Global Telecom API Market (2022 to 2030) - Size, Share & Trends Analysis Report

Global Telecom API Market

Dublin, May 30, 2022 (GLOBE NEWSWIRE) -- The "Telecom API Market Size, Share & Trends Analysis Report by Type (Messaging API, IVR API), by End User (Enterprise Developers, Partner Developers), by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

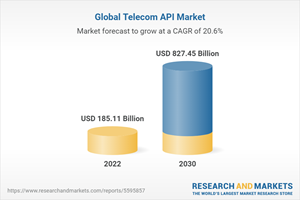

The global telecom API market size is anticipated to reach USD 827.45 billion by 2030, expanding at a CAGR of 20.6% from 2022 to 2030. Growing demand for smartphones integrated with features such as 5G, digital wallets, GPS services, and near-field communication (NFC), among others, is projected to drive the market growth over the forecast period. API facilitates web-based solution developers to develop applications through a single point of contact utilizing the capabilities offered by the API platform for agile application development.

The increasing adoption of the Internet of Things (IoT) in the telecommunication sector is expected to sustain market growth in the forecast period. CSPs such as AT&T, Inc., Orange, Google LLP, and Verizon, among others are providing their IoT API platforms to various sectors such as manufacturing, utilities, retail, and transportation, among others. AT&T has an API marketplace to help solution providers quickly build web-based collaboration apps for their voice, video, text, and other communications services. IoT platform developed by Orange namely Live Objects forms connections centrally through a web portal and standard API.

Web Real-Time Communication (WebRTC) API is a compilation of several standard APIs and protocols that operate simultaneously to facilitate data sharing and peer-to-peer teleconferencing eliminating the need for installing any third-party additional plug-ins. The market is expected to witness significant growth owing to the rising adoption of WebRTC by various CSPs and technology providers such as Cisco Systems, Inc., Vodafone Group, Orange, Google LLP, Huawei Technologies Co., Ltd., and AT&T, Inc., among others. However, stringent government regulations for end-user data protection are expected to act as an inhibitor to market growth over the forecast period.

Since the outbreak of COVID-19, key players operating in the telecom API market are focused on solidifying their presence in the market by implementing strategies such as new product developments, mergers & acquisitions, partnerships, and geographical expansion. For instance, in March 2022, U.S.-based T-Mobile Ventureinvested in telecom API development startup SignalWire, which develops voice, video, and messaging APIs, for advancement in API and 5G technology, among others.

Telecom API Market Report Highlights

The messaging API segment of the market is projected to account for the largest market share in 2021 and is expected to grow at a CAGR of 21.6% over the forecast period. This growth is ascribed to the increasing adoption of A2P messaging by large organizations for applications such as promotional activities, and product announcements, among others.

The partner developer segment is estimated to grow at the fastest CAGR of over 22.3% during the forecast period. The growth can be attributed to the rising number of internet users and increasing adoption of over-the-top (OTT) media services by organizations.

Asia Pacific held a maximum revenue share of over 28% in 2021 and is projected to witness a healthy CAGR over the forecast period. The growth can be attributed to the increasing number of smartphone users in countries such as India and China.

Leading companies in the market are adopting various organic and inorganic growth strategies such as collaborations, mergers & acquisitions to increase their market presence and expand their existing product portfolio.

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Telecom API Industry Outlook

3.1. Market Segmentation

3.2. Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint/challenge analysis

3.3.3. Market opportunity analysis

3.4. Penetration & Growth Prospects Mapping

3.5. Industry Analysis-Porter's Five Force Analysis

3.6. PEST Analysis

Chapter 4. Telecom API Market: Type Outlook

4.1. Telecom API Market Estimates & Forecasts, by Type, 2021 & 2030 (USD Billion)

4.2. Messaging API

4.2.1. Market estimates and forecasts, 2018-2030 (USD Billion)

4.2.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

4.3. WebRTC API

4.3.1. Market estimates and forecasts, 2018-2030 (USD Billion)

4.3.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

4.4. Payment API

4.4.1. Market estimates and forecasts, 2018-2030 (USD Billion)

4.4.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

4.5. IVR API

4.5.1. Market estimates and forecasts, 2018-2030 (USD Billion)

4.5.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

4.6. Location API

4.6.1. Market estimates and forecasts, 2018-2030 (USD Billion)

4.6.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

4.7. Others

4.7.1. Market estimates and forecasts, 2018-2030 (USD Billion)

4.7.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

Chapter 5. Telecom API Market: End User Outlook

5.1. Telecom API Market Estimates & Forecasts, by End User, 2021 & 2030 (USD Billion)

5.2. Enterprise Developers

5.2.1. Market estimates and forecasts, 2018-2030 (USD Billion)

5.2.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

5.3. Internal Telecom Developers

5.3.1. Market estimates and forecasts, 2018-2030 (USD Billion)

5.3.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

5.4. Partner Developers

5.4.1. Market estimates and forecasts, 2018-2030 (USD Billion)

5.4.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

5.5. Long Tail Developers

5.5.1. Market estimates and forecasts, 2018-2030 (USD Billion)

5.5.2. Market estimates and forecasts, by region, 2018-2030 (USD Billion)

Chapter 6. Telecom API Market: Regional Outlook

Chapter 7. Competitive Landscape

7.1. AT&T, Inc.

7.1.1. Company overview

7.1.2. Financial performance

7.1.3. Product benchmarking

7.1.4. Recent developments

7.2. Globe Labs

7.2.1. Company overview

7.2.2. Financial performance

7.2.3. Product benchmarking

7.2.4. Recent developments

7.3. Google, LLC

7.3.1. Company overview

7.3.2. Financial performance

7.3.3. Product benchmarking

7.3.4. Recent developments

7.4. Huawei Technologies Co., Ltd.

7.4.1. Company overview

7.4.2. Financial performance

7.4.3. Product benchmarking

7.4.4. Recent developments

7.5. LocationSmart

7.5.1. Company overview

7.5.2. Financial performance

7.5.3. Product benchmarking

7.5.4. Recent developments

7.6. Orange S.A.

7.6.1. Company overview

7.6.2. Financial performance

7.6.3. Product benchmarking

7.6.4. Recent developments

7.7. Twilio Inc.

7.7.1. Company overview

7.7.2. Financial performance

7.7.3. Product benchmarking

7.7.4. Recent developments

7.8. Verizon

7.8.1. Company overview

7.8.2. Financial performance

7.8.3. Product benchmarking

7.8.4. Recent developments

7.9. Vonage Holdings Corp.

7.9.1. Company overview

7.9.2. Financial performance

7.9.3. Product benchmarking

7.9.4. Recent developments

7.10. Vodafone Ltd.

7.10.1. Company overview

7.10.2. Financial performance

7.10.3. Product benchmarking

7.10.4. Recent developments

For more information about this report visit https://www.researchandmarkets.com/r/b3hohf

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance