Grainger (GWW) Benefits From Non-Pandemic Product Demand

W.W. Grainger, Inc. GWW is poised well to gain from forecast-topping third-quarter 2021 results and strong momentum in the High-Touch Solutions and Endless Assortment segments. The company’s efforts to strengthen customer relationships, investments in growth initiatives and solid e-commerce sales will continue to support the top line.

Earnings & Sales Beat Q3 Estimates: Grainger reported third-quarter 2021 adjusted earnings per share of $5.65, beating the Zacks Consensus Estimate of $5.31. The bottom line increased 25% year over year. Revenues of $3,372 million also beat the Zacks Consensus Estimate of $3,330 million and rose 12% year over year.

Recovery in Non-Pandemic Product Volumes to Drive Segment Results

In the High Touch Solutions North America (N.A) segment, Grainger witnessed year-on-year revenue improvement in nearly all the end markets in third-quarter 2021, driven by a strong recovery in core, non-pandemic product volume. Pandemic product sales also remained elevated during the quarter. The Endless Assortment segment delivered 14.9% top-line growth year over year, courtesy of strong customer acquisition at Zoro U.S. business. This momentum will continue in the fourth quarter as well.

Backed by this upbeat performance, Grainger projects net sales in 2021 between $12.7 billion and $13 billion. In 2020, the company had reported sales of $11.8 billion. The company expects total daily sales growth between 11.5% and 12.5%. It anticipates earnings per share in the band of $19.00-$20.50 for 2021, calling for year-over-year growth of 17.5-26.5%.

Grainger is investing in the non-pandemic product inventory and partnering with suppliers to mitigate the supply-related challenges, inbound lead-time challenges and any possible cost increases. Grainger expects non-pandemic sales growth to positively impact fourth-quarter results. Benefits from price realization are likely to drive margin in the quarter.

Growth Initiatives, E-Commerce to Stoke Growth

Grainger accomplished the goal of remerchandising a record $1.2 billion of products in the United States in 2019 and completed another $1.6 billion in 2020. In the past decade, the company has invested strategically in its network to ensure optimal capacity, increased automation and standardization in response to the need for the on-demand delivery of products. The company continues to outpace the U.S. maintenance, repair and operating (MRO) market, highlighting the continued traction of its growth initiatives and pandemic-related sales.

Grainger is focused on driving 300-400 basis points of outgrowth compared with the market by focusing on strategic activities, such as building advantaged MRO solutions, delivering unparalleled customer service and offering differentiated sales and services. It will continue its efforts to strengthen relationships with large- and mid-sized customers to improve the sales-force effectiveness.

Grainger is focused on improving the end-to-end customer experience by making investments in its e-commerce and digital capabilities as well as executing improvement initiatives within the supply chain. The pandemic provided a significant boost to its e-retail sales. In 2020, 65% of the company’s revenues stemmed from online channels and the company was ranked as the 11th largest e-retailer in North America, according to Internet Retailer.

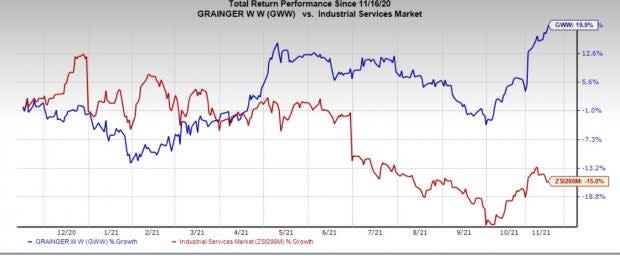

Price Performance

The company’s shares have gained 19.9% in the past year against the industry’s loss of 15.8%.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Grainger currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Industrial Products sector include Encore Wire Corporation WIRE, Heritage-Crystal Clean, Inc. HCCI and Casella Waste Systems, Inc. CWST. While Encore Wire and Heritage-Crystal sport a Zacks Rank #1 (Strong Buy), Casella Waste carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Encore Wire has an expected earnings growth rate of around 491% for the current year. The Zacks Consensus Estimate for the current-year earnings has been revised 37% upward in the past 60 days.

Encore Wire’s shares have surged 171% in the past year. The company has a trailing four-quarters earnings surprise of 271%, on average.

Heritage-Crystal has a projected earnings growth rate of around 553% for 2021. The Zacks Consensus Estimate for the current-year earnings has been revised upward by 9.3% in the past 60 days.

The company’s shares have appreciated 65% in a year. Heritage-Crystal has a trailing four-quarter earnings surprise of 62.3%, on average. It has a long-term earnings growth of 15%.

Casella Waste has an estimated earnings growth rate of around 6% for the current year. In the past 60 days, the Zacks Consensus Estimate for the current-year earnings has been revised upward by 11.4%.

The company’s shares have increased 44% in the past year. Casella Waste has a trailing four-quarter earnings surprise of 42.1%, on average. It has a long-term earnings growth of 14.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

HeritageCrystal Clean, Inc. (HCCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance