Global Wax Market Report to 2030 - Featuring Exxon Mobil, HollyFrontier Sinclair and Honeywell International Among Others

Global Wax Market

Dublin, Sept. 16, 2022 (GLOBE NEWSWIRE) -- The "Wax Market By Application, By Type: Global Opportunity Analysis and Industry Forecast, 2020-2030" report has been added to ResearchAndMarkets.com's offering.

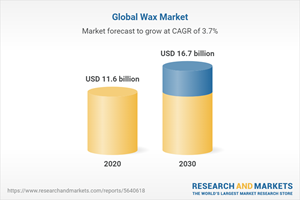

The global wax market was valued at $11.6 billion in 2020, and is projected to reach $16.7 billion by 2030, growing at a CAGR of 3.7% from 2021 to 2030.

Wax is an organic ingredient that is solid at normal room temperature but becomes free flowing fluid when the temperature is high. The main commercial source of wax is crude oil. However, waxes are produced from plants, lignite, animals, and insects. Paraffin/Mineral wax, synthetic wax, and natural wax are the three types of waxes available in the market. These waxes differ in their chemical composition; however, the presence of normal alkanes is always in high ratio compared to other ingredients.

High requirement of waxes in the packaging industry drives the growth of global wax market. Paraffin waxes offer exceptional resistance to water, hence it is widely used for packaging. Moreover, surge in demand for waxes from applications, including tire & rubber, coating, and floor polishes boosts the growth of market across the globe. Increase in demand for wax from the personal care industry is another driver for the growth of wax industry. Cosmetics and personal care sectors have the maximum usage of wax.

The personal care industry accounted for a healthy share in the global market in 2019. However, the market growth is restricted, due to high prices of synthetic and natural waxes. Moreover, shortage in supply of paraffin/mineral wax hampers the market growth. However, growth in awareness toward natural cosmetics is expected to provide major opportunity for the manufacturers.

The wax market is segmented on the basis of type, application, and region. By type, it is segregated into paraffin/mineral wax, synthetic wax, natural wax, and others. On the basis of application, it is fragmented into candles, packaging, emulsions, hot melts, floor polishes, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include Akzo Nobel N.V., Baker Hugher Company, BASF SE, Cepsa, China National Petroleum Corporation, Evonik Industries AG, Exxon Mobil Corporation, HollyFrontier Sinclair Corporation, Honeywell International Inc., The International Group Inc.

Impact of COVID-19 on Global Wax Market

The outbreak of COVID-19 led to partial or complete shutdown of production facilities that do not come under essential goods, owing to prolonged lockdown in major countries, including the U.S., China, Japan, India, and Germany. It led to either closure or suspension of their production activities in most of the industrial units across the globe.

COVID-19 pandemic stagnated production activities in various areas such as packaging, cosmetics, chemicals, and candle making. Supply chain disruptions disrupted the supply of raw materials to these industries. As a result, the demand for wax from these industries that depended on wax for production declined. In addition, the decline in demand for cosmetics, candles, and consumer goods reduced the demand for waxes across the globe.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wax market analysis from 2020 to 2030 to identify the prevailing wax market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the wax market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global wax market trends, key players, market segments, application areas, and market growth strategies.

Key Topics Covered:

CHAPTER 1: INTRODUCTION

CHAPTER 2: EXECUTIVE SUMMARY

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key findings

3.2.1. Top investment pockets

3.3. Porter's five forces analysis

3.4. Top player positioning

3.5. Market dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunities

3.6. COVID-19 Impact Analysis on the market

3.7. Pricing Analysis

3.8. Regulatory Guidelines

3.9. Patent Landscape

CHAPTER 4: WAX MARKET, BY APPLICATION

4.1 Overview

4.1.1 Market size and forecast

4.2 Candles

4.2.1 Key market trends, growth factors and opportunities

4.2.2 Market size and forecast, by region

4.2.3 Market analysis by country

4.3 Packaging

4.3.1 Key market trends, growth factors and opportunities

4.3.2 Market size and forecast, by region

4.3.3 Market analysis by country

4.4 Emulsions

4.4.1 Key market trends, growth factors and opportunities

4.4.2 Market size and forecast, by region

4.4.3 Market analysis by country

4.5 Hot Melts

4.5.1 Key market trends, growth factors and opportunities

4.5.2 Market size and forecast, by region

4.5.3 Market analysis by country

4.6 Floor Polishes

4.6.1 Key market trends, growth factors and opportunities

4.6.2 Market size and forecast, by region

4.6.3 Market analysis by country

4.7 Others

4.7.1 Key market trends, growth factors and opportunities

4.7.2 Market size and forecast, by region

4.7.3 Market analysis by country

CHAPTER 5: WAX MARKET, BY TYPE

5.1 Overview

5.1.1 Market size and forecast

5.2 Paraffin/Mineral Wax

5.2.1 Key market trends, growth factors and opportunities

5.2.2 Market size and forecast, by region

5.2.3 Market analysis by country

5.3 Synthetic Wax

5.3.1 Key market trends, growth factors and opportunities

5.3.2 Market size and forecast, by region

5.3.3 Market analysis by country

5.4 Natural Wax

5.4.1 Key market trends, growth factors and opportunities

5.4.2 Market size and forecast, by region

5.4.3 Market analysis by country

5.5 Others

5.5.1 Key market trends, growth factors and opportunities

5.5.2 Market size and forecast, by region

5.5.3 Market analysis by country

CHAPTER 6: WAX MARKET, BY REGION

CHAPTER 7: COMPANY LANDSCAPE

7.1. Introduction

7.2. Top winning strategies

7.3. Product Mapping of Top 10 Player

7.4. Competitive Dashboard

7.5. Competitive Heatmap

7.6. Key developments

CHAPTER 8: COMPANY PROFILES

8.1 Akzo Nobel N.V.

8.1.1 Company overview

8.1.2 Company snapshot

8.1.3 Operating business segments

8.1.4 Product portfolio

8.1.5 Business performance

8.1.6 Key strategic moves and developments

8.2 Baker Hughes Company

8.2.1 Company overview

8.2.2 Company snapshot

8.2.3 Operating business segments

8.2.4 Product portfolio

8.2.5 Business performance

8.2.6 Key strategic moves and developments

8.3 BASF SE

8.3.1 Company overview

8.3.2 Company snapshot

8.3.3 Operating business segments

8.3.4 Product portfolio

8.3.5 Business performance

8.3.6 Key strategic moves and developments

8.4 Cepsa

8.4.1 Company overview

8.4.2 Company snapshot

8.4.3 Operating business segments

8.4.4 Product portfolio

8.4.5 Business performance

8.4.6 Key strategic moves and developments

8.5 china national petroleum corporation

8.5.1 Company overview

8.5.2 Company snapshot

8.5.3 Operating business segments

8.5.4 Product portfolio

8.5.5 Business performance

8.5.6 Key strategic moves and developments

8.6 Evonik Industries AG

8.6.1 Company overview

8.6.2 Company snapshot

8.6.3 Operating business segments

8.6.4 Product portfolio

8.6.5 Business performance

8.6.6 Key strategic moves and developments

8.7 Exxon Mobil Corporation

8.7.1 Company overview

8.7.2 Company snapshot

8.7.3 Operating business segments

8.7.4 Product portfolio

8.7.5 Business performance

8.7.6 Key strategic moves and developments

8.8 HollyFrontier Sinclair Corporation

8.8.1 Company overview

8.8.2 Company snapshot

8.8.3 Operating business segments

8.8.4 Product portfolio

8.8.5 Business performance

8.8.6 Key strategic moves and developments

8.9 Honeywell International Inc.

8.9.1 Company overview

8.9.2 Company snapshot

8.9.3 Operating business segments

8.9.4 Product portfolio

8.9.5 Business performance

8.9.6 Key strategic moves and developments

8.10 The International Group Inc.

8.10.1 Company overview

8.10.2 Company snapshot

8.10.3 Operating business segments

8.10.4 Product portfolio

8.10.5 Business performance

8.10.6 Key strategic moves and developments

For more information about this report visit https://www.researchandmarkets.com/r/nywn47

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance