Global Oil & Gas Pipeline Leak Detection System Market Report 2022: Featuring Key Players Siemens, Honeywell, Xylem & Others

Global Pipeline Leak Detection System (LDS) Market

Dublin, Sept. 14, 2022 (GLOBE NEWSWIRE) -- The "Global Oil & Gas Pipeline Leak Detection System (LDS) Market (2022 Edition) - Analysis By Equipment, Application, By Region, By Country: Market Insights and Forecast with Impact of COVID-19 (2023-2028)" report has been added to ResearchAndMarkets.com's offering.

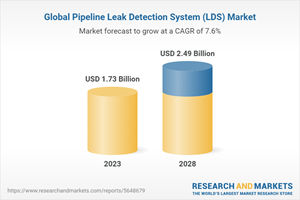

The Global Oil & Gas Pipeline Leak Detection System Market was valued at USD 1585.27 Million in the year 2021 with the Americas region dominating the regional market share.

The global market is driven by the factors such as increasing natural gas production, increasing trade of oil & gas products coupled with growing pipeline infrastructure and associated regulatory policies.

Also, the rising expenditure of pipeline companies on maintenance of the ageing pipelines in the countries and escalating role of government in empowering the usage of leak detection measures to avoid disastrous leakage is driving the market growth.

The growing market of oil and gas, especially gas production in countries like the United States, China and India and increasing energy consumption across the globe are expected to drive the LDS market during the forecast period.

Also, the oil & gas pipeline leak detection market is anticipated to witness significant growth because the incidence of leaks adversely affects the environment as well as the finances of the companies accountable to pay hefty amounts in the form of compensation or damage. Hence, rising awareness to prevent such leakages fuel the demand and also it is paramount for companies to install efficient detection methods.

However, the global oil and gas pipeline sector has been facing several hardships due to the Covid-19 pandemic-induced demand destruction and a weak global economic outlook. Consequently, delaying financial investment decisions (FIDs), slashing capital expenditure, and stalling avoidable projects have become a norm for several pipeline operators to sustain and tide over the current crisis.

One of the primary measures that a majority of pipeline operators adopted to contain the losses is to delay (final Investment Decision) FIDs of upcoming projects. Driftwood Pipeline's FID, initially expected in 2020, is planned in 2021 as its developer, Tellurian Investments Inc. has been struggling to secure financing partners for its entire project. Similarly, Phillips 66 Partners, one of the joint developers of Ace pipeline, postponed FID on this project, which is likely to push the start of the project by a couple of years from the initially planned 2020.

Key Target Audience

Oil & Gas Companies

Oil & Gas Leak Detection System Vendors

Consulting and Advisory Firms

Government and Policy Makers

Regulatory Authorities

Key Topics Covered:

1. Report Scope and Methodology

2. Strategic Recommendations

3. Global Oil & Gas Pipeline Leak Detection System Market: Product Overview

4. Global Oil & Gas Pipeline Leak Detection System Market: An Analysis

5. Global Oil & Gas Pipeline Leak Detection System Market: Segmental Analysis

5.1 Global Oil & Gas Pipeline Leak Detection System Market Segmentation, By Equipment

5.2 Competitive Positioning of Oil & Gas Pipeline Leak Detection System Market: By Equipment (2021 & 2028)

5.3 By Thermal Imaging, By Value (USD Million), 2018-2028

5.4 By Flow Meters, By Value (USD Million), 2018-2028

5.5 By Pressure Sensors, By Value (USD Million), 2018-2028

5.6 By Fiber Optics, By Value (USD Million), 2018-2028

5.7 By Acoustic Sensors, By Value (USD Million), 2018-2028

5.8 By Software Sensors, By Value (USD Million), 2018-2028

6. Global Oil & Gas Pipeline Leak Detection System Market: Segment Analysis

6.1 Global Oil & Gas Pipeline Leak Detection System Market Segmentation, By Application

6.2 Competitive Positioning of Global Oil & Gas Pipeline Leak Detection System Market, By Application (2021 & 2028)

6.3 By Offshore, By value (USD Million), 2018-2028

6.4 By Onshore, By Value (USD Million), 2018-2028

7. Global Oil & Gas Pipeline Leak Detection System Market: Regional Analysis

8. Americas Oil & Gas Pipeline Leak Detection System Market: An Analysis (2018-2028)

9. Europe Oil & Gas Pipeline Leak Detection System Market: An Analysis (2018-2028)

10. Asia Pacific Oil & Gas Pipeline Leak Detection System Market: An Analysis (2018-2028)

11. Middle East and Africa Oil & Gas Pipeline Leak Detection System Market: An Analysis (2018-2028)

12. Global Oil & Gas Pipeline Leak Detection System Market Dynamics

13. Market Attractiveness and Strategic Analysis

14. Competitive Landscape

15. Company Profiles (Business Description, Financial Analysis, Business Strategy)

15.1 Siemens AG

15.2 Honeywell International Inc.

15.3 Xylem Inc.

15.4 PSI AG

15.5 Perma-Pipe

15.16 Schneider Electric

15.7 Teledyne FLIR

15.8 Emerson,

15.19 Schlumberger

15.10 SENSIT Technologies

For more information about this report visit https://www.researchandmarkets.com/r/osk4mj

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance