Google parent company Alphabet on verge of trillion-dollar valuation

Google's parent company Alphabet is on the verge of hitting a trillion-dollar stock market value for the first time, potentially becoming the fourth of the major US technology companies to reach the milestone.

Alphabet’s market value sat at around $990bn (£762bn) as of Monday evening, as investors brushed off months of employee spats, the departure of its co-founders and ongoing competition and data privacy investigations.

Shares have climbed by 7pc this year and by more than a third in the last 12 months as it core internet advertising business continues to grow strongly, despite repeated predictions of a slowdown.

If it hits the trillion-dollar mark, it will be only the fourth US company in history to do so, following Apple, Amazon and Microsoft, which have reached the level in the last two years.

It comes despite the company facing the prospect of stricter regulation in the US and UK, where officials are investigating whether it has abused the dominant position of its search engine.

Both the Department of Justice and a group of US states are examining Google on anti-competitive grounds, while the UK's Competition and Markets Authority has raised the prospect of its own action against the company, saying it may force it to open up about its advertising business.

The European Union has already issued the company with billions in competition-related fines over the past three years.

Last month, Google's founders Larry Page and Sergey Brin announced they would step back from Alphabet, which they have run since restructuring Google in 2015.

Google - which includes its search engine, Android operating system and online advertising network - is now listed as one subsidiary of the Alphabet parent, which also includes driverless car division Waymo and a string of other ventures. However, Google continues to make up the vast majority of Alphabet's revenues.

Mr Page and Mr Brin, who founded the company while studying computer science at Stanford University in 1998, made way for Google chief executive Sundar Pichai, a move that analysts said could bring more financial discipline to the Alphabet group.

The share price rise also comes despite the company facing internal turmoil. Employees have become more vocally critical of the company, which has faced allegations of sacking workers who spoke out about sexual harassment and discrimination.

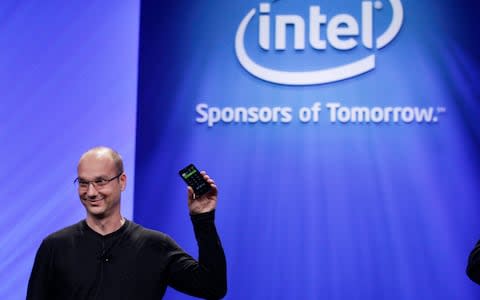

Protests were ignited by revelations in late 2018 that a high ranking smartphone executive, Andy Rubin, who co-founded Android, received a $90m exit package after being fired for an inappropriate relationship with a junior employee.

Last week Google’s top lawyer, David Drummond, announced he would be leaving after amid an investigation into alleged workplace affairs. Google said the investigation had now been left to external mediators.

Alphabet verging on the trillion-dollar mark comes as tech companies enjoy record high share prices. Tesla surged to its highest ever price on Monday, briefly topping the $500 per share mark for the first time and reaching a market value of $93.4bn.

Last week, Facebook’s shares hit an all-time high, recovering from a period of scandal and turbulence to surpass the previous record they hit in July 2018.

Yahoo Finance

Yahoo Finance