Goldman and Morgan Stanley slash Europe outlook amid new national lockdowns

Both Goldman Sachs (GS) and Morgan Stanley (MS) downgraded their expectations for European gross domestic product (GDP) in the fourth quarter, as new waves of COVID-19 infections sweep the continent.

A slew of new lockdown measures are in the works across the continent. Last week, French president Emmanuel Macron announced a new national lockdown, while the UK is due to enter national lockdown on Thursday for one month. Germany also moved to tighten restrictions.

Goldman Sachs said in a note titled “Winter is Coming” it expects the euro area’s real GDP to shrink 2.3% in Q4, a reversal of its original projection the area would grow by 2.2%.

It also cut its UK GDP forecast from an expansion of 3.6% to a contraction of 2.4%. It expects the UK economy will return to growth in the first quarter, edging up by 0.4%.

“The near-term outlook has deteriorated sharply,” it said, although its longer-term outlook is more optimistic due to the fact it expects a coronavirus vaccine to become available in Q3 of 2021.

Morgan Stanley also noted that GDP had been a major beat, increasing by 12.7%. This left the euro area just 5% below pre-COVID-19 levels. A second wave and lockdown measures mean its expects a contraction of 2.2% in Q4.

READ MORE: Oil price tumbles as lockdowns sweep Europe

It said: “We see a French-style lockdown – shutting leisure, hospitality and non-essential retail - having about a quarter of the impact of the spring lockdown, and a German-style lockdown – a leisure only lockdown - as having about 15% of the impact of the spring lockdown.”

The note assumes that the lockdowns will last for around six weeks at “full stringency” and a further six weeks with watered down restrictions, only fully lifted next year as the virus is contained and a vaccine comes widely available.

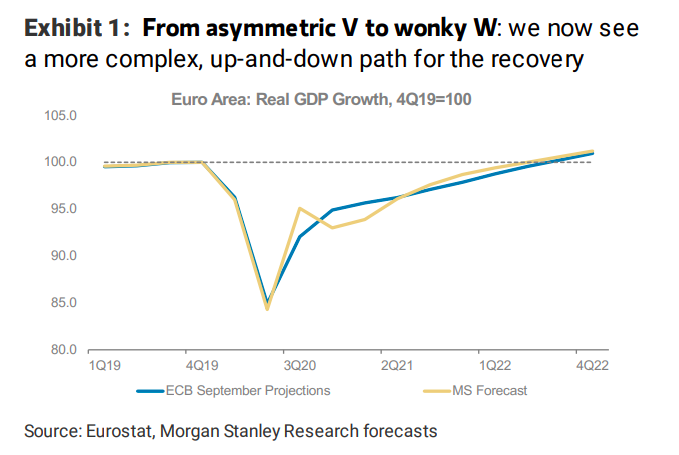

Morgan Stanley believes a strong rebound will be delayed to the spring, in this case, causing a “W-shaped recovery” rather than “an asymmetric V.”

They said: “Despite the projected 4Q second slump, we revise up our 2020 forecast materially on the record 3Q rebound from -9.0%Y to -7.2%Y.”

The bank’s estimate of the date at which the euro area will recover to pre-Covid levels is “before Q2 2022,” just beyond their forecast horizon.

The predictions come after flash estimates for third-quarter GDP in leading European economies beat analysts’ expectations on Friday.

France, Italy, Germany and Spain all saw quarter-on-quarter growth beating analysts’ expectations in figures released on Friday morning in Europe.

European Central Bank (ECB) policymakers also signalled last week there was fresh stimulus to come in December. Its governing council had said it would “recalibrate its instruments, as appropriate, to respond to the unfolding situation.”

Watch: What is a recession?

Yahoo Finance

Yahoo Finance