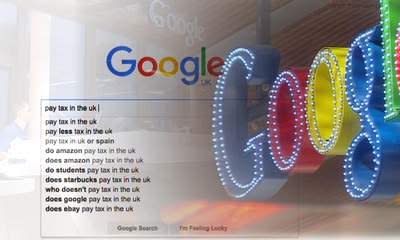

Google Deal A 'Major Success' Osborne Insists

George Osborne has come under further pressure over Google's tax after it emerged the £130m deal is set to be investigated by Europe and MPs for being unfair.

Labour and SNP MPs have called on the EU’s Competition Commissioner to examine the deal, described by politicians on all sides as "derisory".

And the powerful Public Accounts Committee has summoned Google and HMRC to explain themselves next month.

However, in an interview with Sky News, Mr Osborne insisted the deal was a "major success" .

The Chancellor has been criticised for turning the UK into a "kind of tax haven" for big tech firms because the level of tax paid is significantly less than for other smaller firms with less profits.

Both France and Italy appear to be likely to get a far better deal from Google over tax.

Mr Osborne said: "When I became Chancellor Google paid no tax. Now Google is paying tax and I have introduced a new thing called a diverted profits tax to make sure they pay tax in the future.

"I regard that as a major success."

EU Competition Commissioner Margrethe Vestager has said she would be willing to investigate the deal, which saw the firm agree to pay £130m in taxes dating back a decade – amounting to 3% tax.

She (Munich: SOQ.MU - news) told the Radio 4 Today programme: "If we find there is something to be concerned about, if someone writes to us and says this is maybe not as it should be, then we will take a look."

She said that "sweetheart deals" for big tech were "unfair and sometimes it is also illegal state aid".

:: PM Forced To Defend Google Deal

SNP MP Stewart Hosie has written to Ms Vestager calling on the European Commission to investigate whether the deal is within the state aid rules and represents a good deal for UK taxpayers.

He said: "There is a palpable sense of scepticism amongst the public, experts and even within the Conservative Party, that the tax settlement reached with Google represents value for the taxpayer.

"The truth is that we know very little about the settlement reached between the tax authorities and the company.

"These discussions have taken place in private, little detail has been revealed by the Treasury and the methodologies employed by HMRC are shrouded in secrecy."

:: Facebook Shares Up After Huge Revenue Rise

A Downing Street spokesman said the Government would cooperate with any inquiry.

He said: : "It (Other OTC: ITGL - news) 's ultimately a decision for the Commission. They have the ability to investigate if they believe state aid has been given in tax or anything else.

"HMRC have been very clear that they have collected all the tax that's due."

Speaking on Today on Wednesday, French MEP Eva Joly, vice chairwoman of the Special European Parliamentary Committee on Tax Rulings, said she was asking Mr Osborne to come and explain the Google deal.

She said: "This bad deal is very bad news for everybody because it shows that the UK prepares itself to become a kind of a tax haven to attract the multinationals."

Mr Cameron's Business Minister, Anna Soubry, said that £130m "doesn't sound like an awful lot of money".

Even (Taiwan OTC: 6436.TWO - news) one of the firm's biggest British shareholders, James Anderson, has said it should pay "much more" in tax.

:: Google Deal 'Shocking' If France Gets More

The European Commission has proposed new rules that could help EU nations claw back tax from the profits of multi-national firms - even if they have been shifted abroad.

The announcement was made by tax commissioner Pierre Moscovici, less than 24-hours after 31 countries, including the UK, signed a cross-border tax cooperation agreement to boost transparency.

He said the clawback would be allowed only if the effective tax rate in the country where the profits were transferred was less than 40% of that in the original country.

Facebook (NasdaqGS: FB - news) is also understood to be in negotiations with HMRC. In 2014 the firm paid £4,237 in corporation tax.

The firm today announced total revenue rose to $5.84bn (£4.1bn) in the final quarter of 2015.

Yahoo Finance

Yahoo Finance