Global Glyphosate Market Report (2022 to 2027) - by Production Application, Crop Type and Geography

Global Glyphosate Market

Dublin, May 02, 2022 (GLOBE NEWSWIRE) -- The "Glyphosate Market - Forecasts from 2022 to 2027" report has been added to ResearchAndMarkets.com's offering.

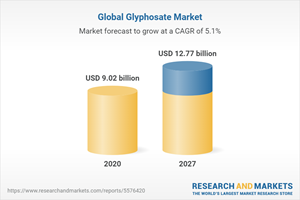

The glyphosate market was valued at US$9.016 billion in 2020 and is expected to grow at a CAGR of 5.10% over the forecast period to reach a total market size of US$12.771 billion by 2027.

Glyphosates are pesticides that protect against and control fungi and spore diseases. Glyphosates can control specific fungal diseases as well as those from multiple sources. Due to the susceptibility of fungi to diseases, fruit and vegetable cultivation is boosting the demand for glyphosate globally. Modern farming methods, an uptick in the incidence of fungi attacking crops, and the low cost of fungicides over other control methods are driving the demand for glyphosate. Fungicide manufacturers will benefit from the trend towards precision farming and organic agriculture.

Several factors influence the market growth, including the increasing demand for higher yields, the growing population worldwide, and the increasing demand for high-value crops in emerging markets. World population growth currently stands at approximately 1.05%. There will be an average population increase of 81 million people each year. Since 1959, the world population has grown twofold, from 3 billion to 6 billion. The population is estimated to reach 9 billion by 2037, growing by another 50% within the next 40 years. Growing global demand for food products is reflected in this trend. By 2050, food demand is projected to increase by 59 to 98 percent. (Source: fao.org; who) . To meet this demand, herbicides such as glyphosate could be used to kill weeds that are detrimental to growing crops and plants, hence increasing its demand.

Glyphosate's versatility and flexibility have been cited as the primary benefits conveyed to vegetable growers. Vegetable crops are permitted to use glyphosate nearly everywhere and in almost any climate. A majority of glyphosate application occurs late in the growing season in field crops, in terms of the number of acres treated. In North America and Asia-Pacific, glyphosate is a lucrative product. The Asia Pacific glyphosate market is expected to be driven by the adoption of GM crops and the availability of arable land in the years to come.

Growth Factors:

GE-HT crop commercialization

A variety of herbicide-tolerant (HT) crops offers farmers a wide range of options for controlling weeds. Approximately 56% of global glyphosate use is now attributed to genetically engineered herbicide-tolerant crops, according to the USDA. No other pesticide has ever been used so intensively and widely in the United States. As a result of the increasing demand for crops with higher yields and quality, the loss of agricultural land to cultivation, and the decrease in weed losses, the demand for glyphosate may increase in the future, according to the report.

This will support industry growth over the forecast period. Approximately 90 % of the corn grown in the United States is HT-seed based. Currently, more than 90 percent of corn, cotton, and soybeans grown in the United States are GE varieties. Herbicide-tolerant (HT), insect-resistant (Bt), or stacked varieties which combine both herbicides- and insect-resistant elements are the broad categories of GE crops. In 1997, HT cotton acres were about 10 percent. By 2001, they had reached 56 percent, and in 2019, they reached 95 percent. The majority of GE crops are grown in the United States (70.9 Mha), Brazil (44.2 Mha), Argentina (24.5 Mha), India (11.6 Mha), and Canada (11 Mha).

The EU grows GE maize in five countries: Spain, Portugal, the Czech Republic, Romania, and Slovakia. Spain ranks first (0.1 Mha). Three countries in Africa that grow GE crops: South Africa (2.3 Mha), Burkina Faso (0.4 Mha), and Sudan (0.1 Mha), where GE cotton is the leading crop. Thus, these estimates show the growing demand for glyphosate in the forecast period. (Source: ers.usda.gov). As a result, glyphosate continues to be an effective herbicide in agricultural settings since it has such a wide application range, is easy to use, and is generally affordable.

Approvals for herbicide-tolerant crop hybrids

Herbicide-tolerant crop hybrids are genetically modified to withstand non-selective herbicides, such as glyphosate. In order to develop tolerance to glyphosate, many research and development efforts focus on evaluating glyphosate, which is the most effective herbicide that can control all plants in spite of species. Several companies have continuously carried out research and launched products into the market.

Restraints

Lacks of standards and environmental impact

Several environmental effects of glyphosate have been documented within both terrestrial and aquatic environments. On a larger scale, glyphosate is a critical component of entire ecosystems. In the event of herbicide leakage into water bodies, aquatic organisms such as tadpoles and fish are killed. Aside from killing plants in the areas where glyphosate is distributed, it also kills plants in their surroundings. Whether they are on land or in water, the deaths of these living organisms can have far-reaching effects. This type of environmental impact threatens the market in general.

COVID-19 insights:

As a result of COVID-19's restrictions on the raw material supply chain, glyphosate production in several countries has been negatively impacted. The glyphosate trade has been adversely affected by the spread of the pandemic. Glyphosate is largely supplied by China, which meets a significant portion of the global demand for herbicides, primarily glyphosate. Since the COVID-19 outbreak began, the country's industrial output has slowed. Significant supply disruptions were also caused by the interruptions in transportation during the spread.

Key Topics Covered:

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Powers of Buyers

4.3.3. Threat of Substitutes

4.3.4. The Threat of New Entrants

4.3.5. Competitive Rivalry in Industry

4.4. Industry Value Chain Analysis

5. GLYPHOSATE MARKET, BY PRODUCTION APPLICATION

5.1. Introduction

5.2. Conventional Crops

5.3. GM Crops

6. GLYPHOSATE MARKET, BY CROP TYPE

6.1. Introduction

6.2. Fruits and Vegetables

6.3. Cereals and Grains

6.4. Oilseeds and Pulses

7. GLYPHOSATE MARKET, BY GEOGRAPHY

8. COMPETITIVE ENVIRONMENT AND ANALYSIS

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisition, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. COMPANY PROFILES

9.1. BASF SE

9.2. Bayer AG

9.3. Xingfa USA Corporation

9.4. Solvay

9.5. Nufarm

9.6. SinoHarvest

9.7. Zhejiang Xinan Chemical Industrial Group Co., Ltd

9.8. DuPont

For more information about this report visit https://www.researchandmarkets.com/r/tr290t

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance