Global Battery Electrolyte Market Report 2022: Increasing Research Activities to Develop New Electrolytes Presents Opportunities

Global Battery Electrolyte Market

Dublin, Sept. 02, 2022 (GLOBE NEWSWIRE) -- The "Global Battery Electrolyte Market by Battery Type (Lead-Acid and Lithium-Ion), Electrolyte Type (Liquid, Gel, Solid), End-Use (EV, Consumer Electronics, Energy Storage) and Region (APAC, North America, Europe, South America, and MEA) - Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

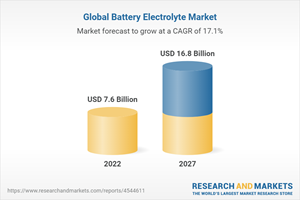

The market size of battery electrolyte is estimated to grow from USD 7.6 billion in 2022 to USD 16.8 billion by 2027, at a CAGR of 17.1% during the forecast period. The battery electrolyte market is expected to grow at a moderate rate over the next five years, owing to rapid technological advancements and expansion in the energy storage and electric vehicle industry.

Energy storage is the fastest growing segment of battery electrolyte market by end-use

The battery electrolyte market by end-use is segmented into electric vehicle, comsumer electronics, energy storage and others. The energy storage segment is estimated to grow at the fastest rate owing to the increase in demand for batteries in energy storage industry. There are various initiatives taken by government of different countries such as India and China to enhance the demand for energy storage. This will propel the demand for batteries, creating the market for battery electrolyte.

By electrolyte type, liquid electrolyte segment is expected to account for the largest market share during the forecast period

By electrolyte type, liquid electrolyte segment accounted for the largest segment in the battery electrolyte market, in 2021, in terms of value. Liquid electrolyte is used in lead acid as well as lithium-ion batteries. These batteries are generally used in energy storage and electric vehicles. Owining to increasing demand for electric vehicles and energy storage systems, the liquid battery electrolyte market is expected to have the largest market share during the forecasted period.

Asia Pacific has largest market share region for battery electrolyte market in 2021

Asia Pacific is one of the major market for battery electrolyte, in terms of value. The region accounted for the largest market for battery electrolyte in 2021, and this dominance is expected to continue during the forecast period as well. Key countries in the Asia Pacific battery electrolyte market include China, Japan, South Korea, and India, which dominated the region's overall market in terms of value in 2021. The growing demand for electric vehicles, and consumer electronics in emerging countries of Asia Pacific are expected to drive the growth of the battery electrolyte market in the region.

Premium Insights

Battery Electrolyte Market to Witness Moderate Growth During Forecast Period

Asia-Pacific to Account for Largest Share of Battery Electrolyte Market During Forecast Period

Lead-Acid Battery Accounted for Larger Market Share in 2021

Liquid Electrolyte Accounted for Larger Market Share in 2021

Electric Vehicles Segment Accounted for Largest Market Share in 2021

Market Dynamics

Drivers

Growth in Demand for Batteries in Key Industries

Growing Need for Battery-Operated Material-Handling Equipment in Industries due to Automation

Restraints

Lack of Efficient Recycling Technologies for Battery Materials

Opportunities

Increasing Research Activities to Develop New Electrolytes

Challenges

Lack of Government Subsidies and Incentives for Lithium-Ion Battery Manufacturers in Emerging Markets

Safety Related to Battery Usage

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Battery Electrolyte Patent Analysis

7 Battery Electrolyte Market, by Battery Type

8 Battery Electrolyte Market, by Electrolyte Type

9 Battery Electrolyte Market, by End Use

10 Battery Electrolyte Market, by Region

11 Competitive Landscape

12 Company Profiles

13 Appendix

Companies Mentioned

3M

American Elements

Basf Corporation

Capchem

Daikin America, Inc.

Enchem Co., Ltd.

Gs Yuasa International Ltd.

Guangdong Jinguang High-Tech Co., Ltd.

Guangzhou Tinci Materials Technology Co., Ltd.

Hitachi, Ltd.

Hopax

Lg Chem

Mitsubishi Chemical Corporation

Morita Chemical Industries Co., Ltd.

Nei Corporation

Nohms Technologies, Inc.

Ohara Inc.

Shanshan Co., Ltd.

Stella Chemifa Corporation

Tokyo Chemical Industry Co., Ltd.

Ube Corporation

Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/njohht

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance