Goodyear Tire & Rubber Co Reports Mixed Q1 Results, Aligns with EPS Projections

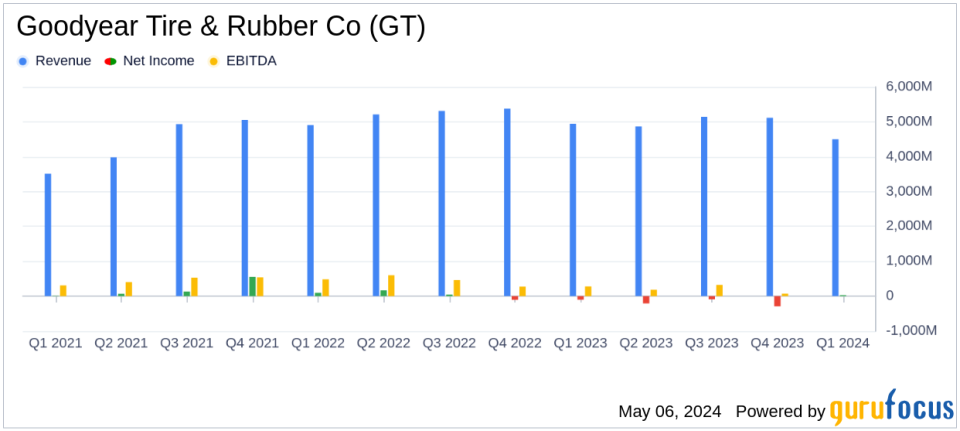

Reported Net Loss: $57 million, significantly improved from a net loss of $101 million in the same quarter last year.

Adjusted Net Income: $29 million, compared to an adjusted net loss of $82 million in the prior year's quarter, surpassing the estimated net income of $9.57 million.

Earnings Per Share: Reported a loss of $0.20 per share; however, adjusted earnings were $0.10 per share, exceeding the estimated earnings per share of $0.01.

Total Revenue: $4.5 billion, closely aligning with the estimated revenue of $4.815 billion.

Americas Segment Operating Income: More than doubled to $179 million from $79 million in the prior year, with operating margin increasing to approximately 7.0%.

Asia Pacific Performance: Segment operating income rose to $60 million from $38 million, with a significant increase in operating margin to 10.0%.

EMEA Challenges: Sales down 9.7% to $1.3 billion, with segment operating income remaining flat at $8 million despite adverse market conditions.

On May 6, 2024, Goodyear Tire & Rubber Co (NASDAQ:GT) disclosed its first-quarter financial results through its 8-K filing, revealing a net loss of $57 million, or 20 cents per share. However, when adjusted for specific one-time costs, the net income stood at $29 million, or 10 cents per share, aligning with analyst expectations of an EPS of $0.01. This performance marks a significant improvement from the prior year's adjusted net loss of $82 million, or 29 cents per share.

Goodyear, a global manufacturer of rubber tires, operates across diverse segments including Americas; Europe, the Middle East, and Africa (EMEA); and Asia Pacific. The company's tires are essential for a wide range of vehicles, contributing to its strategic positioning in the automotive industry.

Financial Performance Overview

The company posted revenues of $4.5 billion, slightly below the analyst's forecast of $4.815 billion, with total tire unit volumes reaching 40.4 million. Despite the revenue shortfall, Goodyear's segment operating income increased significantly to $247 million, up $122 million from the same quarter last year, driven by favorable price/mix adjustments and cost-saving measures under the Goodyear Forward transformation plan.

In the Americas, segment operating income more than doubled to $179 million with a margin of approximately 7.0%, attributed to lower transportation costs and successful execution of strategic initiatives. However, sales in this segment fell by 9.7% due to lower replacement volumes and unfavorable price/mix influenced by industry challenges in the commercial truck sector.

The Asia Pacific region showed a robust performance with a 10.0% operating margin, a notable increase from 6.5% in the previous year, driven by higher original equipment volumes, particularly from electric vehicle fitments in China.

Conversely, the EMEA segment faced a stagnant growth in operating income and a slight decrease in sales, impacted by competitive pressures and a challenging commercial truck market.

Strategic Initiatives and Market Adaptation

Goodyear's management highlighted the ongoing benefits from the Goodyear Forward plan, which contributed $72 million to the quarter's earnings. This initiative focuses on cost optimization and enhancing operational efficiency, crucial in navigating the current inflationary pressures and raw material cost fluctuations.

Despite the positive adjustments in operational income, Goodyear faced several challenges including net inflationary costs of $33 million and a decrease in tire volume amounting to $28 million. These factors underscore the competitive and volatile nature of the global tire market.

Looking Forward

Goodyear's leadership, under CEO Mark Stewart, remains optimistic about the continuation of strategic initiatives and further integration of innovative practices to bolster market position. The upcoming investor call is expected to provide additional insights into the company's strategic direction and operational focus areas for the coming quarters.

The detailed financial tables and reconciliation of non-GAAP measures to their nearest GAAP equivalents are available in the company's filing, providing stakeholders with a transparent view of Goodyear's financial health and operational performance.

As Goodyear navigates through market uncertainties and strategic realignments, its focus on innovation, cost management, and market adaptation will be critical in sustaining growth and profitability in a competitive landscape.

Explore the complete 8-K earnings release (here) from Goodyear Tire & Rubber Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance