The Goldplat (LON:GDP) Share Price Has Gained 88% And Shareholders Are Hoping For More

Goldplat PLC (LON:GDP) shareholders might be concerned after seeing the share price drop 13% in the last week. On the bright side the returns have been quite good over the last half decade. After all, the share price is up a market-beating 88% in that time.

See our latest analysis for Goldplat

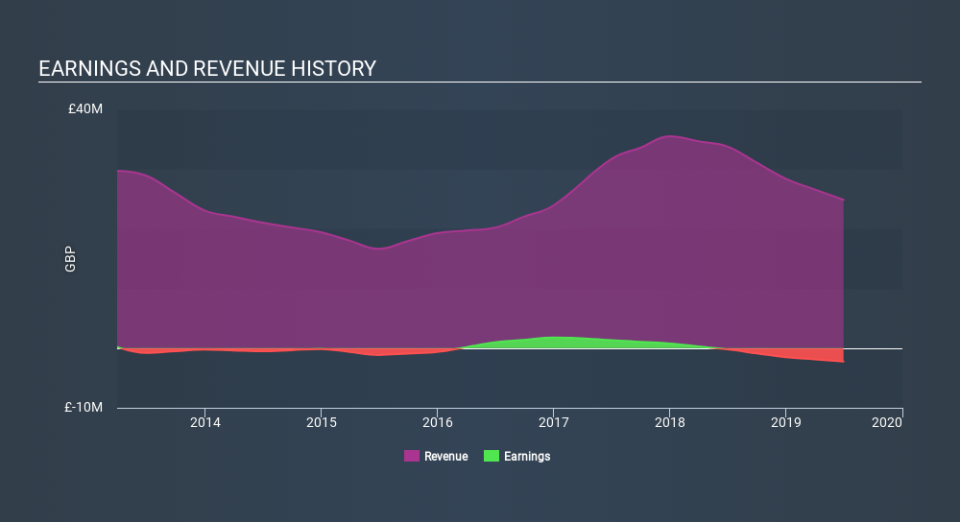

Goldplat wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Goldplat can boast revenue growth at a rate of 9.7% per year. That's a fairly respectable growth rate. While the share price has beat the market, compounding at 13% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Goldplat

A Different Perspective

We're pleased to report that Goldplat shareholders have received a total shareholder return of 61% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Goldplat (including 1 which is makes us a bit uncomfortable) .

Of course Goldplat may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance