Global Citric Acid Market Report 2022 to 2027: Industry Trends, Share, Size, Growth, Opportunities and Forecasts

Global Citric Acid Market

Dublin, Nov. 21, 2022 (GLOBE NEWSWIRE) -- The "Citric Acid Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027" report has been added to ResearchAndMarkets.com's offering.

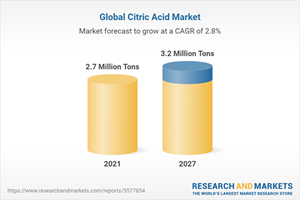

The global citric acid market reached a volume of 2.7 million Tons in 2021. Looking forward, the market is projected to reach 3.2 million Tons by 2027, exhibiting a CAGR of 3.3% during 2022-2027.

Keeping in mind the uncertainties of COVID-19, the analyst is continuously tracking and evaluating the direct as well as the indirect influence of the pandemic on different End-use industries. These insights are included in the report as a major market contributor.

Citric acid is a weak organic acid found in the juice of lemons and other citrus fruits. Around 75% of the global consumption of citric acid is accounted by the food and beverages industry, primarily as an acidulant in carbonated soft drinks.

In addition to this, it is used to control the growth of microorganisms, for pH adjustment and inducing sourness. In household detergents and cleaners, citric acid is utilized as a co-builder, mainly in concentrated liquid detergents with zeolite builder systems. As citric acid provides a less harmful formulation than phosphates in water systems, it is gaining traction among detergent manufacturers.

Global Citric Acid Market Drivers:

Due to its various advantageous properties, citric acid is widely used as an additive in food and beverages, personal care products, cleaners and detergents, adhesives and sealants, coatings, inks, plastics and polymers, pharmaceutical products and clinical nutrition, feed and pet food items.

The chemical makeup and potency of citric acid remains stable for at least five years in its original closed container. Owing to its long shelf-life, it finds application as a preservative, flavoring and coloring agent.

Growing awareness about the adverse effects caused by the chemicals used in daily use products has led the consumers to shift towards organic products so as to lower their chemical intake. This has created a positive outlook for the growth of the citric acid market.

Heightened demand for ready-to-drink beverages and processed foods has been witnessed in the developing countries on account of continuous economic growth, busy lifestyles, increasing urbanization and rising disposable incomes. As a result, the emerging regions are expected to be the future growth driver of the citric acid market.

Key Questions Answered in This Report

1. What was the size of the global citric acid market in 2021?

2. What are the key factors driving the global citric acid market?

3. What has been the impact of COVID-19 on the global citric acid market?

4. What is the breakup of the global citric acid market based on the application?

5. What is the breakup of the global citric acid market based on the form?

6. What are the key regions in the global citric acid market?

7. Who are the key players/companies in the global citric acid market?

Key Topics Covered:

1 Preface

2 Scope and Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Citric Acid Industry

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Markey Breakup by Region

5.5 Market Breakup by Application

5.6 Market Breakup by Form

5.7 Market Forecast

5.8 SWOT Analysis

5.8.1 Overview

5.8.2 Strengths

5.8.3 Weaknesses

5.8.4 Opportunities

5.8.5 Threats

5.9 Value Chain Analysis

5.9.1 Input Suppliers

5.9.2 Farmers

5.9.3 Collectors

5.9.4 Manufacturers

5.9.5 Distributors

5.9.6 Exporters

5.9.7 Retailers

5.9.8 End-Users

5.10 Porter's Five Forces Analysis

5.10.1 Overview

5.10.2 Bargaining Power of Buyers

5.10.3 Bargaining Power of Suppliers

5.10.4 Degree of Competition

5.10.5 Threat of New Entrants

5.10.6 Threat of Substitutes

5.11 Price Analysis

5.11.1 Key Price Indicators

5.11.2 Price Structure

5.11.3 Margin Analysis

5.12 Trade Data

5.12.1 Import by Major Countries

5.12.2 Export by Major countries

5.13 Key Market Drivers and Success Factors

6 Performance of Key Regions

6.1 Western Europe

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 United States

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 China

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Middle East and Africa

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Central/Eastern Europe

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Brazil

6.6.1 Market Trends

6.6.2 Market Forecast

6.7 India

6.7.1 Market Trends

6.7.2 Market Forecast

7 Market by Application

7.1 Food and Beverages

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Household Detergents and Cleaners

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Pharmaceuticals

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market by Form

8.1 Anhydrous

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Liquid

8.2.1 Market Trends

8.2.2 Market Forecast

9 Competitive Landscape

9.1 Competitive Structure

9.2 Production Capacity of Key Manufacturers

10 Citric Acid Manufacturing Process

10.1 Product Overview

10.2 Manufacturing Process

10.3 Raw Material Requirements

10.4 Mass Balance and Feedstock Conversion Rates

11 Project Details, Requirements and Costs Involved

11.1 Land Requirements and Expenditures

11.2 Construction Requirements and Expenditures

11.3 Plant Machinery

11.4 Machinery Pictures

11.5 Raw Material Requirements and Expenditures

11.6 Raw Material and Final Product Pictures

11.7 Packaging Requirements and Expenditures

11.8 Transportation Requirements and Expenditures

11.9 Utility Requirements and Expenditures

11.10 Manpower Requirements and Expenditures

11.11 Other Capital Investments

12 Loans and Financial Assistance

13 Project Economics

13.1 Capital Cost of the Project

13.2 Techno-Economic Parameters

13.3 Product Pricing and Margins Across Various Levels of the Supply Chain

13.4 Taxation and Depreciation

13.5 Income Projections

13.6 Expenditure Projections

13.7 Financial Analysis

13.8 Profit Analysis

14 Key Player Profiles

14.1 Archer Daniels Midland Company

14.2 Cargill, Incorporated

14.3 Tate & Lyle PLC

14.4 Jungbunzlauer Suisse AG

14.5 Cofco Biochemical (Anhui) Co., Ltd.

14.6 Huangshi Xinghua Biochemical Co. Ltd.

14.7 RZBC Group Co. Ltd.

14.8 Weifang Ensign Industry Co., Ltd.

14.9 Gadot Biochemical Industries Ltd.

14.10 S.A. Citrique Belge N.V.

For more information about this report visit https://www.researchandmarkets.com/r/9buh22

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance