Global Digital Printing Packaging Market Forecast Report 2024-2029 - Solvent-based Ink to Lead Market During Forecast Period

Global Digital Printing Packaging Market

Dublin, April 24, 2024 (GLOBE NEWSWIRE) -- The "Global Digital Printing Packaging Market by Printing Ink (Solvent-Based Ink, UV-Based Ink, Aqueous Ink), Printing Technology, Format( Full Color Printing, Variable Data Printing, Large Format Printing), Packaging Type, End-Use Industry - Forecast to 2029" report has been added to ResearchAndMarkets.com's offering.

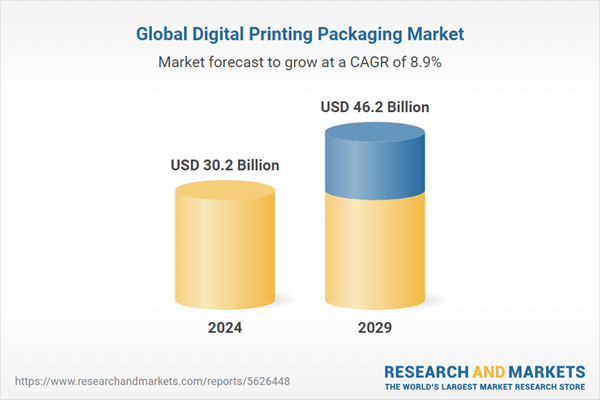

The digital printing packaging market is projected to grow from USD 30.2 billion in 2024 to USD 46.2 billion by 2029 at a CAGR of 8.9%. In recent years, the digital printing packaging market has seen remarkable expansion, spurred by several key factors. Heightened demand for tailored and personalized packaging solutions, alongside a rising consumer inclination towards distinctive and visually striking designs, has been pivotal in driving this growth trajectory. Additionally, the trend towards smaller production batches has gained momentum, further propelling market expansion. Advancements in digital printing technologies, characterized by enhanced print quality, accelerated production speeds, and improved cost efficiency, have significantly bolstered manufacturers' capabilities to meet evolving consumer needs effectively.

Solvent-based ink to be the largest printing ink used in the digital printing packaging market

Solvent-based ink stands as the largest printing ink type in the digital printing packaging market, owing to its widespread adoption and established presence across various industries. Its dominance can be attributed to several factors, including its versatility, durability, and compatibility with a wide range of substrates commonly used in packaging materials. Solvent-based inks are renowned for their ability to deliver vibrant colors and sharp images, making them particularly well-suited for applications where high print quality is paramount.

Thermal transfer printing to be the largest printing technology in the digital printing packaging market.

Thermal transfer printing stands out as the largest printing technology in the digital printing packaging market. This technology utilizes heat to transfer ink from a ribbon onto the substrate, enabling precise and high-quality printing on labels, tags, and flexible packaging. Its dominance can be attributed to its ability to produce durable, long-lasting prints with excellent resistance to fading, abrasion, and environmental factors.

Variable data printing holds the largest market share in the digital printing packaging market

One of the key drivers behind the rapid growth of Variable data printing (VDP) in the packaging industry is its ability to enable mass customization at scale. By leveraging data analytics and digital printing technology, brands can dynamically change elements of their packaging, such as product descriptions, promotional offers, or even imagery, to resonate with different demographics or geographical regions. This level of customization not only strengthens brand-consumer relationships but also increases the likelihood of conversion and repeat purchases.

Labels packaging type holds the largest market share in the digital printing packaging market.

One of the key drivers behind the rapid growth of labels in the digital printing packaging market is the rising demand for personalized and on-demand packaging solutions. Digital printing technology enables brands to produce labels in small quantities with variable data printing, allowing for customized designs tailored to specific products, events, or consumer preferences. This flexibility not only enhances brand authenticity but also enables brands to adapt quickly to changing market trends and consumer demands.

Food & beverage holds the largest market share in the digital printing packaging market.

The food and beverage industry stands as the largest end-use industry in the digital printing packaging market, owing to its substantial consumption volume, diverse product offerings, and evolving consumer preferences. With a vast array of products ranging from packaged foods and beverages to snacks and confectionery, this industry relies heavily on packaging to attract consumers and differentiate brands on crowded store shelves. As a result, the demand for innovative and eye-catching packaging solutions has surged, driving the adoption of digital printing technology to meet the evolving needs of food and beverage manufacturers.

Asia Pacific is the biggest market for digital printing packaging.

One of the key drivers behind the rapid growth of digital printing packaging in Asia Pacific is the increasing adoption of advanced printing technologies by packaging manufacturers to meet the evolving needs of consumers. As brands seek to differentiate themselves in competitive markets, there is a growing demand for customized and visually appealing packaging solutions, which digital printing technology enables efficiently. Additionally, the rise of e-commerce platforms and changing retail landscapes in Asia Pacific have further accelerated the adoption of digital printing for packaging, as brands look to enhance their online presence and offer unique packaging experiences to consumers.

The report provides insights on the following:

Analysis of key drivers (Customization and personalization demand, Rapid prototyping and time-to-market advantage, Sustainability concerns), restraints (Limited application scope, Volatile raw material cost) opportunities (Growth of the e-commerce industry, Emerging economies offer significant growth opportunities, Emerging markets and niche segments), and challenges (Competition from traditional printing methods, Regulatory compliance and quality standard) influencing the growth of the digital printing packaging market

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital printing packaging market

Market Development: Comprehensive information about lucrative markets - the report analyses the digital printing packaging market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital printing packaging market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as DS Smith Plc (UK), Smurfit Kappa Group (Ireland), CCL Industries, Inc. (Canada), Quad/Graphics, Inc. (US), Printpack Inc. (US), Huhtamaki Oyj (Finland), Constantia Flexibles (Austria), THIMM Holding GmbH (Germany), Epac Holdings, LLC (US), Amcor plc (Switzerland), Sonoco Products Company (US), Berry Global Group, Inc. (US), ACME Printing (US), WestRock Company (US), Stora Enso Oyj (Finland), Elanders AB (Sweden), and others in the digital printing packaging market.

Key Attributes:

Report Attribute | Details |

No. of Pages | 432 |

Forecast Period | 2024 - 2029 |

Estimated Market Value (USD) in 2024 | $30.2 Billion |

Forecasted Market Value (USD) by 2029 | $46.2 Billion |

Compound Annual Growth Rate | 8.9% |

Regions Covered | Global |

Key Topics Covered:

Executive Summary

Solvent-based Inks to Account for Largest Market Share During Forecast Period

Thermal Transfer Printing to Remain Largest Segment During Forecast Period

Variable Data Printing to Lead Market During Forecast Period

Labels Segment to Grow at Highest CAGR from 2024 to 2029

Food & Beverage Industry to Dominate Market During Forecast Period

Asia-Pacific Led Digital Printing Packaging Market in 2023

Premium Insights

Attractive Opportunities for Players in Digital Printing Packaging Market - Emerging Economies Offer Lucrative Opportunities in Digital Printing Packaging Market

Asia-Pacific: Digital Printing Packaging Market, by Printing Ink and Country - China and Solvent-based Printing Ink Dominated Market in 2023

Digital Printing Packaging Market, by Printing Ink - Solvent-based Ink to Lead Market During Forecast Period

Digital Printing Packaging Market, by Printing Technology - Inkjet Printing Segment to Record Highest Growth During Forecast Period

Digital Printing Packaging Market, by Format - Variable Data Printing to Account for Largest Share During Forecast Period

Digital Printing Packaging Market, by Packaging Type - Labels Segment to Lead Market During Forecast Period

Digital Printing Packaging Market, by End-use Industry - Food & Beverage Segment to Dominate Market During Forecast Period

Digital Printing Packaging Market, by Key Country - China to Witness Highest CAGR from 2024 to 2029

Market Dynamics

Drivers

Pressing Need for Customized and Personalized Packaging Solutions

Rapid Prototyping and Time-To-Market Advantage

Sustainability Concerns

Restraints

Limited Applications of Digital Printing

Volatile Raw Material Cost

Opportunities

Growth of E-Commerce Industry

Improving Living Standards in Emerging Economies

Emerging Markets and Niche Segments

Challenges

Competition from Traditional Printing Methods

Pressing Need for Regulatory Compliance and Quality Standards

Technology Analysis

Key Technologies

Electrophotography

Inkjet

Complementary Technologies

Hybrid Printing

Varnishes & Coatings

Case Study Analysis

Sunkey Packaging's Digital Printing Solution for Tyson Foods' Agile Product Development Needs

DS Smith Tecnicarton Revolutionizes Reusable Container Customization with Digital Printing Solutions

EPAC's Digital Printing Solutions Revolutionize Product Launch Speed for West Shore Foods

Companies Profiled

DS Smith

Smurfit Kappa

CCL Industries

Quad/Graphics, Inc.

Printpack, Inc.

Huhtamaki

Constantia Flexibles

Thimm Group

EPAC Holdings, LLC

Amcor PLC

Sonoco Products Company

Berry Global Group, Inc.

Acme Printing

Westrock Company

Nosco, Inc.

Quantum Print & Packaging Ltd.

Stora Enso Oyj

Traco Packaging

Tailored Label Products, Inc.

Schumacher Packaging GmbH

Creative Labels Inc.

Reynders Label Printing

Elanders Ab

Colordruck Baiersbronn

Sun Print Solutions

Xymoprint

Weber Packaging Solutions

Packman Packaging Pvt. Ltd.

Sunkey Plastic Packaging Co. Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/nyvrhp

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance