Global Military Battery Market to 2026 - Featuring EnerSys, Arotech and EaglePicher Technologies Among Others

Global Military Battery Market

Dublin, April 20, 2022 (GLOBE NEWSWIRE) -- The "Military Battery Market - Forecasts from 2021 to 2026" report has been added to ResearchAndMarkets.com's offering.

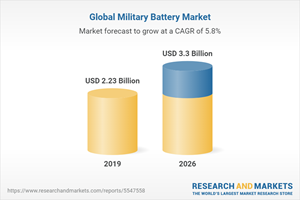

The global military battery market is projected to grow at a CAGR of 5.78% to reach US$3.304 billion by 2026, from US$2.230 billion in 2019.

The military uses batteries to power a variety of devices, ranging from power tools to military portable equipment. On the military battlefield, lithium-ion batteries have proven to be the most reliable power source for portable equipment. Because military lithium batteries are particularly engineered to handle severe military conditions, they are not commonly available for commercial usage. In the event of a power outage, the military battery serves as a backup generator. In the military and defense sectors, batteries are used for a variety of purposes, including APUs, propulsion systems, backup power, and ignition systems, among others.

Over the projected period, demand for these batteries will be driven by rising military spending on sophisticated weaponry and a growing need for unmanned aerial vehicles for surveillance. Military operations are frequently carried out in remote and inaccessible places, necessitating the usage of power for a number of purposes. These military batteries need to be robust and able to resist extreme weather. Military batteries power a wide range of military electrical equipment as well as ships and submarines.

The batteries show to be a beneficial solution in emergency backup circumstances where electricity may fail. Integration of various emerging electronic gadgets, such as wearable devices for night vision applications, has grown popular in the military business. Because these technologies need the usage of batteries, military batteries are in high demand. Defense forces' use of batteries as energy storage devices, as well as rising demand for solid-state batteries, are two significant drivers driving the worldwide military battery market forward.

Some of the key trends that will boost market expansion over the projected period include the desire for contemporary combat systems based on sophisticated technologies, an increase in demand for drones for surveillance, and a decrease in the price of lithium-ion batteries. Some market factors that are estimated to promote market expansion include growing demand for rechargeable batteries and rigorous military rules and regulations for military battery producers. Furthermore, a rise in defense spending across the board, owing to an increase in the number of international disputes, will fuel market development in the future years. Due to an increase in the modernization of military equipment and the replacement of aircraft, outmoded weaponry, and ground vehicles in the area, the military battery market in the Asia Pacific. Additionally, increased defense and security procurements in countries like India and China are expected to drive worldwide demand for military batteries throughout the projection period.

Growth Factors

The surging demand for lithium-ion batteries among end-user industries is fueling the market growth

One of the major reasons for the growth of the global military battery market is the growing demand for lithium-ion batteries among end-users. Lithium-based batteries have a significantly better power density and are much lighter than alkaline and carbon-zinc batteries. In military applications, rechargeable lithium-ion batteries are used. This battery is used by the military for a number of purposes, including radios, thermal imagers, and thermal cameras.

During discharge, the battery moves lithium ions from the negative electrode to the positive electrode, and during charging, the battery does the opposite. High power density military batteries are replacing standard batteries in a variety of military applications, including air defense and electronic warfare equipment. Furthermore, high-capacity, long-duration batteries that are lightweight are in great demand for unmanned aerial vehicles (UAVs) and man-portable devices, resulting in a reduction in overall system size. Large D-sized lithium main battery packs, for example, are being phased out in favor of tiny, high-powered lithium AA batteries, which are utilized by military UAVs to assure safe landings during power outages. These batteries not only help UAVs to be smaller, but they also help them to last longer.

Restraints

Charging issues related to rechargeable military batteries and the stringent regulations hinder the market growth

A major restraint in the growth of the global military battery market is the issues with charging rechargeable military batteries, as well as restrictions and safety concerns with lead-acid military batteries. Also, the design constraints with the military batteries have proved to be a major challenge to end-users and new entrants in the market. Improved Battery Management Systems are being developed (BMS) causing a major threat to the global military battery market during the forecast period.

Impact of COVID-19 on the military battery market

Trade barriers have restrained the stock. Since COVID-19 lockdown has a detrimental impact on battery supply chains, the COVID-19 pandemic has had a negative impact on the battery sector throughout the world. Certain manufacturers are continuously pursuing various methods such as partnerships and joint ventures in order to maintain a strong place in the overall market.

Indian Oil Corporation forged a strategic partnership with Phinergy to deploy breakthrough technologies in the development, manufacture, assembly, and sales of Al-air batteries. Following the closure of COVID-19, Phinergy has continued to develop aluminum-air batteries in order to broaden the company's portfolio in India. However, in the post COVID scenario, the global military battery market is expected to bloom with the surging demand in various industry sectors in the forecast period.

Key Topics Covered:

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. MILITARY BATTERY MARKET BY TYPE

5.1. Introduction

5.2. Lithium Batteries

5.3. Lead Acid Batteries

5.4. Nickel Batteries

5.5. Thermal Batteries

5.6. Others

6. MILITARY BATTERY MARKET BY POWER DENSITY

6.1. Introduction

6.2. Less Than 100 WH/ Kg

6.3. Between 100 and 200 WH/ KG

6.4. More Than 200 WH/ KG

7. MILITARY BATTERY MARKET BY APPLICATION

7.1. Introduction

7.2. Propulsion System

7.3. Backup Power

7.4. Ignition System

7.5. Fire Control System

7.6. Auxiliary Power Unit

7.7. Others

8. MILITARY BATTERY MARKEY BY END-USERS

8.1. Introduction

8.2. Aviation

8.3. Land

8.4. Marine

8.5. Munition

8.6. OEMs

9. MILITARY BATTERY MARKET BY GEOGRAPHY

9.1. Introduction

9.2. North America

9.2.1. USA

9.2.2. Canada

9.2.3. Mexico

9.3. South America

9.3.1. Brazil

9.3.2. Argentina

9.3.3. Others

9.4. Europe

9.4.1. Germany

9.4.2. France

9.4.3. United Kingdom

9.4.4. Spain

9.4.5. Others

9.5. Middle East and Africa

9.5.1. Israel

9.5.2. Saudi Arabia

9.5.3. Others

9.6. Asia Pacific

9.6.1. China

9.6.2. Japan

9.6.3. South Korea

9.6.4. India

9.6.5. Thailand

9.6.6. Indonesia

9.6.7. Taiwan

9.6.8. Others

10. COMPETITIVE ENVIRONMENT AND ANALYSIS

10.1. Major Players and Strategy Analysis

10.2. Emerging Players and Market Lucrativeness

10.3. Mergers, Acquisitions, Agreements, and Collaborations

10.4. Vendor Competitiveness Matrix

11. COMPANY PROFILES

11.1. EnerSys

11.2. Arotech Corporation

11.3. EaglePicher Technologies

11.4. Bren-Tronics, Inc.

11.5. Denchi Power Ltd.

11.6. Ultralife Corporation

11.7. JFM Engineering, Inc

11.8. HBL Power Systems Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/3hrkm1

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance