Global Wearable Injectors Market (2022 to 2028) - Size, Share & Industry Trends Analysis Report

Global Wearable Injectors Market

Dublin, July 14, 2022 (GLOBE NEWSWIRE) -- The "Global Wearable Injectors Market Size, Share & Industry Trends Analysis Report By Therapy, By End User, By Type, By Technology, By Regional Outlook and Forecast, 2022 - 2028" report has been added to ResearchAndMarkets.com's offering.

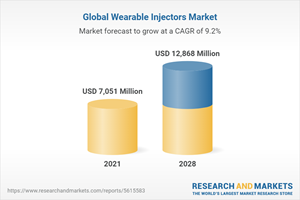

The Global Wearable Injectors Market size is expected to reach $12.9 billion by 2028, rising at a market growth of 9.2% CAGR during the forecast period.

Wearable injectors (WIs) are drug delivery systems that anchor to the body and release significant amounts of medicine subcutaneously over time. Wearable injectors provide medications at predetermined intervals over a particular timeframe. Wearable injectors allow patients to self-inject medication, alleviating the strain on doctors and healthcare personnel. Wearable injectors are important in the treatment of diabetes and a variety of chronic conditions, including cancer, respiratory ailments, and arthritis. Because they do not require additional equipment or a competent person to give medications, wearable injectors are more affordable than IV infusions.

The presence of the growing healthcare industry has aided sales in the wearable injectors market. It is critical for individuals with chronic conditions to have appropriate treatment as well as dosage at regular intervals. Wearable injectors have evolved as a self-administered and self-scalable technology that can assist patients in ensuring that their medication dosage is taken on a regular basis. Wearable injectors have gained popularity due to the requirement to provide the correct volume of medical fluid. It is critical for medical practitioners and healthcare specialists to educate the public about the benefits of employing newer technology like wearable injectors and other gadgets. In the coming years, the increased occurrence of chronic conditions that mandate the utilization of seamless technologies is expected to be a major driver of the market demand.

The rise in the prevalence of chronic conditions, the shift toward new drug delivery technologies, and improvements in wearable injector development are all factors driving market expansion. According to the Centers for Disease Control and Prevention (CDC), 129 million non-institutionalized civilian people were diagnosed with at least one chronic illness in 2018. Furthermore, as people's concerns about immunological disease develop, the wearable injector industry is expected to grow. Moreover, the rising need for effective, quick, and precise treatment outcomes has prompted the development of improved wearable injectors, moving the market forward.

COVID-19 Impact Analysis

The COVID-19 pandemic surged the demand for wearable injectors. In response to the COVID-19 outbreak, medical priorities have been reoriented across healthcare facilities, with treatment for COVID-19 patients taking priority. Wearable injectors offer a viable platform for closing the gap between in-clinic treatment and auto injectors. Wearable injectors addressed major loopholes in healthcare infrastructure as well as connected health services.

As patients with cardiovascular, chronic pulmonary and neurological diseases begin to manage the long-term repercussions of the disease, an increase in chronic ailments resulting from COVID-19 morbidity may partially fuel expansion in the adoption of wearable injectors. To protect themselves from COVID-19 exposure at clinics, patients with chronic diseases are requesting a transition from clinic to at-home drug delivery.

Market Growth Factors

Rising consumer preference for home care solutions

The COVID-19 pandemic's uncertainty has driven demand for various therapeutics as well as wearable drug delivery technologies. Healthcare systems around the world took steps to postpone treatments for diseases like cancer to prevent the spread of the infection and safeguard high-risk patients from infection. The hazards for individuals receiving care rose as the pandemic began. Hospitals, which serve the bulk of patients, also became high-risk areas during the epidemic. To address these issues and provide appropriate care to patients suffering from various ailments, a movement from hospital-based treatment to home-based care has occurred.

Rising demand for mAbs and biologics

Biologics and mAbs are mandated to be supplied via the parenteral route, due to which, an increasing focus on their usage to treat diseases like cardiovascular disease, rheumatoid arthritis, and cancer is expected to create major development prospects for wearable injectors such as subcutaneous, intravenous, or intramuscular delivery. In addition, a significant number of biologics were in development in recent years, and the number of biologic pharmaceuticals in development continues to rise exponentially. MAb-based biotherapies currently account for a significant proportion of 100 medications.

Market Restraining Factors

Lack of favorable reimbursement policies

In the healthcare infrastructure of any nation, the government plays a crucial role in the development of assets. In addition, the government is also responsible for making various advanced healthcare devices accessible to people. However, there is a lack of favorable reimbursement policies for making wearable injectors accessible to people in several countries. Wearable injectors are not reimbursed in a number of underdeveloped nations.

Wearable insulin pumps, for example, are not paid in several countries, and there are no precise rules for their use on prescription. Patients with Type 1 diabetes in numerous countries must pay for their insulin pumps as well as refills and supplies on their own. The absence of reimbursement has a direct impact on access to and acceptance of wearable injectors.

Key Topics Covered:

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.2.4 Approvals and Trials

3.2.5 Business Expansions

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2018,Apr - 2022, Apr) Leading Players

Chapter 4. Global Wearable Injectors Market by Therapy

4.1 Global Diabetes Market by Region

4.2 Global Cardiovascular disease Market by Region

4.3 Global Immuno-oncology Market by Region

4.4 Global Others Market by Region

Chapter 5. Global Wearable Injectors Market by End User

5.1 Global Hospitals & Clinics Market by Region

5.2 Global Home healthcare setting Market by Region

Chapter 6. Global Wearable Injectors Market by Type

6.1 Global On-body Injector Market by Region

6.2 Global Off-body Injector Market by Region

Chapter 7. Global Wearable Injectors Market by Technology

7.1 Global Spring Based Market by Region

7.2 Global Motor Based Market by Region

7.3 Global Rotary pump Market by Region

7.4 Global Expanding battery Market by Region

7.5 Global Others Market by Region

Chapter 8. Global Wearable Injectors Market by Region

Chapter 9. Company Profiles

9.1 Insulet Corporation

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Partnerships, Collaborations, and Agreements:

9.1.5.2 Approvals anf Trials:

9.2 United Therapeutics Corporation

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Regional Analysis

9.2.4 Research & Development Expenses

9.2.5 Recent strategies and developments:

9.2.5.1 Product Launches and Product Expansions:

9.2.5.2 Acquisition and Mergers:

9.3 ATS Automation Tooling Systems, Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Regional Analysis

9.4 Ypsomed AG

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Recent Strategies and Developments:

9.4.4.1 Partnerships, Collaborations, and Agreements:

9.4.4.2 Business Expansions:

9.5 Amgen, Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Regional Analysis

9.5.5 Recent Strategies and Developments:

9.5.5.1 Acquisitions and Mergers:

9.6 West Pharmaceutical Services, Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expense

9.6.5 Recent Strategies and Developments:

9.6.5.1 Partnerships, Collaborations and Agreements:

9.6.5.2 Product Launches and Product Expansions:

9.7 Zealand Pharma A/S (Valeritas, Inc.)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Research & Development Expenses

9.7.4 Recent strategies and developments:

9.7.4.1 Partnerships, Collaborations and Agreements:

9.8 Medtronic PLC

9.8.1 Company overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expenses

9.8.5 Recent strategies and developments:

9.8.5.1 Product Launches and Product Expansions:

9.8.5.2 Acquisition and Mergers:

9.9 CeQur SA

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Acquisition and Mergers:

9.10. Subcuject ApS

9.10.1 Company Overview

9.10.2 Recent strategies and developments:

9.10.2.1 Partnerships, Collaborations, and Agreements:

For more information about this report visit https://www.researchandmarkets.com/r/6xo2oi

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance