Global Insurance Third Party Administrator Market (2022 to 2027) - Featuring American International, Healthscope Benefits and Meritain Health Among Others

Global Insurance Third Party Administrator Market

Dublin, April 26, 2022 (GLOBE NEWSWIRE) -- The "Global Insurance Third Party Administrator Market (2022-2027) by End-User, Service Type, Insurance Type, Geography, Competitive Analysis and the Impact of Covid-19 with Ansoff Analysis" report has been added to ResearchAndMarkets.com's offering.

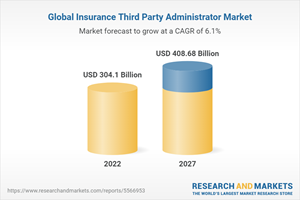

The Global Insurance Third Party Administrator Market is estimated to be USD 304.1 Bn in 2022 and is expected to reach USD 408.68 Bn by 2027, growing at a CAGR of 6.09%.

Market Dynamics

Market dynamics are forces that impact the prices and behaviors of the Global Insurance Third Party Administrator Market stakeholders. These forces create pricing signals which result from the changes in the supply and demand curves for a given product or service. Forces of Market Dynamics may be related to macro-economic and micro-economic factors. There are dynamic market forces other than price, demand, and supply. Human emotions can also drive decisions, influence the market, and create price signals.

As the market dynamics impact the supply and demand curves, decision-makers aim to determine the best way to use various financial tools to stem various strategies for speeding the growth and reducing the risks.

Company Profiles

The report provides a detailed analysis of the competitors in the market. It covers the financial performance analysis for the publicly listed companies in the market. The report also offers detailed information on the companies' recent development and competitive scenario. Some of the companies covered in this report are - American International Group, Inc, Cannon Cochran Management Services Inc, Capital Group, etc.

Countries Studied

America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of - Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of - Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA.

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Competitive Quadrant

The report includes Competitive Quadrant, a proprietary tool to analyze and evaluate the position of companies based on their Industry Position score and Market Performance score. The tool uses various factors for categorizing the players into four categories. Some of these factors considered for analysis are financial performance over the last 3 years, growth strategies, innovation score, new product launches, investments, growth in market share, etc.

Ansoff Analysis

The report presents a detailed Ansoff matrix analysis for the Global Insurance Third Party Administrator Market. Ansoff Matrix, also known as Product/Market Expansion Grid, is a strategic tool used to design strategies for the growth of the company. The matrix can be used to evaluate approaches in four strategies viz. Market Development, Market Penetration, Product Development and Diversification. The matrix is also used for risk analysis to understand the risk involved with each approach.

The analyst analyses Global Insurance Third Party Administrator Market using the Ansoff Matrix to provide the best approaches a company can take to improve its market position.

Based on the SWOT analysis conducted on the industry and industry players, the analyst has devised suitable strategies for market growth.

Why buy this report?

The report offers a comprehensive evaluation of the Global Insurance Third Party Administrator Market. The report includes in-depth qualitative analysis, verifiable data from authentic sources, and projections about market size. The projections are calculated using proven research methodologies.

The report has been compiled through extensive primary and secondary research. The primary research is done through interviews, surveys, and observation of renowned personnel in the industry.

The report includes an in-depth market analysis using Porter's 5 forces model and the Ansoff Matrix. In addition, the impact of Covid-19 on the market is also featured in the report.

The report also includes the regulatory scenario in the industry, which will help you make a well-informed decision. The report discusses major regulatory bodies and major rules and regulations imposed on this sector across various geographies.

The report also contains the competitive analysis using Positioning Quadrants, the analyst's competitive positioning tool.

Key Topics Covered:

1 Report Description

2 Research Methodology

3 Executive Summary

4 Market Dynamics

4.1 Drivers

4.1.1 Increased Risk of Non-Payment

4.1.2 Increasing Digitization of Financial Services

4.1.3 Increase in Business Operations

4.1.4 Growth in Strict Terms and Conditions

4.2 Restraints

4.2.1 Complex Governing Rules

4.2.2 Adds More Cost on Doing Business

4.3 Opportunities

4.3.1 Advancements in Technologies

4.3.2 Demand for Customized Trade Services

4.4 Challenges

4.4.1 Fraud and Cyber Attacks Concerns

5 Market Analysis

5.1 Regulatory Scenario

5.2 Porter's Five Forces Analysis

5.3 Impact of COVID-19

5.4 Ansoff Matrix Analysis

6 Global Insurance Third Party Administrator Market, By End-User

6.1 Introduction

6.2 Life and Annuities Insurance

6.2.1 Life Insurance

6.2.2 Annuities Insurance

6.3 P and C Insurance

7 Global Insurance Third Party Administrator Market, By Service Type

7.1 Introduction

7.2 Claims Management

7.3 Policy Management

7.4 Commission Management

7.5 Others

8 Global Insurance Third Party Administrator Market, By Insurance Type

8.1 Introduction

8.2 Healthcare Providers

8.3 Retirement Plans

8.4 Commercial General Liability

8.5 Other

9 Americas' Insurance Third Party Administrator Market

9.1 Introduction

9.2 Argentina

9.3 Brazil

9.4 Canada

9.5 Chile

9.6 Colombia

9.7 Mexico

9.8 Peru

9.9 United States

9.10 Rest of Americas

10 Europe's Insurance Third Party Administrator Market

10.1 Introduction

10.2 Austria

10.3 Belgium

10.4 Denmark

10.5 Finland

10.6 France

10.7 Germany

10.8 Italy

10.9 Netherlands

10.10 Norway

10.11 Poland

10.12 Russia

10.13 Spain

10.14 Sweden

10.15 Switzerland

10.16 United Kingdom

10.17 Rest of Europe

11 Middle East and Africa's Insurance Third Party Administrator Market

11.1 Introduction

11.2 Egypt

11.3 Israel

11.4 Qatar

11.5 Saudi Arabia

11.6 South Africa

11.7 United Arab Emirates

11.8 Rest of MEA

12 APAC's Insurance Third Party Administrator Market

12.1 Introduction

12.2 Australia

12.3 Bangladesh

12.4 China

12.5 India

12.6 Indonesia

12.7 Japan

12.8 Malaysia

12.9 Philippines

12.10 Singapore

12.11 South Korea

12.12 Sri Lanka

12.13 Thailand

12.14 Taiwan

12.15 Rest of Asia-Pacific

13 Competitive Landscape

13.1 Competitive Quadrant

13.2 Market Share Analysis

13.3 Strategic Initiatives

13.3.1 M&A and Investments

13.3.2 Partnerships and Collaborations

13.3.3 Product Developments and Improvements

14 Company Profiles

14.1 American International Group, Inc

14.2 Cannon Cochran Management Services Inc

14.3 Capital Group

14.4 Charles Taylor General Agency, Inc

14.5 Coresource Inc

14.6 Corvel

14.7 Crawford & Company

14.8 East West Assist Insurance TPA Private Limited

14.9 Ericson Insurance TPA Private Limited

14.10 Exlservice Holdings, Inc

14.11 Gallagher Bassett Services, Inc

14.12 Healthscope Benefits, Inc

14.13 HSBC Securities Services

14.14 Meritain Health

14.15 Northern Trust Corporation

14.16 Sedgwick Claims Management Services Inc

14.17 UMR Inc

14.18 United Health Care Parekh Insurance TPA Private Limited

14.19 United Healthcare Services, Inc

15 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/2dibqw

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance