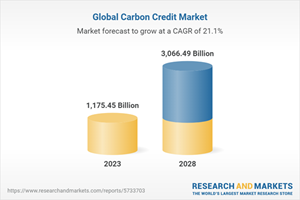

Global Carbon Credit (Value, Volume) Market Report 2023: A $3,066.49 Billion Market by 2028 - Demand Increase in the Offsetting Markets

Global Carbon Credit Market

Dublin, Feb. 24, 2023 (GLOBE NEWSWIRE) -- The "Global Carbon Credit Market (Value, Volume) - Analysis By Market Type (Voluntary, Compliance), End User, By Region, By Country: Market Size, Insights, Competition, Covid-19 Impact and Forecast (2023-2028)" report has been added to ResearchAndMarkets.com's offering.

The Global Carbon Credit market was valued at USD 760.28 Billion in 2021 and is expected to grow at a CAGR of 21.14% during the forecast period of 2023-2028.

Demand for carbon credits is expected to increase drastically in the near future due to the growing number of corporate net-zero commitments. Purchasing carbon credits allows corporations to become carbon-neutral today while they continue to work to reduce their emissions.

Businesses can commit to more aggressive and earlier goals with the help of carbon credits. Credits give companies the option to offset their current emissions while also taking cost-effective steps to cut future emissions through asset turnover and the evolution of their business models. In the long run, credits are crucial for offsetting hard-to-abate emissions from items that don't offer options for low or zero emissions.

As more private companies seek to engage in the offset market, recent advances have been fuelled by a rise in voluntary demand for these credits. Since projects with societal benefits coupled with emissions reductions are perceived as more attractive to voluntary buyers, these corporations have been under pressure from shareholders and the general public to drive this in recent years.

The demand increase in the offsetting market is caused by a rising awareness of environmental challenges on a global level, catalyzed by COP26. More and more companies are recognizing the environmental and social value of offsetting projects and taking climate action by compensating for their carbon footprint.

The voluntary market segment is expected to grow tremendously in the upcoming years. Voluntary carbon credits, whilst historically transacted through bespoke bilateral agreements between buyer and seller, can increasingly be bought through specialized carbon credit exchanges and trading platforms. Given the growth of the voluntary carbon credit market, more established exchanges are looking to launch their own offerings.

The report tracks competitive developments, strategies, mergers and acquisitions and new product development.

The companies analysed in the report include

AltaGas

Sterling Planet

Degrees Group Inc.

Native Energy

Cool Effect

South Pole Group

ClearSky Climate Solutions

Carbon Credit Capital

Sustainable Travel International

EcoAct

Key Topics Covered:

1. Market Background

1.1 Scope and Product Outlook

1.2 Executive Summary

1.3 Research Methodology

2. Strategic Recommendations

3. Global Carbon Credit Market: Historic and Forecast (2018-2028)

3.1 Impact Analysis of Macro Economic Factors on Carbon Credit Market

3.2 Emissions Coverage of Carbon Compliance Markets: By Country

3.3 Annual Carbon Annual Supply Capacity

3.4 Lifecycle Of A Carbon Credit

3.5 Global Voluntary Carbon Credit Market Issuances, Retirements And Pricing

3.6 Voluntary Carbon Credit Market Transaction Volume & Price

3.7 Worldwide Annual Average Investment in Low-Emissions Technologies

3.8 Venture Capital Investments in Carbon Capture & Utilization Start-Ups

3.9 Carbon Taxes & Price Dynamics of Carbon Markets

3.10 Global Carbon Credit Market: Dashboard

3.11 Global Carbon Credit Market: Market Size and CAGR, 2018-2028 (USD Billion & CAGR)

3.12 Global Carbon Credit Market: Volume Sales and CAGR, 2018-2028 (Million Tonnes & CAGR)

3.13 Average Selling Price Analysis of Carbon Credit Market

3.14 Impact of COVID-19 on Carbon Credit Market

3.15 Global Carbon Credit Market Segmentation: By Market Type

3.15.1 Global Carbon Credit Market, By Market Type Overview

3.15.2 Global Carbon Credit Market Size, By Voluntary Market, By Value, 2018H-2028F (USD Billion & CAGR)

3.15.3 Global Carbon Credit Market Size, By Compliance Market, By Value, 2018H-2028F (USD Billion & CAGR)

3.16 Global Carbon Credit Market Segmentation : By End User

3.16.1 Global Carbon Credit Market, By End User Overview

3.16.2 Global Carbon Credit Market Size, By Aviation, By Value, 2018H-2028F (USD Billion & CAGR)

3.16.3 Global Carbon Credit Market Size, By Energy, By Value, 2018H-2028F (USD Billion & CAGR)

3.16.4 Global Carbon Credit Market Size, By Petrochemical, By Value, 2018H-2028F (USD Billion & CAGR)

3.16.5 Global Carbon Credit Market Size, By Manufacturing, By Value, 2018H-2028F (USD Billion & CAGR)

3.16.6 Global Carbon Credit Market Size, By Other End Users, By Value, 2018H-2028F (USD Billion & CAGR)

For more information about this report visit https://www.researchandmarkets.com/r/w5bltn-carbon?w=12

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance