pandemic, unprecedented lockdowns were enacted around the world, and many manufacturing units were shut down. The pandemic wreaked havoc on the global population and the virus killed millions of people around the world. It also had a drastically negative impact on the manufacturing sector.

The disposable income of many people dropped. This resulted in lower demand for industrial items and, as a result, slowed global economic activity. Many countries are in the process of recovering from the ill effects of the pandemic. Improvements in manufacturing plant operating efficiency, rising application of AI in intelligent business operations, and increasing deployment of automation technologies to mitigate the consequences of COVID-19 are all prospects for AI in the manufacturing industry.

Market Growth Factors

Developing Industrial IoT and Automation Technologies

The Industrial Internet of Things (IIoT) enables an architecture that offers real-time information about operational and business systems, making industrial operations more efficient, productive, and inventive. The data collected by IoT devices must be transformed into instructions that tell machines how to execute specific tasks.

These instructions were created by an AI system that used deep learning, context awareness, and natural language processing to learn human behavior (NLP). AI-based systems function faster and are less likely to make mistakes. As a result, manufacturing efficiency improves, assisting in business expansion.

Demand for AI in Manufacturing Being Driven by Increasing Volume of Complex Datasets

Companies in the manufacturing industry have access to a wealth of data collection and tracking resources. Big data, also known as sensor data, production data, IoT-driven systems, and manufacturing software, is exceedingly massive and difficult for humans to understand.

Since vast volumes of structured and unstructured data from a variety of sources can be examined rapidly, AI and big data analytics have emerged as viable solutions for important manufacturing concerns.

Organizations can interpret data and detect anomalies using AI and machine learning algorithms, minimize maintenance costs, improve customer service, increase predictive and preventative maintenance, and use raw data to support decision-making.

Market Restraining Factors

Hesitancy Among Manufacturers to Adopt AI-based Technologies

Artificial intelligence (AI) provides firms with tools to improve their predictive maintenance and machinery inspection processes. But, manufacturers, on the other hand, are hesitant to incorporate new technologies, particularly AI-based solutions, into their expensive machines and equipment.

Any errors in management could increase the costs. Furthermore, many manufacturers are skeptical of AI-based systems' ability to accurately perform maintenance and inspection tasks. Given these considerations, persuading manufacturers and persuading them that AI-based solutions are cost-effective, effective, and safe is a little more difficult. However, some manufacturers are increasingly accepting of the potential benefits of AI-based solutions and the range of applications they can support.

Report Attribute | Details |

No. of Pages | 359 |

Forecast Period | 2021 - 2028 |

Estimated Market Value (USD) in 2021 | $1812.2 Million |

Forecasted Market Value (USD) by 2028 | $21342.3 Million |

Compound Annual Growth Rate | 42.2% |

Regions Covered | Global |

Key Topics Covered:

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Market Share Analysis, 2020

3.4 Top Winning Strategies

3.4.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.4.2 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2018, Aug - 2022, Mar) Leading Players

Chapter 4. Global Artificial Intelligence in Manufacturing Market by Offering

4.1 Global Software Market by Region

4.2 Global Hardware Market by Region

4.3 Global Services Market by Region

Chapter 5. Global Artificial Intelligence in Manufacturing Market by Application

5.1 Global Predictive maintenance & Machinery Inspection Market by Region

5.2 Global Inventory Optimization Market by Region

5.3 Global Quality Control Market by Region

5.4 Global Cybersecurity Market by Region

5.5 Global Industrial robots Market by Region

5.6 Global Field Services Market by Region

5.7 Global Production Planning Market by Region

5.8 Global Others Market by Region

Chapter 6. Global Artificial Intelligence in Manufacturing Market by Technology

6.1 Global Machine Learning Market by Region

6.2 Global Computer Vision Market by Region

6.3 Global Natural Language Processing Market by Region

6.4 Global Context-aware Computing Market by Region

Chapter 7. Global Artificial Intelligence in Manufacturing Market by Industry

7.1 Global Automotive Market by Region

7.2 Global Food & Beverage Market by Region

7.3 Global Pharmaceutical Market by Region

7.4 Global Heavy Metals & Machine Manufacturing Market by Region

7.5 Global Semiconductor & Electronics Market by Region

7.6 Global Others Market by Region

Chapter 8. Global Artificial Intelligence in Manufacturing Market by Region

Chapter 9. Company Profiles

9.1 NVIDIA Corporation

9.1.1 Company Overview

9.1.5 Recent Strategies and Developments

9.1.5.1 Partnerships, Collaborations, and Agreements:

9.1.5.2 Product Launches and Product Expansions:

9.2 Cisco Systems, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Regional Analysis

9.2.4 Research & Development Expense

9.2.5 Recent Strategies and Developments

9.2.5.1 Partnerships, Collaborations, and Agreements:

9.3 Microsoft Corporation

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 Recent Strategies and Developments

9.3.5.1 Partnerships, Collaborations, and Agreements:

9.4 IBM Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Regional & Segmental Analysis

9.4.4 Research & Development Expenses

9.4.5 Recent Strategies and Developments

9.4.5.1 Partnerships, Collaborations, and Agreements:

9.4.5.2 Acquisitions and Mergers:

9.5 Intel Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent Strategies and Developments

9.5.5.1 Partnerships, Collaborations, and Agreements:

9.5.5.2 Product Launches and Product Expansions:

9.6 Oracle Corporation

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expense

9.6.5 Recent Strategies and Developments

9.6.5.1 Product Launches and Product Expansions:

9.7 Google LLC

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expense

9.7.5 Recent Strategies and Developments

9.7.5.1 Partnerships, Collaborations, and Agreements:

9.8 Micron Technology, Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expense

9.9 Siemens AG

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expense

9.9.5 Recent Strategies and Developments

9.9.5.1 Partnerships, Collaborations, and Agreements:

9.9.5.2 Product Launches and Product Expansions:

9.10. General Electric (GE) Co.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 Research & Development Expense

For more information about this report visit https://www.researchandmarkets.com/r/749h14

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance