Global Mobile Payment Technologies Market Report 2022: Breakdown by Near-field Communication (NFC), Sound-wave, & Magnetic Secure Transmission (MST) Payments

Global Mobile Payment Technologies Market

Dublin, June 23, 2022 (GLOBE NEWSWIRE) -- The "Mobile Payment Technologies Global Market Report 2022, By Solutions, Application, Pos Solutions, In-Store Payments Solutions, Remote Payments" report has been added to ResearchAndMarkets.com's offering.

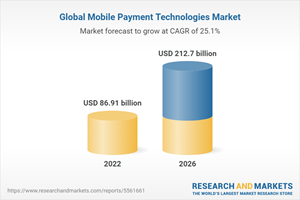

The global mobile payment technologies market is expected to grow from $68.85 billion in 2021 to $86.91 billion in 2022 at a compound annual growth rate (CAGR) of 26.2%. The market is expected to reach $212.70 billion in 2026 at a CAGR of 25.1%.

Mobile Payment Technologies Global Market Report 2022 provides strategists, marketers and senior management with the critical information they need to assess the global mobile payment technologies market.

The report focuses on the mobile payment technologies market which is experiencing strong growth. The report gives a guide to the mobile payment technologies market which will be shaping and changing our lives over the next ten years and beyond, including the market's response to the challenge of the global pandemic.

Where is the largest and fastest growing market for the mobile payment technologies? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The Mobile Payment Technologies Market Global Report answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography.

The Market Characteristics section of the report defines and explains the market.

The market size section gives the market size ($b) covering both the historic growth of the market, the impact of the COVID-19 virus and forecasting its recovery.

Market segmentations break down market into sub markets.

The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the impact and recovery trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

Competitive landscape gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Key Topics Covered:

1. Executive Summary

2. Mobile Payment Technologies Market Characteristics

3. Mobile Payment Technologies Market Trends And Strategies

4. Impact Of COVID-19 On Mobile Payment Technologies

5. Mobile Payment Technologies Market Size And Growth

5.1. Global Mobile Payment Technologies Historic Market, 2016-2021, $ Billion

5.1.1. Drivers Of The Market

5.1.2. Restraints On The Market

5.2. Global Mobile Payment Technologies Forecast Market, 2021-2026F, 2031F, $ Billion

5.2.1. Drivers Of The Market

5.2.2. Restraints On the Market

6. Mobile Payment Technologies Market Segmentation

6.1. Global Mobile Payment Technologies Market, Segmentation By Solutions, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Point-of sale (PoS)

In-store payments

Remote payments

6.2. Global Mobile Payment Technologies Market, Segmentation By Application, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Retail & E-Commerce

Healthcare

BFSI

Enterprise

6.3. Global Mobile Payment Technologies Market, Segmentation By PoS Solutions, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Near-field communication (NFC) payments

Sound-wave based payments

Magnetic secure transmission (MST) payments

6.4. Global Mobile Payment Technologies Market, Segmentation By In-store Payments Solutions, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Mobile wallets

Quick response (QR) code payments

6.5. Global Mobile Payment Technologies Market, Segmentation By Remote Payments, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Internet payments

SMS payments

Direct carrier billing

Mobile banking

7. Mobile Payment Technologies Market Regional And Country Analysis

7.1. Global Mobile Payment Technologies Market, Split By Region, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

7.2. Global Mobile Payment Technologies Market, Split By Country, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Major players in the mobile payment technologies market are

PayPal Inc.

MasterCard

Bharti Airtel

Google Inc.

Apple Inc.

First Data Corporation

American Express Co.

Vodacom Group

Millicom International Cellular

Mahindra Comviva

Orange

Dwolla Inc.

WorldPay

Paytm

AT & T Inc.

Safaricom Limited

MTN Group

Econet Wireless Zimbabwe

Visa

BlueSnap

PayU

Bank of America

Amazon

Citrus Payment Solutions

Stripe

Six Payment services

Paysafe

Wirecard

Novatti

Vodafone Ltd.

Microsoft Corporation

For more information about this report visit https://www.researchandmarkets.com/r/ss4mfw

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance