Global Target Drones Market Research Report 2022

Global Target Drones Market

Dublin, Aug. 10, 2022 (GLOBE NEWSWIRE) -- The "Global Target Drones Market by End-use Sector (Defense, Commercial), End Use (Aerial Targets, Ground Targets, Marine Targets), Application, Mode of Operation, Payload Capacity, Build, Target Type, Engine Type, Speed, Type and Region - Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

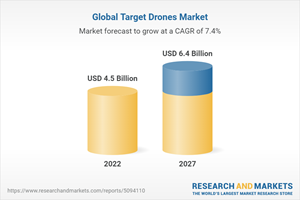

The target Drones market is projected to grow from USD 4.5 billion in 2022 to USD 6.4 billion by 2027, at a CAGR of 7.4% from 2022 to 2027

The market is driven by rising need for UAVs in military applications. However, the market's growth is limited by the regulations on lithium batteries that power drones to foresee the market growth.

The COVID-19 outbreak has had an impact on the target drones supply chain. The spread of COVID-19 in the United States and Europe is expected to be slowed by lockdowns at target drones research and development centres.

As a result of the Asia Pacific lockdown, many businesses in the target drones industry have lost revenue. Many startups have failed to continue operating in the area due to delays in development and a lack of funds. The commercialization of target drones appears to have been delayed by a year when compared with pre conditions.

The aerial targets segment is expected to hold major share of the market during the forecast period on the basis of composition

On the basis of end use, the target drones market has been segmented into aerial targets, ground targets, and marine targets. Aerial targets include unmanned aerial target drones, whereas ground targets include unmanned ground vehicles used as targets. Marine targets include unmanned underwater target drones as well as sea surface targets.

Aerial targets include all unmanned aerial target vehicles; about 80% of target drones acquired by armed forces worldwide fall under this category. In the US, there are two variants of target drones - full-scale targets and subscale targets. Full-scale targets are fighter aircraft converted into unmanned target drones.

For instance, F-4 and F-16 are currently being utilized by the US Air Force as target drones. Subscale aerial target drones are smaller versions of full-scale aerial target drones, capable of handling tasks carried out by the latter in terms of speed, countermeasures, and scoring.

The defense segment is anticipated to lead the target drones market in near future

On the basis of end-use sector, the target drones market has been segmented into defense and commercial. The increasing applicability of target drones in these sectors has prompted companies to undertake R&D to improve their performance capabilities.

Target drones are used by military forces worldwide to perform various defense-related tasks due to their extreme endurance capabilities and potential for high-altitude threat simulation. The defense end-use sector is further divided into the military and homeland security sectors.

New build segment led the target drones market

On the basis of build, the target drones market has been segmented into newbuild and converted. Manned aircraft/boats converted to unmanned target vehicles fall under the category of converted target drones.

For instance, in the US, retired fighter aircraft F-4 and F-16 were converted into QF-16 and QF-4 aerial target drones. Another example is the UK Royal Navy's conversion of the blade-runner boat into a high-speed sea surface target.

North America held largest market share in terms of value

North America is estimated to account for 52% of the target drones market in 2022. The market in North America is projected to grow from USD 2,332 million in 2022 to USD 3,398 million by 2027, at a CAGR of 7.8% from 2022 to 2027.

Competitive landscape

The Boeing Company (US), QinetiQ Group plc (UK), Northrop Grumman Corporation (US), Kratos Defense & Security Solutions, Inc. (US), Airbus Group (Netherlands), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Air Affairs Australia Pty Ltd. (Australia), Saab AB (Sweden), AeroTargets International, LLC (US) are key players operating in the target drones market.

Premium Insights

Increased Focus on Enhanced Military Training Drives Growth of Target Drones Market

Newbuild Segment to Lead Target Drones Market, 2022-2027 (USD Million)

Combat Training Segment to Lead Target Drones Market, 2022-2027 (USD Million)

North American Target Drones Market to Record Highest CAGR, 2022-2027

Market Dynamics

Drivers

Growing Prominence of Intensified Military Training

Advantages Over Manned Target Vehicles

Restraints

Lack of Skilled and Trained Personnel

Opportunities

Full-Scale Conversion of Target Drones for Simulation of War Scenarios

Growing Defense Budgets of Major Economies

Demand for Target Drones in Homeland Security Applications

Challenges

Lack of Sustainable Power Sources to Improve Endurance of Drones

Industry Trends

Key Technology Vendors

Maturity Map of Target Drones

Technology Trends

Scoring Systems

Converted Drones

Electronic Countermeasures

Chaff Dispensers

Flare Dispensers

Recovery Systems

Innovation and Patent Registrations

Key Players

The Boeing Company

Qinetiq Group plc

Northrop Grumman Corporation

Kratos Defense & Security Solutions Inc.

Airbus Group

Lockheed Martin Corporation

Leonardo Spa.

Raytheon Technologies Corporation

Bsk Defense Sa

Air Affairs Australia Pty Ltd

Saab Ab

Aerotargets International LLC.

L3 Asv

Bae Systems

General Dynamics Corporation

Almaz-Antey

Thales

Anadrone Systems

Denel Dynamics

Griffon Aerospace

For more information about this report visit https://www.researchandmarkets.com/r/sjjzoa

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance