Global Cell Analysis Market (2022 to 2027) - Growing Risk of Pandemics and Communicable Diseases Presents Opportunities

Global Cell Analysis Market

Dublin, June 17, 2022 (GLOBE NEWSWIRE) -- The "Cell Analysis Market by Product & Service (Reagents & Consumables, Instruments), Technique (Flow Cytometry, High Content Screening), Process (Single-cell Analysis), End User (Pharmaceutical and Biotechnology Companies) - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

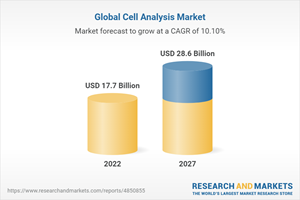

The global cell analysis market is projected to reach USD 28.6 Billion by 2027 from USD 17.7 Billion in 2022, at a CAGR of 10.1% during the forecast period.

Key opportunities for the cell analysis market include emerging economies, high risk of communicable diseases and pandemic outbreaks, and increasing adoption of novel cellular assays in various cancer research applications. On the other hand, high costs associated with cell analysis instruments along with limitations on the usage of reagents for experiments are expected to restrain the market growth.

The reagents & consumables segment dominates the cell analysis market through the study period of 2020-2027.

Based on product & service, the global cell analysis market is segmented into reagents & consumables, instruments, accessories, software, and services. The reagents & consumables segment represented the largest market share for the year 2021, in the cell analysis market. The development of affordable reagent solutions by key market players is the key attributive factor to the segment's dominance. This is further supplemented by increasing demand for novel cell analysis reagents & consumables in flow cytometry experiments.

The high content screening (HCS) segment will witness the highest growth in the cell analysis market during the forecast period.

Based on technique, the global cell analysis market is segmented into flow cytometry, PCR, cell microarrays, microscopy, spectrophotometry, high-content screening (HCS), and other techniques. HCS technique combines high-throughput automated imaging with analysis which helps in the extraction of single-cell data, multi-parametric in nature. In addition, widening applications of HCS have contributed to the robust CAGR registered by this segment from 2022-2027.

North America dominated the cell analysis market in 2021.

Geographically, the cell analysis market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2021, North America accounted for the largest share of the cell analysis market. North America harbors the majority of the key market players leading to the maturity of the cell analysis market in this region. Also, robust government support for academic & research activities offers opportunities for the key market players to introduce cutting-edge cell analysis products, further intensifying regional market competition.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Cell Analysis Market Overview

4.2 North America: Cell Analysis Market Share, by Product & Service and Country (2021)

4.3 North America: Cell Analysis Market, by Technique, 2022 Vs. 2027 (USD Million)

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Preference for Cell-Based Assays in Drug Discovery

5.2.1.2 Increasing Funding for Cell-Based Research

5.2.1.3 Growing Number of Drug Discovery Activities

5.2.2 Restraint

5.2.2.1 High Cost of Instruments and Restrictions on Reagent Use

5.2.3 Opportunities

5.2.3.1 Emerging Economies

5.2.3.2 Growing Risk of Pandemics and Communicable Diseases

5.2.3.3 Application of Novel Cell-Based Assays in Cancer Research

5.3 Porter's Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Degree of Competition

5.4 Impact of COVID-19 on the Cell Analysis Market

5.5 Supply Chain Analysis

5.6 Value Chain Analysis

5.7 Ecosystem Analysis

5.8 Regulatory Analysis (Flow Cytometry-Based Cell Analysis)

5.9 Technology Analysis

5.10 Key Conferences & Events, 2021-2022

5.11 Pricing Analysis

6 Cell Analysis Market, by Product & Service

6.1 Introduction

6.2 Reagents & Consumables

6.2.1 Advent of Novel Cell Analysis Kits & Reagents for Flow Cytometry to Boost Segment Growth

6.3 Instruments

6.3.1 Innovations in Cell Analysis Instruments for Drug Discovery Research to Drive Market Growth

6.4 Accessories

6.4.1 Flow Cytometry Accessories Enable End-users to Customize Flow Cytometry Instruments

6.5 Software

6.5.1 Expanding Pool of Key Players Introducing Unique Software or Data Interpretation Tools Propels Segment Growth

6.6 Services

6.6.1 Remote Services Ensure Workflow Continuity and Maximize Performance

7 Cell Analysis Market, by Technique

7.1 Introduction

7.2 Flow Cytometry

7.2.1 Ability to Perform Multiple Measurements on Single Cells is Key Advantage Associated with this Technique

7.3 Pcr

7.3.1 Digital Pcr Can Effectively Measure and Monitor Rare Sequences

7.4 Cell Microarrays

7.4.1 Cell Microarrays are Used in Designing and Controlling Stem Cells in Tissue Engineering

7.5 Microscopy

7.5.1 Rising Incidence of Cancer and Growing Investments in Cell Biology to Drive Market Growth

7.6 Spectrophotometry

7.6.1 High Demand for Spectrophotometers in Research Settings to Support Market Growth

7.7 High-Content Screening (Hcs)

7.7.1 High Demand for Hcs in Cell Behavior Research Studies to Support Segment Growth

7.8 Other Techniques

8 Cell Analysis Market, by Process

8.1 Introduction

8.2 Cell Identification

8.2.1 Increasing Research Activities to Propel Market Growth

8.3 Cell Viability

8.3.1 Cell Viability is Used to Correlate Cell Behavior to Cell Numbers

8.4 Cell Signaling Pathway/Signal Transduction

8.4.1 High Demand for Toxicity Testing in Drug Development to Drive Market Growth

8.5 Cell Proliferation

8.5.1 Cell Proliferation is Measured on the Basis of Average Dna Content

8.6 Cell Counting & Quality Control

8.6.1 Flow Cytometry Enables Easy Differentiation of Cells Via Scattering or Staining

8.7 Cell Interaction

8.7.1 Increasing Advancements in Cell-Cell Interactions/Cell-Cell Communication to Boost Market Growth

8.8 Cell Structure Study

8.8.1 Advancements in Cellular Imaging to Support Market Growth

8.9 Target Identification & Validation

8.9.1 Hcs in Target Identification is Used to Identify Novel Targets Through Screening of Cellular Pathways

8.10 Single-Cell Analysis

8.10.1 Expanding Applications of Single-Cell Analysis in Clinical Research to Propel Segment Growth

9 Cell Analysis Market, by End-user

9.1 Introduction

9.2 Pharmaceutical & Biotechnology Companies

9.2.1 High Demand for Cell-Based Research in Drug Discovery & Development Process Contributes to Segment Growth

9.3 Hospitals & Clinical Testing Laboratories

9.3.1 Development of Complex & Highly Specialized Tests and Assays Supports Market Growth

9.4 Academic & Research Institutes

9.4.1 Growing Number of Research Projects Through Industry-Academia Collaborations to Drive Market Growth

9.5 Other End-users

10 Cell Analysis Market, by Region

11 Competitive Landscape

11.1 Introduction

11.2 Right-To-Win Approaches Adopted by Key Players

11.3 Market Share Analysis

11.4 Revenue Share Analysis (Top 7 Market Players)

11.5 Company Evaluation Quadrant

11.5.1 Stars

11.5.2 Emerging Leaders

11.5.3 Pervasive Players

11.5.4 Participants

11.6 Competitive Leadership Mapping: Emerging Companies/ SMEs/Start-Ups (2021)

11.6.1 Progressive Companies

11.6.2 Starting Blocks

11.6.3 Responsive Companies

11.6.4 Dynamic Companies

11.7 Competitive Scenario and Trends

11.7.1 Product Launches

11.7.2 Deals

11.7.3 Other Developments

12 Company Profiles

12.1 Key Companies

12.1.1 Thermo Fisher Scientific Inc.

12.1.2 Danaher

12.1.3 Becton, Dickinson and Company (Bd)

12.1.4 General Electric

12.1.5 Merck KGaA

12.1.6 Agilent Technologies, Inc.

12.1.7 Bio-Rad Laboratories, Inc.

12.1.8 Fluidigm Corporation

12.1.9 Miltenyi Biotec

12.1.10 Olympus Corporation

12.1.11 Biostatus Limited

12.1.12 Nanocellect Biomedical

12.1.13 Cell Biolabs, Inc.

12.1.14 Creative Bioarray

12.1.15 Meiji Techno

12.2 Other Players

12.2.1 Promega Corporation

12.2.2 PerkinElmer

12.2.3 Tecan Trading Ag

12.2.4 Carl Zeiss

12.2.5 Sysmex America, Inc.

12.2.6 Cellink

12.2.7 Qiagen

12.2.8 Illumina, Inc.

12.2.9 Corning Incorporated

12.2.10 10X Genomics

13 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/v4ypac

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance