Global Generic Injectables Markets, 2021-2022 & 2028: Increasing Patent Expiry of Drugs & Government Support for Generic Injectables Production and Healthcare Cost Reduction

Global Generic Injectables Market

Dublin, April 27, 2022 (GLOBE NEWSWIRE) -- The "Generic Injectables Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type, Container Type, Application and Route of Administration and Geography" report has been added to ResearchAndMarkets.com's offering.

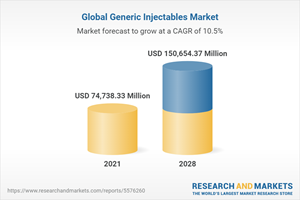

The generic injectables market is projected to reach US$ 150.65 billion by 2028 from US$ 74.73 billion in 2021; it is expected to grow at a CAGR of 10.5% from 2021 to 2028.

Low R&D, marketing, and manufacturing costs and high demand for affordable drugs are driving the generic injectables market growth. However, the critical inspection system for prefilled injection is hampering the generic injectables market growth.

Generic injectables are as safe and effective as innovator molecules because they are bioequivalent to their branded counterparts, but they are not patented for many reasons. These medications can be produced for commercial usage only after the patent expiration of the branded drug.

As the drug molecules are similar in branded and generic formulation, no or minimal R&D cost is associated with generic injectables. The low upfront R&D costs allow drug manufacturers to sell generic injectables at lower prices. As stated by the US FDA, a single generic competitor can lead to price reductions of 30%, while five generics competing could lead to price drops of ~85%.

Additionally, generic injectables saved US$ 2.2 trillion for the US healthcare system during 2009-2019. As mentioned in a report by Congressional Budget Office, the pharmaceutical industry spent US$ 83 billion on R&D in 2019. However, with generic injectables, the repetition of clinical studies is not required to demonstrate their effectiveness and safety, which contributes to their low prices.

Further, the approval process of generic medicines is faster than branded ones. As reported by the USFDA, in 2019, 107 first generic drugs and 110 complex generic drugs were approved, totaling 11% of the generic drug product approvals. Overall, in 2019, the generic drug program approved or tentatively approved 1,014 generic drug applications.

Additionally, the development of a new chemical entity takes almost a decade on average, which is bypassed in the development of generic injectables. Thus, the low cost associated with generic injectables is one of the major factors attracting new players to enter the market and driving the generic injectables market.

Further, the patents of branded injectables in several regions are likely to expire in the upcoming years, offering numerous remunerative opportunities to the generic injectables manufacturers. As per a recent publication by Business Standard, patented drugs worth US$ 240 billion will lose patents globally in the coming years.

In India, the shortage of branded medicines and the expiry of branded drug patents have prompted generic injectable manufacturers to introduce advanced drug delivery systems, including self-injection devices. Biological E Limited, an Indian biotechnology and biopharmaceutical company based in Hyderabad, Telangana, is gaining recognition for broadening its portfolio with the addition of 20 routine and injectable products.

Thus, generic injectables companies are tapping regulated markets and exploring other markets to generate incomes and establish stable revenue streams. Additionally, manufacturers in the generic injectables market are becoming future-ready by maintaining adequate supply chains to prevent vulnerabilities, similar to those caused by the COVID-19 outbreak. Zydus Cadila is significantly reducing the price of its generic version of remdesivir, namely Remdac. Thus, the nearing expiry of patent validity of branded drugs is likely to provide significant opportunities to generic drug manufacturers, including the companies offering generic injectables.

Based on product type, the generic injectables market is segmented into large molecule injectables and small molecule injectables. In 2021, the large molecule injectables segment accounted for a greater market share. The market position of this segment is credited to a surge in the adoption of biologics in the healthcare sector, and the progress of monoclonal antibody and antibody-drug conjugates (ADCs) into the drug development.

The global generic injectables market, based on container type, has been categorized into vials, premix, prefilled syringes, ampoules, and others. The vials segment is likely to dominate the market in 2021. The rise in health awareness on the back of the growth in the detection of new life-threatening diseases is driving the growth of vial market segment during the forecast period.

The global generic injectables market, based on application, has been categorized into oncology, infectious diseases, cardiology, diabetes, immunology, and others. The oncology segment is likely to hold the largest share of the market in 2021. With the increase in the cancer incidences and rise in the launches of drugs is anticipated to drive growth of the oncology market segment. Moreover, increasing initiatives taken by the leading players across the globe, are some of the factors which is driving the growth of the overall market segment.

Based on route of administration, the global generic injectables market has been categorized into intravenous, intramuscular, subcutaneous, and others. The intravenous route of administration holds the largest market share in 2021. The growing prevalence of chronic diseases and increasing number of product launches, have resulted in fueling the demand for intravenous route of administration market segment during the forecast period.

Key Market Dynamics

Market Drivers

Low R&D, Marketing, and Manufacturing Costs

High Demand for Affordable Drugs

Market Restraints

Critical Inspection System for Prefilled Injection

Market Opportunities

Increasing Patent Expiry of Drugs

Future Trends

Government Support for Generic Injectables Production and Healthcare Cost Reduction

Company Profiles

Astrazeneca

Baxter International, Inc.

Biocon

Fresenius Se & Co. Kgaa

GlaxoSmithKline plc

Hikma Pharmaceuticals

Johnson & Johnson Services, Inc.

Lupin, Ltd.

Merck & Co. Inc.

Mylan N.V.

Pfizer, Inc.

For more information about this report visit https://www.researchandmarkets.com/r/7swsp6

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance