Gold miner Randgold unveils £13.7bn merger with Barrick but London investors could 'miss out'

Gold miner Randgold Resources is to disappear from the London Stock Market after unveiling a shock merger with rival Barrick of Canada that will create an $18bn (£13.7bn) giant that will span North America and Africa.

The all-share deal will see Barrick shareholders given two-thirds of the combined company while drafting in Randgold’s management to run the business.

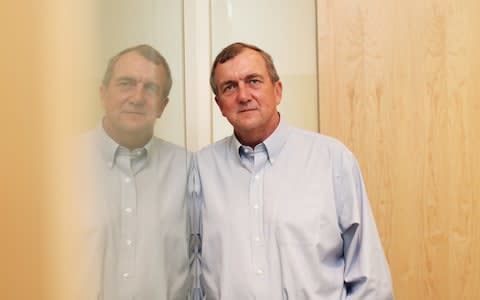

Randgold boss Mark Bristow, who co-founded the company in 1995, will become president and chief executive of the enlarged Barrick, with a brief to “implement the Randgold way” across its operations. His chief financial officer Graham Shuttleworth will fill the same role at the new entity while former Goldman Sachs banker John Thornton will remain executive chairman.

The move is seen as a defensive play as both companies have suffered steep declines in their share prices this year, while gold has fallen 8pc amid sluggish demand.

The deal received tentative approval from investors, with Randgold shares rising 6.3pc in morning trade to £52.33.

However some analysts criticised Barrick’s decision to offer “nil premium” to Randgold investors and cancel its shares on the London Stock Exchange in favour of a listing in Toronto and New York.

Kieron Hodgson, of Panmure Gordon, said: “If you’re a London investor, you’ll miss out. The prospect of owning shares in a North America-listed business isn’t an attractive option.”

Mr Hodgson compared the merger to the “proverbial ‘two drunks supporting each other at closing time’” and added: “Barrick is doing better out of this deal than Randgold, although Randgold's growth options were starting to look limited.”

Investec analysts noted London would be left “without the world class, go-to [gold] company that it has long enjoyed”, and questioned the wisdom of dual leadership. “We will always have reservations when ‘alpha’ personalities take joint leadership of a company,” they said.

Under the deal, Randgold shareholders would be given 6.1280 shares in the combined company for each share they own. The combined company would hold five of the world’s “tier one” gold mines, while gaining the firepower to invest in new mines.

Barrick owns the Goldstrike and Cortez mines in Nevada, while Randgold owns 45pc of the Kibali mine in the Democratic Republic of Congo and 80pc of Loulo-Gounkoto in Mali.

Mr Bristow, currently the longest-serving chief executive in the FTSE 100, said he had “no intention of changing way the we run Randgold” and that he would import its management style - including greater decentralisation - to Barrick’s mines in North and South America.

He denied concerns of a “culture clash” insisting: “On a DNA culture basis we are very aligned already.”

Mr Bristow defended the decision to drop the London listing, saying: “The majority of trading in the combined business is in the US by a long way.”

Asked whether a number of funds would be forced to sell their shares because they are unable to hold US stock, Mr Shuttleworth said: “There are some pluses and minuses… but we don’t expect it to be significant.”

The deal could prove beneficial for London-listed Acacia Mining, in which Barrick holds a 63pc stake. Acacia shares rose 5.7pc on hopes that South African-born Mr Bristow, with his long experience on the continent, might be able to break a deadlock with the Tanzanian government over an export ban that has severely damaged the miner's business.

Yahoo Finance

Yahoo Finance