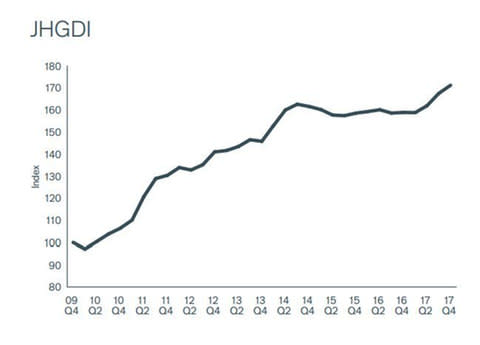

Global dividends hit record $1.25 trillion

Investors are reaping the benefits of the global economic recovery as companies paid out a record $1.25 trillion in dividends last year.

The unprecedented sum is close to three times 2009’s level when the financial crisis trashed profits.

Almost every region of the world experienced rising payouts and 11 of the 41 countries tracked by Janus Henderson had record years.

The annual growth of 7.7pc is expected to be repeated this year, which would take dividends to $1.35 trillion in 2018.

Part of the boost came from a weakening dollar which flatters other countries dividends when converted into the greenback for international comparisons.

But even if that currency effect is stripped out, along with other variable factors including one-off special dividends, underlying growth came in at 6.8pc.

Underlying UK dividend growth hit 10pc as mining companies’ fortunes turned around, though the weak pound turned that into a headline growth rate of just 3pc, to a total of $95.7bn.

Australian dividends grew almost as quickly at 9.7pc.

Asia-Pacific’s underlying growth of 8.6pc was led by companies in Taiwan and South Korea.

US underlying dividends rose 6.3pc, Japan’s 11.8pc and Europe’s 2.7pc.

“All three of the largest economies in the world, the US, the EU, and China, are now expanding at the same time,” said Ben Lofthouse at Janus Henderson.

“As a result, companies are seeing rising profits, and healthy cash flows, and that’s enabling them to fund generous dividends.”

Yahoo Finance

Yahoo Finance