Gold Tests 2019 Lows, Platinum Fails At 915.00

Gold is trading down on Tuesday as investors are betting on riskier assets such as equities amid better than expected corporate earnings reports.

Also, oil is consolidating gains following US decision to end waivers on Iranian oil sanctions.

On the economic front, the calendar is light on Tuesday with the United States housing data as the most important data scheduled today.

Experts are waiting for central banks in Canada and Japan and durable goods orders, jobless claims and the second preliminary release of the GDP in the US later on the week.

Dollar index on the offensive

The dollar index, one of the most critical catalysts for gold, is trading positive on Tuesday following the negative sessions.

After the jump from 96.90 to 97.50 on April 18, the unit moved on consolidation mode for two days after finding support at 97.25 on Monday.

Currently, DXY is trading 0.10% positive at 97.40. The pair seems ready to move higher and test the 97.50 area again.

Gold at 2019 fresh lows

Gold is trading negative on Tuesday after a brief period of consolidation between 1,270 and 1,280. Now, XAU/USD is testing the 1,270 support, which is the mínimum since December 27.

In this framework, analysts at MKS PAMP Group acknowledge in a note that “gold looks vulnerable to a further extension lower through $1,270, opening a test toward the 200-day moving average at $1,251.”

Currently, XAU/USD is trading at 1,271, 0.26% negative on the day. The pair looks bearish with technical studies suggesting that the break below the 2019 low is possible today. However, the move wouldn’t be violent due to the performance of gold’s correlated units.

Watch out for the 200-day moving average at 1,250 as the next significant support. Below there, 1,240 is the level to check.

To the upside, the metal needs to recover above 1m280 to give some relief to bulls. However, the chart pattern looks very bearish now.

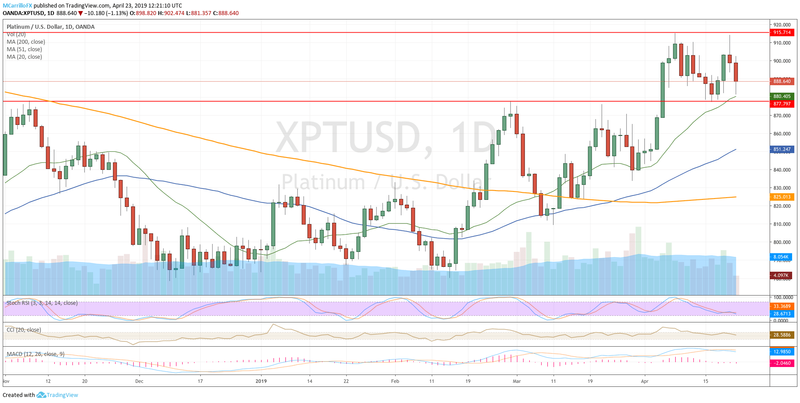

Platinum fails at 915.00

The anticipated bounce from 877 in Platinum ended at 915.00 with a firm rejection that sent XPT/USD to trade as low as 880.00 on Tuesday where the pair looks barely supported.

Platinum is currently trading at 887.65, 1.24% negative on the day. The 877.00 level is again the significant support. Let’s see in what direction the unit will finally break out.

While moving averages are aligned to the north, other technical studies such as RSI and MACD are suggesting that the unit is ready for a middle term correction below 877.00. In that case, 850,00 would be its destiny.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini S&P 500 Index (ES) Futures Technical Analysis – April 23, 2019 Forecast

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – April 23, 2019 Forecast

Crude Oil Price Forecast – Crude oil markets rally for another session

Crude Oil Price Update – Buyers Stepping in to Defend Against Closing Price Reversal Top

Yahoo Finance

Yahoo Finance