Green Dot Corp (GDOT) Q1 2024 Earnings: Misses EPS Estimates Amidst Revenue Growth

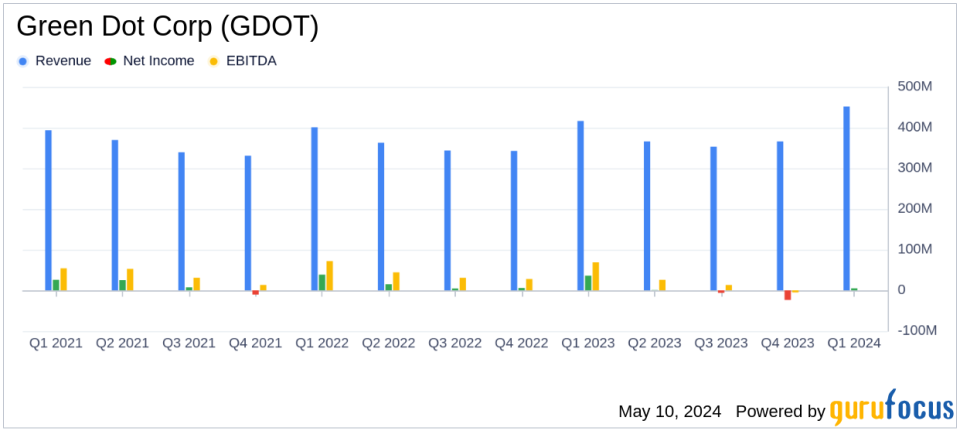

Revenue: Reported $451.99 million, up 7% year-over-year, surpassing estimates of $420.69 million.

Net Income: Reported $4.75 million, a significant decrease of 87% year-over-year, falling short of estimates of $37.28 million.

Earnings Per Share (EPS): Reported GAAP EPS of $0.09, down 87% from $0.69 year-over-year, and Non-GAAP EPS of $0.59, down 14% year-over-year from $0.99.

Adjusted EBITDA: Reported $59.23 million, a decrease of 20% year-over-year, with an adjusted EBITDA margin of 13.2%, down from 18.1% the previous year.

Gross Dollar Volume: Increased to $30.76 billion in Q1 2024 from $23.29 billion in Q1 2023.

Active Accounts: Number of active accounts decreased to 3.51 million in Q1 2024 from 3.84 million in Q1 2023.

2024 Financial Guidance: Reaffirmed with non-GAAP operating revenues expected between $1.55 billion and $1.60 billion, and adjusted EBITDA projected between $170 million and $180 million.

On May 9, 2024, Green Dot Corp (NYSE:GDOT) disclosed its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company, a leading digital bank and fintech provider, reported a mixed financial performance with significant revenue growth but a substantial decline in earnings per share (EPS).

Company Overview

Green Dot Corp is a financial technology company that offers banking and payment solutions primarily through its three segments: Consumer Services, Business to Business (B2B) Services, and Money Movement Services. The B2B segment, which includes Banking-as-a-Service (BaaS) and payroll platforms, is the major revenue contributor, providing integrated financial services to large consumer and technology companies.

Financial Performance Analysis

For Q1 2024, Green Dot reported total operating revenues of $451.99 million, a 9% increase from $416.38 million in Q1 2023. This growth is indicative of the company's robust business development pipeline and the successful launch of new retail partnerships. However, net income saw a dramatic decline, falling 87% to $4.75 million from $36.01 million in the prior year's quarter. This resulted in diluted EPS of $0.09, significantly below the estimated $0.73, marking a substantial miss against analyst expectations.

Non-GAAP measures also reflected challenges, with adjusted EBITDA down 28% to $59.23 million and non-GAAP net income decreasing 39% to $31.44 million. The non-GAAP diluted EPS was $0.59, compared to $0.99 in the same quarter last year, highlighting ongoing pressures on profitability.

Operational Highlights and Challenges

Despite the financial headwinds, Green Dot reported positive developments in its operations. The company experienced a strong start to the tax season and saw improved momentum in its BaaS division. The gross dollar volume in the B2B Services segment grew significantly, indicating a solid expansion in this area. However, the company faced challenges such as client de-conversions and increased expenses related to regulatory initiatives, which impacted its overall profitability.

Future Outlook

Looking ahead, Green Dot reaffirmed its 2024 financial guidance, expecting non-GAAP total operating revenues to be between $1.55 billion and $1.60 billion and adjusted EBITDA to range from $170 million to $180 million. The non-GAAP EPS is anticipated to be between $1.45 and $1.59. These projections reflect management's expectations of moderate growth and a focus on strategic initiatives to enhance operational efficiency and compliance.

Conclusion

Green Dot's first quarter of 2024 was a period of both progress and challenge. While revenue growth is a positive indicator of the company's potential to capitalize on market opportunities, the significant drop in profitability underscores the need for careful management of operational and regulatory costs. Investors and stakeholders will likely watch closely how Green Dot navigates these challenges in the upcoming quarters.

For detailed financial figures and further information, please refer to the full earnings release here.

Explore the complete 8-K earnings release (here) from Green Dot Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance