Global Satellite Modem Market 2022 to 2028: Data Connectivity at High Speeds is Becoming More Important Driving Demand

satellite-modem-market-size.jpg

Dublin, March 03, 2023 (GLOBE NEWSWIRE) -- The "Global Satellite Modem Market Size, Share & Industry Trends Analysis Report by Channel Type, Technology, End-user, Regional Outlook and Forecast, 2022-2028" report has been added to ResearchAndMarkets.com's offering.

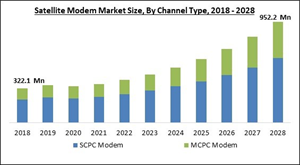

The Global Satellite Modem Market size is expected to reach $952.2 million by 2028, rising at a market growth of 15.5% CAGR during the forecast period.

Key Market Players

List of Companies Profiled in the Report:

Comtech Telecommunications Corp.

Datum System

Gilat Satelite Networks Ltd.

Hughes Network Systems, LLC (EchoStar Corporation)

Orbcomm, Inc. (GI Partners)

NOVELSAT

ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.)

Teledyne Technologies, Inc.

Viasat, Inc.

WORK Microwave GmbH

Additionally, satellite antennae and frequency converters are required for the establishment of a satellite link. Data to be communicated are transmitted to modems from data terminal equipment. The intermediate frequency (IF) output of the modem is typically 50-200 MHz; however, the signal is occasionally modulated straight to the L band.

In the majority of instances, the frequency must be transformed with an upconverter before amplification and transmission. Depending on the modulation technique employed, a modulated signal is a sequence of symbols, or forms of data conveyed by a corresponding signal state, such as a bit or a few bits.

Recovering a symbol clock (synchronizing a local symbol clock generator with a distant one) is one of the most essential responsibilities of a demodulator. Similarly, a signal received from a satellite is initially down-converted, followed by demodulation by a modem, and finally handled by data terminal equipment. The LNB is typically supplied with 13 or 18 V DC through the solution providers by the modem.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a substantial influence on the expansion of this sector. During the pandemic, the demand for this market was greatly bolstered by the increase in demand for satellite communication solutions across several industries. In addition, the worldwide telecommunications industry has begun deploying satellite modem solutions, which is anticipated to boost the expansion of the satellite modem market study post-pandemic.

Market Growth Factors

Data Connectivity at High Speeds Is Becoming More Important

Numerous end-user sectors, including those in the maritime, oil and gas, transport, communications, and education, among others, have increased their need for real-time and high-speed communication, which has led to an increase in the demand for sophisticated high-speed satellite modems.

Users are now able to send massive quantities of data effectively due to the satellite modem industry's ongoing advancements. The speed and data connectivity rates that are also available onshore are not available to offshore teams.

Increasing Leo Satellite and Constellation Launches

A lot of businesses in this industry have suggested or are putting into practice plans to create satellite constellations, while CubeSats and other tiny spacecraft are also gaining popularity. The rising popularity of GPS is a key factor in the expansion of LEO and MEO satellites. It is now a crucial component of the satellite communications system.

To supply GPS, a large number of MEO satellites are deployed into orbit. More MEO satellites will be required as the demand for GPS connection rises. For effective signal transmission, this will lead to a necessity for several satellite modems to be placed throughout base stations. The massive launches of the satellites surge the growth of the satellite modem market.

Market Restraining Factors

Satcom Equipment's Susceptibility to Cyberattacks

For the majority of enterprises installing IoT systems and, more recently, 5G networks, which include numerous connected devices across networks, platforms, and devices, security is the most important technical challenge.

IoT growth implies a bad actor might potentially control a vast network of linked devices if just one unencrypted device or the communication between them isn't safeguarded. Every step of the data transmission process must be secured, not only the devices themselves.

The satellite-space industry is now under threat from network hacking and cyberattacks, which is creating an increasing challenge to satellite operators.

Scope of the Study

Market Segments Covered in the Report:

By Channel Type

SCPC Modem

MCPC Modem

By Application

IP-trunking

Mobile & Backhaul

Enterprise & Broadband

Media & Broadcast

Others

By Technology

Satcom-on-the-move

Satcom-on-the-pause

VSAT

Others

By End User

Military & Defense

Telecommunications

Marine

Oil & Gas

Transportation & Logistics

Others

By Geography

North America

US

Canada

Mexico

Rest of North America

Europe

Germany

UK

France

Russia

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Singapore

Malaysia

Rest of Asia Pacific

LAMEA

Brazil

Argentina

UAE

Saudi Arabia

South Africa

Nigeria

Rest of LAMEA

For more information about this report visit https://www.researchandmarkets.com/r/swo8ws

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance