Graham Holdings Co Reports First Quarter 2024 Earnings: A Strong Start with Significant Revenue ...

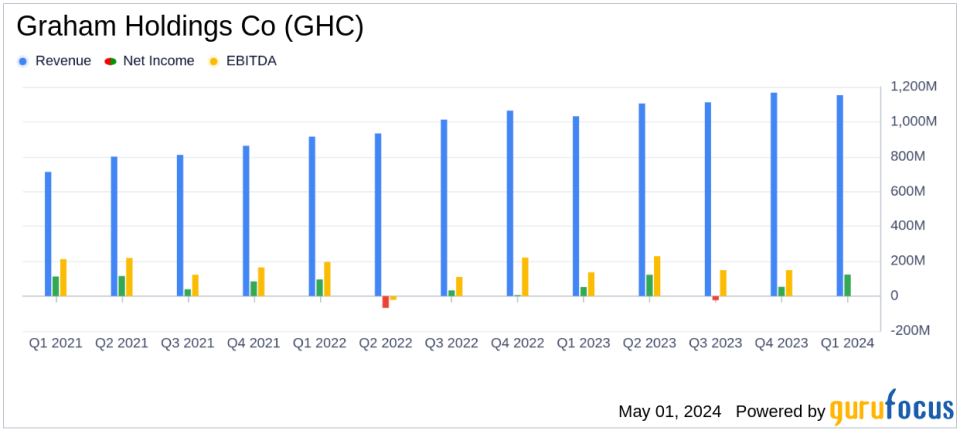

Revenue: Reported $1,152.7 million, up 12% from $1,031.5 million in the previous year, falling short of estimates of $1,169.8 million.

Net Income: Reported $124.4 million, significantly exceeding the estimate of $40.2 million.

Earnings Per Share (EPS): Reported $27.72, surpassing the estimated $8.96.

Operating Income: Increased to $35.4 million from $27.7 million in the previous year, reflecting a 28% improvement.

Adjusted Operating Cash Flow: Improved to $82.8 million from $71.6 million year-over-year.

Capital Expenditures: Slightly reduced to $21.5 million from $22.3 million the previous year.

Common Stock Repurchases: Purchased 28,606 shares at a cost of $20.0 million during the quarter.

On May 1, 2024, Graham Holdings Co (NYSE:GHC) disclosed its financial outcomes for the first quarter of 2024, showcasing a robust performance with significant year-over-year improvements in revenue and net income. The detailed earnings snapshot was released in the company's 8-K filing. Graham Holdings Co, a diversified education and media company, operates through various segments including Kaplan International and Television Broadcasting, which are major contributors to its revenue stream.

Financial Highlights and Performance Overview

For Q1 2024, GHC reported a revenue of $1,152.7 million, a 12% increase from $1,031.5 million in Q1 2023, surpassing the estimated revenue of $1,169.8 million. This growth was primarily driven by gains in the education, healthcare, and automotive segments. Net income attributable to common shares dramatically rose to $124.4 million, or $27.72 per share, compared to $52.3 million, or $10.88 per share, in the same quarter the previous year. This performance significantly exceeded the estimated earnings per share of $8.96.

The company's operating income also saw a healthy increase, reaching $35.4 million from $27.7 million in Q1 2023, a 28% rise, influenced by improvements across education, television broadcasting, and healthcare sectors. Adjusted operating cash flow was reported at $82.8 million, up from $71.6 million in the prior year, reflecting enhanced operational efficiency.

Strategic Financial Management

Graham Holdings Co demonstrated prudent financial management with total capital expenditures of $21.5 million, slightly down from $22.3 million in Q1 2023. The company's strategic focus on optimizing its investment portfolio is evident from its net gains on marketable equity securities, which amounted to $104.2 million, a substantial increase from $18.0 million in the previous year.

Debt levels were managed with $815.6 million in borrowings at an average interest rate of 6.4%, including $108.1 million outstanding on its revolving credit facility. The company also continued its shareholder return policy by purchasing 28,606 shares of its Class B common stock at a cost of $20.0 million.

Operational Challenges and Adjustments

Despite the financial gains, the company faced challenges in its manufacturing and automotive segments, where revenue declines partially offset the overall positive performance. The detailed operational adjustments and focus on core profitable areas will be crucial for sustaining growth in these segments.

Conclusion and Outlook

Graham Holdings Co's first quarter results for 2024 reflect a strong financial position and an effective strategy execution, particularly in its education and broadcasting segments. The company's ability to exceed analyst expectations in both revenue and earnings per share sets a positive tone for the fiscal year. Investors and stakeholders will likely watch closely how GHC navigates the operational challenges in its less performing segments and how it continues to leverage its strengths in the more profitable areas.

For detailed financial figures and further information, refer to the company's official SEC filings and upcoming communications.

Explore the complete 8-K earnings release (here) from Graham Holdings Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance