Government borrowing narrows to 17-year low after EU rebate

Britain’s budget deficit halved last month to £2.6bn, helped by an unusually large rebate from the European Union, meaning Chancellor Philip Hammond is on track to meet his borrowing targets this year.

Public sector borrowing in December dropped by £2.5bn, much more than had been expected, thanks to a £1.2bn credit from the EU. It was the smallest December borrowing figure since 2000.

The Office for National Statistics, which publishes the figures each month, said the EU rebate reflected an underperformance by the UK economy as contributions to the bloc are linked to economic forecasts and the size of the economy relative to other member states.

VAT receipts also reached a record high in December, rising £1.8bn year-on-year to £12.3bn.

Borrowing in the 2017/18 financial year to date is now running at £50bn, down from £56.7bn at the same stage in 2016/17 and the lowest to-date total since 2007.

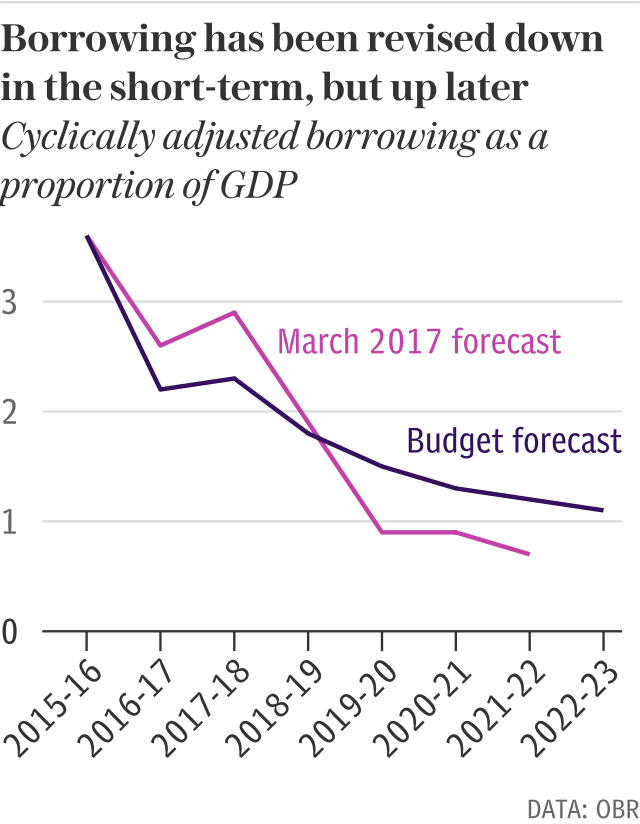

The figure means Mr Hammond is on course to meet the target set by the Office for Budget Responsibility, the country’s fiscal watchdog, of borrowing £49.9bn in the 12 months to the end of March 2018 - equivalent to 2.4pc of gross domestic product.

Figures for January, when self-declared income tax returns are paid in, are likely to show a budget surplus, helping the annual total.

Howard Archer, chief economic adviser for the EY Item Club, said that the latest borrowing figures would be “welcome news” for the Chancellor.

“If the pattern of the first nine months were repeated over the full fiscal year, 2017/18 public borrowing would come in at £40.6bn – which would be substantially below the downwardly revised shortfall of £49.9bn forecast by the Office for Budget Responsibility in November’s budget,” he said.

But Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said last month's low public borrowing reflected falling Government spending, “not a resurgent UK economy”.

The ONS noted in its release that the recent insolvency of construction and support services firm Carillion could affect future public finances. The Government had stated it would provide funding required by the Official Receiver to maintain public services.

“Any impact of these financial interventions on public sector finances will be announced in due course,” the ONS said.

A Treasury spokesman said: “We have made great progress in reducing the deficit by three quarters since 2010, but Government debt is still far too high.

“Our balanced approach to Government spending is getting debt falling, while investing in key public services and keeping taxes low.”

Meanwhile the latest CBI data showed British manufacturing grew strongly in January, helped by export demand, but the proportion of factories expecting to raise prices hit a 34-year high.

Rain Newton-Smith, the CBI's chief economist, said: "The past depreciation in sterling continues to leave its mark on firms’ costs and margins. With expectations for factory gate price inflation at their highest in 30 years, the pressure on consumer prices looks set to persist.”

Yahoo Finance

Yahoo Finance