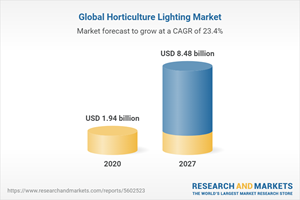

Global Horticulture Lighting Market (2022 to 2027) - Growing Population and a Scarcity of Agricultural Land is Driving the Industry

Global Horticulture Lighting Market

Dublin, July 14, 2022 (GLOBE NEWSWIRE) -- The "Horticulture Lighting Market - Forecasts from 2022 to 2027" report has been added to ResearchAndMarkets.com's offering.

Horticulture lighting helps plants grow by using the light according to their needs and requirements. These lights help in increasing the yield and maintaining the health of crops. They produce less heat, which is why their demand is high in the market. Moreover, an increasing population and a lack of agricultural land area are anticipated to boost the growth of this market during the forecast period.

The growing population across the globe has increased the demand for agriculture and food products. This rising demand has forced farmers to adopt advanced technologies and methods in their agricultural practices to meet the growing demand for food by the global population. Over the past few years, human and animal power in agriculture has been reduced because of the need for a variety of equipment. Furthermore, many initiatives are being taken by the governments of various countries to support their agriculture or horticulture sectors to improve mechanization and boost farm productivity, which in turn is expected to drive the demand for horticulture lighting.

Market Trends:

With the growing trend of indoor and outdoor vertical farming applications, the use of LED lighting applications is growing in the horticulture sector. With the help of LED, a plant can be grown earlier (only in 35 days) in comparison to its natural growth time, i.e., 50 days, due to its various benefits. LED lights are commonly employed in the production of a variety of crops, including tomatoes, greens, cucumbers, and other vegetables. For instance, Farm8, a South Korean agriculture cultivator, has been using LED and related technology to help plants grow faster. Signify has announced the establishment of a city farm facility, "GrowWise", for the cultivation of a variety of crops such as green leafy vegetables, cherries, strawberries, etc.

NASA is continuously experimenting with plants using LED lighting and concluded that it shows immense potential as a horticultural lighting fixture because of its properties such as low energy consumption, low heat operation, and the capability to customize the spectral output to emit the specific wavelengths usable by plants. LED lights are highly reliable as they can be operated for more than 40,000+ hours depending on the type of application. LED is expected to hold a significant share in the horticulture lighting market.

Market Drivers

A growing population and a scarcity of agricultural land

One of the primary reasons driving the market's growth is the continually increasing demand for food from the growing population, which is expected to drive the adoption of lightning in the horticulture sector to improve the yield of various crops. Moreover, with the decline in arable land/per capita, due to the rise in urbanization, agricultural growers and producers have been looking at alternatives and have been adopting novel technologies that are expected to drive the market growth.

According to the data given by the World Bank and FAO, the global arable land/per capita is expected to be around 0.19 hectares by 2050, down from 0.42 hectares in 1960. Also, the changing climatic conditions during traditional and orthodox farming have led to the adoption of lightning in the horticulture sector to improve the yield of various crops. For instance, Fluence Bioengineering, an Osram business unit, announced new solid-state lighting (SSL) distribution partnership with Israel-based Remy 108 Ltd, with a focus on the burgeoning legalized cannabis market in Israel.

Moreover, the rising development of vertical farming due to the growing food demand across the globe is driving the use of lightning in the horticulture sector. Toshiba and Panasonic are supporting the growers by providing them with financial and technical support for setting up the vertical farms. Stay Food Group, an international supplier and cultivator of fresh fruits and vegetables, has constructed a vertical farm in Europe by using Philips Greenpower LED horticultural lighting. Osram Opto Semiconductors GmbH announced the launch of the Duris S5 purple, which helps in combining the wavelengths of red and blue light into a single purple LED, which helps in making horticulture applications more efficient and cost-effective.

Competitive Insights

The increasing demand for food has led to the entry of several new players into the global horticulture lighting market. The market consists of a few players that are focusing on their strategic expansions into new markets and on their R&D initiatives to develop new and innovative products and to maintain a robust position in the market. The report consists of quantitative as well as qualitative analysis of the market, which involves both economic and non-economic factors.

Key Topics Covered:

1. INTRODUCTION

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Function

4.4. Industry Value Chain Analysis

5. HORTICULTURE LIGHTING MARKET BY TECHNOLOGY

5.1. Fluorescent

5.2. HID

5.3. LED

5.4. Others

6. HORTICULTURE LIGHTING MARKET BY CROP TYPE

6.1. Fruits & Vegetables

6.2. Cannabis

6.3. Floriculture

6.4. Others

7. HORTICULTURE LIGHTING MARKET BY APPLICATION

7.1. Greenhouses

7.2. Vertical Farming

7.3. Indoor Farming

7.4. Others

8. HORTICULTURE LIGHTING MARKET BY GEOGRAPHY

8.1. North America

8.1.1. USA

8.1.2. Canada

8.1.3. Mexico

8.2. South America

8.2.1. Brazil

8.2.2. Argentina

8.2.3. Others

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. United Kingdom

8.3.4. Spain

8.3.5. Others

8.4. Middle East And Africa

8.4.1. Israel

8.4.2. Saudi Arabia

8.4.3. Others

8.5. Asia Pacific

8.5.1. China

8.5.2. Japan

8.5.3. South Korea

8.5.4. India

8.5.5. Others

9. COMPETITIVE INTELLIGENCE

9.1. Competitive Benchmarking And Analysis

9.2. Strategies Of Key Players

9.3. Recent Investments and Deals

10. COMPANY PROFILES

10.1. Signify Holding

10.2. Gavita

10.3. General Electric Company

10.4. Osram Opto Semiconductors GmbH.

10.5. Agrolux

10.6. Heliospectra AB

10.7. EYE Hortilux

10.8. LumiGrow

10.9. Samsung

10.10. Lumileds Holding B.V.

For more information about this report visit https://www.researchandmarkets.com/r/lcyfph

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance