Globe Life Inc (GL) Q1 2024 Earnings: Surpasses Analyst EPS Projections

Earnings Per Share (EPS): Reported at $2.67, surpassing the estimated $2.79.

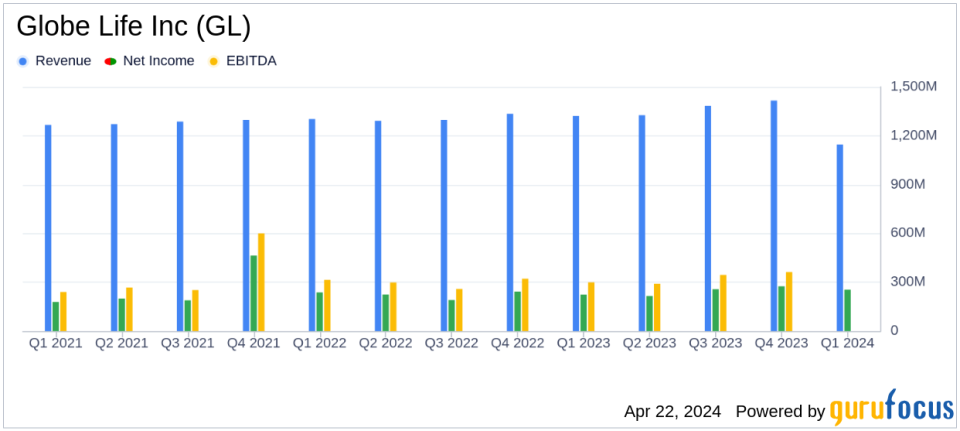

Net Income: Reached $254.2 million, falling short of the estimated $265.37 million.

Revenue: Total premium revenue reported at $1,145.28 million, exceeding the estimated $1,424.98 million.

Net Operating Income: Increased by 6% year-over-year to $264.1 million.

Investment Income: Grew by 10% from the previous year, indicating robust investment management.

Life Insurance Sales: Grew by 7%, reflecting strong market demand and effective sales strategies.

Agent Growth: Notable increases in agent count across divisions, enhancing sales force effectiveness and market penetration.

Globe Life Inc (NYSE:GL) released its 8-K filing on April 22, 2024, revealing a robust performance for the first quarter of the fiscal year 2024. The company reported a net income of $2.67 per diluted common share, a significant increase from $2.28 in the previous year's corresponding quarter. This performance notably exceeds the analyst's estimated earnings per share of $2.79.

Company Overview

Globe Life Inc, an insurance holding company, offers diverse life and supplemental health insurance products and annuities. The company operates through four segments: life insurance, supplemental health insurance, annuities, and investments. Its investment activities are strategically aimed at supporting insurance product obligations, primarily through fixed maturities that align expected yields with premium rates and product profitability.

Financial Performance Insights

The company's net operating income for the quarter stood at $2.78 per diluted common share, up from $2.53 in the prior year, showcasing a growth of 6% in net operating income. The total underwriting margin saw a 5% increase, while net investment income grew by 10% compared to the year-ago quarter. These figures underline Globe Life's effective management and robust operational strategies.

Segment Performance

Significant growth was observed in the American Income Life Division, where life net sales and premiums surged by 17% and 7% respectively. This division also saw a 15% increase in the average producing agent count. Similarly, the Liberty National and Family Heritage Divisions reported increases in life premiums and health net sales, contributing to the overall positive performance of the company.

Strategic Financial Management

Globe Life's strategic focus on maintaining a strong investment portfolio is evident from its 10% increase in net investment income. The company's disciplined approach to investments, particularly in fixed maturities, continues to support its financial stability and growth in shareholder value.

Outlook and Forward Guidance

Looking ahead, Globe Life projects its net operating income for the year ending December 31, 2024, to be between $11.50 and $12.00 per diluted common share. This guidance reflects the company's confidence in its operational strategies and market position.

Conclusion

Globe Life Inc's first quarter results for 2024 not only surpassed analyst expectations in terms of EPS but also demonstrated significant internal growth and operational efficiency. With a strong increase in key financial metrics and a positive outlook for the fiscal year, Globe Life continues to solidify its position as a leader in the insurance industry.

For detailed financial figures and further information, readers are encouraged to view the full earnings report available on the SEC website and Globe Life's investor relations page.

Explore the complete 8-K earnings release (here) from Globe Life Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance