Global Medical Lifting Sling Market Report to 2030 - Increasing Availability of Home Healthcare Services and Staff is Driving Growth

Global Medical Lifting Sling Market

Dublin, Aug. 18, 2022 (GLOBE NEWSWIRE) -- The "Global Medical Lifting Sling Market Size, Share & Trends Analysis Report, by Product (Nylon, Padded, Mesh, Canvas), by Application (Transfer, Universal, Hammock, Standing, Seating, Toilet, Bariatric), by Usage, by End-use, by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

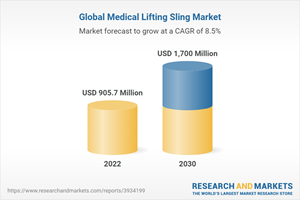

The global medical lifting sling market is anticipated to reach USD 1.7 billion by 2030. The market is expected to expand at a CAGR of 8.5% from 2022 to 2030.

Expanding geriatric and disabled population coupled with rising need for home healthcare products are propelling the market growth. Geriatric population forms the target population for this market. This demographic is highly susceptible to age-related disorders that in certain cases causes immobility. Moreover, the advent of long-term care centers and elderly care centers is creating growth opportunities for market players.

The outbreak of COVID-19 in the year 2020 has positively impacted the medical lifting sling market growth. Increased number of COVID-19 cases and high demand for ventilator support, surged the importance of having supporting aids during the entire stay in hospital. In addition, WHO published the guidance for using disposable medical lifting slings and other equipment, regarding the management of COVID-19 patients. These factors are anticipated to create huge growth opportunities for market players over the forecast period.

Moreover, the prevalence of disabilities is also boosting the demand for the slings. As per the data published by WHO, around 15% of the world's population lives with some form of disability. Out of those some 2% to 4% population experience difficulties in functioning. Old people of 80 years or above are about eight times more likely to have a disability. As per the data published by the U.S. Census Bureau, around 19.9 million people had difficulty in lifting and grasping. All these factors are positively influencing the need for assistive devices like medical lifting slings to obtain mobility.

Medical Lifting Sling Market Report Highlights

Based on product, nylon slings accounted for the largest market share of 29.30% in 2021 owing to the associated benefits, which include greater durability, reusability, and their availability in multiple shapes and sizes..

Based on application, transfer slings was the largest segment in 2021 in terms of revenue and is anticipated to remain the same over the forecast period. Reason being its purpose which includes transferring a patient to and or from a chair, bed and from floor..

Hospitals formed the largest end-user for these products in 2021. The huge patient pool and a greater financing capability facilitate bulk purchasing of these products in hospitals..

Europe medical lifting sling market dominated with around 32.59% market share in 2021 to the higher research expenditure, more initiatives to provide advanced devices, and private-public partnerships..

Asia Pacific is expected to grow at a rapid pace over the forecast owing to the increasing per capita income and the presence of high unmet needs of the huge population pool in this region..

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Medical Lifting Sling Market: Variables, Trends, & Scope

3.1 Market Segmentation and Scope

3.2 Market Driver Analysis

3.2.1 Increasing prevalence of chronic diseases requiring long-term care

3.2.2 Rapidly growing geriatric population

3.2.3 Increasing availability of home healthcare services and staff

3.3 Market Restraint Analysis

3.3.1 Lack of qualified staff

3.3.2 Performance failure and durability issues of medical lifting slings

3.4 Penetration & Growth Prospect Mapping

3.5 Porter's Five Forces Analysis

3.6 PESTEL Analysis

Chapter 4 Medical Lifting Sling Market: Product Segment Analysis

4.1 Medical Lifting Sling: Market Share Analysis, 2021

4.2 Nylon Slings

4.2.1 Nylon slings market, 2018-2030 (USD Million)

4.3 Padded Slings

4.3.1 Padded Slings market, 2018-2030 (USD Million)

4.4 Mesh Slings

4.4.1 Mesh slings Monitors market, 2018-2030 (USD Million)

4.5 Canvas Slings

4.5.1 Canvas slings market, 2018-2030 (USD Million)

4.6 Other Slings

4.6.1 Other Slings market, 2018-2030 (USD Million)

Chapter 5 Medical Lifting Sling Market: Application Segment Analysis

5.1 Medical Lifting Sling: Market Share Analysis, 2021

5.2 Transfer Slings

5.2.1 Transfer slings market, 2018-2030 (USD Million)

5.3 Universal Slings

5.3.1 Universal slings market, 2018-2030 (USD Million)

5.4 Hammock Slings

5.4.1 Hammock slings market, 2018-2030 (USD Million)

5.5 Standing Slings

5.5.1 Standing slings market, 2018-2030 (USD Million)

5.6 Seating Slings

5.6.1 Seating slings market, 2018-2030 (USD Million)

5.7 Toileting Slings

5.7.1 toileting slings market, 2018-2030 (USD Million)

5.8 Bariatric Slings

5.8.1 Bariatric slings market, 2018-2030 (USD Million)

5.9 Other Slings

5.9.1 Other slings market, 2018-2030 (USD Million)

Chapter 6 Medical Lifting Sling Market: Usage Segment Analysis

6.1 Medical Lifting Sling: Market Share Analysis, 2021

6.2.1 Reusable Slings market, 2018-2030 (USD Million)

6.2 Disposable Slings

6.2.1 Disposable Slings market, 2018-2030 (USD Million)

Chapter 7 Medical Lifting Sling Market: End-use Segment Analysis

7.1 Medical Lifting Sling: Market Share Analysis, 2021

7.2 Hospital

7.2.1 Hospital market, 2018-2030 (USD Million)

7.3 Homecare

7.3.1 Homecare market, 2018-2030 (USD Million)

7.4 Elderly Care

7.4.1 Elderly Care market, 2018-2030 (USD Million)

7.5 Other Healthcare Settings

7.5.1 Other healthcare settings market, 2018-2030 (USD Million)

Chapter 8 Medical Lifting Sling Market: Regional Analysis

Chapter 9 Company Profiles

9.1 Company Profiles

9.1.1 Getinge Group (ArjoHuntleigh)

9.1.1.1 Company overview

9.1.1.2 Financial performance

9.1.1.3 Product benchmarking

9.1.2 HILLROM Services inc.

9.1.2.1 Company overview

9.1.2.2 Financial performance

9.1.2.3 Product benchmarking

9.1.3 Invacare Corporation

9.1.3.1 Company overview

9.1.3.2 Financial performance

9.1.3.3 Product benchmarking

9.1.4 Joerns Healthcare LLC

9.1.4.1 Company overview

9.1.4.2 Product benchmarking

9.1.5 Handicare group ab

9.1.5.1 Company overview

9.1.5.2 Financial performance

9.1.5.3 Product benchmarking

9.1.6 V.Guldmann A/S

9.1.6.1 Company overview

9.1.6.2 Product benchmarking

9.1.7 Scaleo Medical

9.1.7.1 Company overview

9.1.7.2 Product benchmarking

9.1.8 Ardoo Hoists

9.1.8.1 Company overview

9.1.8.2 Product benchmarking

For more information about this report visit https://www.researchandmarkets.com/r/317xdn

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance