Global Carbon Capture Utilization and Storage Market Report to 2031 - Focus on Application, Type and Region

Carbon Capture Utilization and Storage Market

Dublin, June 17, 2022 (GLOBE NEWSWIRE) -- The "Carbon Capture Utilization and Storage Market - A Global and Regional Analysis: Focus on Application, Type, and Region - Analysis and Forecast, 2022-2031" report has been added to ResearchAndMarkets.com's offering.

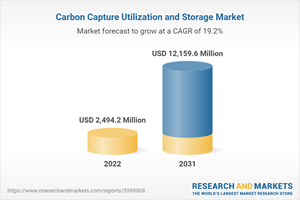

The global carbon capture utilization and storage (CCUS) market was valued at $2,100.0 million in 2021 and is expected to reach $12,159.6 million by 2031, growing at a CAGR of 19.2% between 2022 and 2031.

The growth in the global carbon capture utilization and storage market is expected to be driven by an increasing focus on reducing carbon emissions and the growing demand for enhanced oil recovery (EOR). Lack of storage facilities and leakage of CO2 from underground storage are some key restraining factors of the industry.

Market Lifecycle Stage

The global carbon capture utilization and storage market is still in a nascent phase. New capturing technologies such as bio-based capturing and membrane capturing are expected to reduce the carbon capture process cost.

Industrial Impact

With an increased worldwide focus on achieving net-zero emissions, the shift to eco-friendly industrial practices increases financing opportunities. The shift is more prominent in the oil and gas industry in regions such as North America and the Middle East. The U.S. has the largest carbon capture utilization and storage industry as oil and gas companies use captured carbon for enhanced oil recovery.

Impact of COVID-19

The impact of COVID-19 on carbon capture utilization and storage (CCUS) was limited as it has still not been commercialized. Also, most investments toward CCUS plants were announced prior to the pandemic and are currently in the construction phase.

The new plants, such as the iCORD project in Croatia and Dry Fork Power Plant in the U.S., will start operation in 2025. Therefore, due to the delayed nature of the industry, it did not suffer any significant impact.

Recent Developments in Global Carbon Capture Utilization and Storage Market

In March 2022, ExxonMobil Corporation announced hydrogen production facility, carbon capture, and storage projects at its integrated refining and petrochemical site in Baytown, Texas, U.S. This would support companies in reducing emissions from local industries and company operations.

In November 2021, ExxonMobil Corporation and Petronas signed a Memorandum of Understanding (MoU) to collaborate and jointly explore potential carbon capture and storage projects in Malaysia. This MoU would strengthen a decades-long strategic partnership between ExxonMobil and Petronas and has the objective of helping Malaysia reduce emissions and achieve its net-zero ambitions.

In May 2021, Linde plc was selected by the U.S. Department of Energy's National Energy Technology Laboratory (NETL) to install and test a 200 tons/day CO2 capture large pilot plant at the City Water, Light & Power (CWLP) power plant in Springfield, IL. The project would be executed in collaboration with the BASF, the University of Illinois at Urbana Champaign, ACS, and CWLP. The operation of this facility provides an opportunity to demonstrate economically attractive and innovative capture techniques.

In May 2021, Linde plc was selected by the U.S. Department of Energy's National Energy Technology Laboratory (NETL) to install and test a 200 tons/day CO2 capture large pilot plant at the City Water, Light & Power (CWLP) power plant in Springfield, IL. The project will be executed in collaboration with the BASF, the University of Illinois at Urbana Champaign, ACS, and CWLP.

Demand - Drivers and Limitations

Following are the demand drivers for the global carbon capture utilization and storage market:

Favorable Government Policies Driving the Deployment of CCUS Technology

Increasing Demand for CO2 for Enhanced Oil Recovery (EOR)

Rise in Adoption of Net-Zero Emissions Targets

The market is expected to face some limitations too due to the following challenges:

High Initial Cost of Carbon Capture Utilization and Storage Process

CO2 Leakage from the Underground Storage Reservoirs

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of technology available for carbon capture and their potential globally. Moreover, the study provides the reader a detailed understanding of the different carbon capture utilization and storage application in industries such as the oil and gas industry, power industry, and others (cement and chemical industry).

Growth/Marketing Strategy: Business expansion, partnership, collaboration, and joint venture are some key strategies adopted by key players operating in the space. For instance, in March 2022, ExxonMobil Corporation announced its plans for a hydrogen production facility and one of the world's largest carbon capture and storage projects at its integrated refining and petrochemical site in Baytown, Texas, U.S. This supports companies' efforts to reduce emissions from local industries and company operations. This project can play an important role in achieving the country's goal of reducing emissions.

Competitive Strategy: Key players in the global carbon capture utilization and storage market analyzed and profiled in the study involve technology providers and companies capturing, utilizing, and storing carbon. Moreover, a detailed competitive benchmarking of the players operating in the global carbon capture utilization and storage market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

Fluor Corporation

ExxonMobil Corporation

Linde plc

Shell plc

Mitsubishi Heavy Industries, Ltd

JGC Holdings Corporation

Equinor ASA

Schlumberger Limited

Aker Carbon Capture

Carbon Clean Solutions Limited

C-Capture

Halliburton

Siemens

Hitachi, Ltd

Honeywell International Inc

Mirreco

SeeO2 Energy Inc.

Neustark AG

CarbonFree

Cemvita Factory Inc.

Key Topics Covered:

1 Markets

1.1 Industry Outlook

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Favorable Government Policies Driving the Deployment of CCUS Technology

1.2.1.2 Increasing Demand for CO2 for Enhanced Oil Recovery (EOR)

1.2.1.3 Rise in Adoption of Net-Zero Emissions Targets

1.2.2 Business Challenges

1.2.2.1 High Initial Cost of Carbon Capture Utilization and Storage Process

1.2.2.2 CO2 Leakage from the Underground Storage Reservoirs

1.2.3 Business Strategies

1.2.3.1 Product Developments

1.2.3.2 Market Developments

1.2.4 Business Opportunity

1.2.4.1 Increasing Investment to Setup New Industrial Plants in Growing Economies

1.2.4.2 Upcoming Policies Will Create Opportunities for CCUS Technology

1.3 Start-Up Landscape

1.3.1 Key Start-Ups in the Ecosystem

2 Application

2.1 CO2 Emission by Major Industries, 2021

2.2 Global Carbon Capture Utilization and Storage Market (Applications and Specifications)

2.2.1 Oil and Gas Industry

2.2.2 Power Industry

2.2.3 Others

2.2.3.1 Cement Industry

2.2.3.2 Chemical Industry

2.3 Demand Analysis of Carbon Capture Utilization and Storage Market (by Application), Value and Volume Data

3 Products

3.1 Carbon Capture Utilization and Storage Market - Capture Technology and Specification

3.1.1 Pre-Combustion Carbon Capture

3.1.2 Post-Combustion Carbon Capture

3.1.3 Oxy-Fuel Combustion Carbon Capture

3.2 Demand Analysis of Carbon Capture Utilization and Storage Market (by Capture Technology), Value and Volume Data

3.3 Product Benchmarking: Growth Rate - Market Share Matrix, 2021

3.4 Patent Analysis

3.4.1 Patent Analysis (by Region)

3.5 Global Pricing Analysis

4 Region

5 Markets - Competitive Benchmarking & Company Profiles

5.1 Competitive Benchmarking

5.1.1 Competitive Position Matrix

5.1.2 Product Matrix for Key Companies

5.1.3 Market Share Analysis

5.2 Company Profiles

5.2.1 Fluor Corporation

5.2.1.1 Company Overview

5.2.1.1.1 Product Portfolio

5.2.1.2 Business Strategies

5.2.1.3 Analyst Point of View

5.2.2 ExxonMobil Corporation

5.2.2.1 Company Overview

5.2.2.1.1 Product Portfolio

5.2.2.2 Business Strategies

5.2.2.3 R&D Expenditure Analysis

5.2.2.4 Analyst Point of View

5.2.3 Linde plc

5.2.3.1 Company Overview

5.2.3.1.1 Product Portfolio

5.2.3.2 Business Strategies

5.2.3.3 R&D Expenditure Analysis

5.2.3.4 Analyst Point of View

5.2.4 Shell plc

5.2.4.1 Company Overview

5.2.4.1.1 Product Portfolio

5.2.4.2 Corporate Strategies

5.2.4.3 R&D Expenditure Analysis

5.2.4.4 Analyst Point of View

5.2.5 Mitsubishi Heavy Industries, Ltd

5.2.5.1 Company Overview

5.2.5.1.1 Product Portfolio

5.2.5.2 Business Strategies

5.2.5.3 R&D Expenditure Analysis

5.2.5.4 Analyst Point of View

5.2.6 JGC Holdings Corporation

5.2.6.1 Company Overview

5.2.6.1.1 Product Portfolio

5.2.6.2 Corporate Strategies

5.2.6.3 R&D Expenditure Analysis

5.2.6.4 Analyst Point of View

5.2.7 Equinor ASA

5.2.7.1 Company Overview

5.2.7.1.1 Product Portfolio

5.2.7.2 Production Sites

5.2.7.3 Business Strategies

5.2.7.4 Analyst Point of View

5.2.8 Schlumberger Limited

5.2.8.1 Company Overview

5.2.8.1.1 Product Portfolio

5.2.8.2 Business Strategies

5.2.8.3 R&D Expenditure Analysis

5.2.8.4 Analyst Point of View

5.2.9 Aker Carbon Capture

5.2.9.1 Company Overview

5.2.9.1.1 Product Portfolio

5.2.9.2 Business Strategies

5.2.9.3 R&D Expenditure Analysis

5.2.9.4 Analyst Point of View

5.2.10 Carbon Clean Solutions Limited

5.2.10.1 Company Overview

5.2.10.1.1 Product Portfolio

5.2.10.2 Business Strategies

5.2.10.3 Analyst Point of View

5.2.11 C-Capture

5.2.11.1 Company Overview

5.2.11.1.1 Product Portfolio

5.2.11.2 Corporate Strategies

5.2.11.3 Analyst Point of View

5.2.12 Halliburton

5.2.12.1 Company Overview

5.2.12.1.1 Product Portfolio

5.2.12.2 Production Sites

5.2.12.3 Business Strategies

5.2.12.4 Corporate Strategies

5.2.12.5 Analyst Point of View

5.2.13 Siemens

5.2.13.1 Company Overview

5.2.13.1.1 Product Portfolio

5.2.13.2 Corporate Strategies

5.2.13.3 Analyst Point of View

5.2.14 Hitachi, Ltd

5.2.14.1 Company Overview

5.2.14.1.1 Product Portfolio

5.2.14.2 Corporate Strategies

5.2.14.3 Analyst Point of View

5.2.15 Honeywell International Inc

5.2.15.1 Company Overview

5.2.15.1.1 Product Portfolio

5.2.15.2 Corporate Strategies

5.2.15.3 Analyst Point of View

5.2.16 Mirreco

5.2.16.1 Company Overview

5.2.16.1.1 Product Portfolio

5.2.16.1.2 Analyst Point of View

5.2.17 SeeO2 Energy Inc.

5.2.17.1 Company Overview

5.2.17.1.1 Product Portfolio

5.2.17.1.2 Analyst Point of View

5.2.18 Neustark AG

5.2.18.1 Company Overview

5.2.18.1.1 Product Portfolio

5.2.18.1.2 Analyst Point of View

5.2.19 CarbonFree

5.2.19.1 Company Overview

5.2.19.1.1 Product Portfolio

5.2.19.1.2 Business Strategies

5.2.19.1.3 Analyst Point of View

5.2.20 Cemvita Factory Inc.

5.2.20.1 Company Overview

5.2.20.1.1 Product Portfolio

5.2.20.1.2 Business Strategies

5.2.20.1.3 Analyst Point of View

6 Research Methodology

For more information about this report visit https://www.researchandmarkets.com/r/n31vu5

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance