Global Oral Solid Dosage Contract Manufacturing Market 2024-2030: Regional Trends for Tablets, Capsules, Powders, and Granules

Global Oral Solid Dosage Contract Manufacturing Market

Dublin, March 13, 2024 (GLOBE NEWSWIRE) -- The "Global Oral Solid Dosage Contract Manufacturing Market Size, Share & Trends Analysis Report by Product Type (Tablets, Capsules, Powders, Granules), Mechanism, End-use, Region, and Segment Forecasts, 2024-2030" report has been added to ResearchAndMarkets.com's offering.

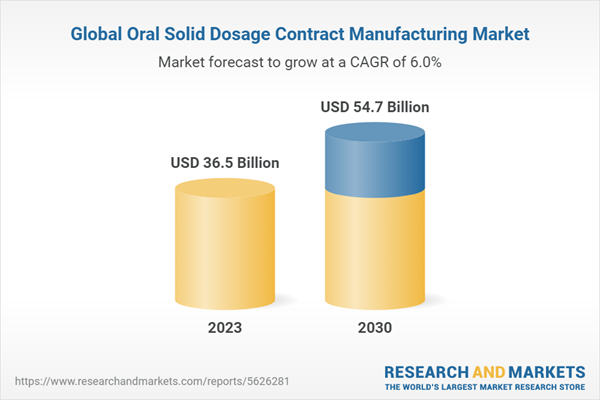

The global oral solid dosage contract manufacturing market is expected to reach USD 54.7 billion by 2030 and expand at a CAGR of 5.97% from 2024 to 2030. Increasing complexity of new drug molecules, R&D investments by large CMOs & CDMOs and rising demand for novel therapies are key factors driving market growth.

Oral solids are widely accepted dosage forms in the pharmaceutical sector since they are cost-effective, simple to manufacture, and patient-friendly. Furthermore, advances in drug delivery technology, such as control release and sustained release formation, are enabling oral solids to achieve even higher levels of bioavailability while lowering drug administration frequency. Thereby, it is anticipated to propel market growth potential.

Technological advancements in the development and bulk manufacturing of oral solid dosage forms are among the primary factors supporting the fast-track commercialization of these products. Currently, a diverse array of dosage forms is accessible in the market. However, the nutraceutical and pharmaceutical industries consistently put effort into developing OSD forms. This preference is due to their ease of handling, convenient consumption, and positive patient adherence. Anticipated advancements in technology and materials of OSD forms are projected to boost the demand for these formulations.

Furthermore, R&D investments by CMOs and CDMOs contribute to enhanced innovation in manufacturing processes, formulation development, & analytical technologies. This can lead to the adoption of more efficient and advanced manufacturing techniques in the production of oral solid dosage forms. Also, investments in R&D result in the expansion of manufacturing capabilities and improved scalability. This allows CMOs and CDMOs to offer larger volumes of oral solid dosage production to meet the increasing demand from pharmaceutical companies.

Moreover, the industry witnessed many strategic movements in 2023, such as collaborations, partnerships, M&As, service expansion, etc.

In July 2023, Aenova Group and Galvita entered a strategic partnership to improve the formulation, production, and development of oral dosage forms.

In April 2023, Aenova invested approximately USD 21.96 million (20 million euros) to expand its high-volume solids site in Tittmoning, resulting in increased capacity.

In January 2023, Catalent and Ethicann collaborated to develop Ethicann's clinical drug pipeline using Catalent's technology known as Orally Disintegrating Tablet (ODT) technology.

Oral Solid Dosage Contract Manufacturing Market Report Highlights

The tablets segment dominated the market with a revenue share of 32.7% in 2023. Tablets are the most common and preferred OSD form due to their cost-effectiveness, high compactness, easy manufacturing, and convenience of self-administration. Increased demand for bilayer tablets and investments by firms to expand formulation and controlled-release tablet manufacturing are predicted to drive market growth

The controlled release segment accounted for the largest share of 52.2% in 2023. This growth is attributed to advancements in oral controlled release delivery systems, including dome tablets, dual drug tablets, intestinal patches, polymer nanosystems, and bioinspired delivery methods, such as exosomes for precise drug delivery. Thus, high demand for control release dosage forms is anticipated to boost segmental revenue growth in the near future

Based on end-use, the large size companies segment accounted for the largest share of 54.8% in 2023. The solid dose manufacturing market is increasingly defined by collaboration, flexibility, and high adaptability. More pharma developers design drugs from the start, intending to outsource them to large CMOs, thereby accelerating market growth. Furthermore, CMOs specializing in oral solid dosage can provide several benefits to large pharmaceutical companies, leading to their increased adoption

Asia-Pacific led the global market in 2023 and is projected to witness the fastest CAGR of 6.3% during the forecast years. China and India are the powerhouses of oral solid dosage contract manufacturing organizations with significantly lower prices. Further, expanding manufacturing capabilities among Asian countries such as Singapore, India, and South Korea have been considered major players in the pharmaceutical industry due to their expanding manufacturing capabilities

Key Attributes

Report Attribute | Details |

No. of Pages | 193 |

Forecast Period | 2023-2030 |

Estimated Market Value (USD) in 2023 | $36.5 Billion |

Forecasted Market Value (USD) by 2030 | $54.7 Billion |

Compound Annual Growth Rate | 5.9% |

Regions Covered | Global |

Key Topics Covered

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Oral Solid Dosage Contract Manufacturing Market: Variables, Trends, & Scope

Chapter 4 Oral Solid Dosage Contract Manufacturing Market: Segment Analysis, by Product Type, 2018-2030 (USD Million)

Chapter 5 Oral Solid Dosage Contract Manufacturing Market: Mechanism Analysis

Chapter 6 Oral Solid Dosage Contract Manufacturing Market: End-use Analysis

Chapter 7 Oral Solid Dosage Contract Manufacturing Market: Regional Analysis

Chapter 8 Competitive Landscape

Chapter 9 Key Takeaways

Companies Mentioned

Richter-Helm BioLogics

Lonza

Catalent, Inc

Lonza

Aenova Group

Boehringer Ingelheim International GmbH

Jubilant Pharmova Limited

Patheon Pharma Services

Recipharm AB.

Corden Pharma International

Siegfried Holding AG

Piramal Pharma Solutions

AbbVie Contract Manufacturing

Next Pharma AB

For more information about this report visit https://www.researchandmarkets.com/r/rnglq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance