Green Dot (GDOT) Beats on Q1 Earnings, Ups 2022 EPS Guidance

Green Dot Corporation GDOT delivered better-than-expected first-quarter 2022 results.

The stock fell 8.8% since the earnings release on May 5 as 2022 revenue guidance was not impressive. Non-GAAP total operating revenues are currently anticipated between $1.394 billion and $1.430 billion. The midpoint ($1.412 billion) of the guidance is below the current Zacks Consensus Estimate of $1.42 billion.

Quarterly earnings (excluding 36 cents from non-recurring items) of $1.06 per share beat the consensus estimate by 24.7% and increased 76.7%% on a year-over-year basis. Non-GAAP operating revenues of $394.7 million surpassed the consensus mark by 1.4% and increased marginally year over year.

Segmental Revenues

The Consumer Services segment’s revenues came in at $158.8 million, down 14% from the year-ago quarter’s level.

The B2B Services segment’s revenues of $133.9 million increased 26.3% year over year.

Money Movement Services segment’s revenues were up 7.6% year over year to $97.3 million.

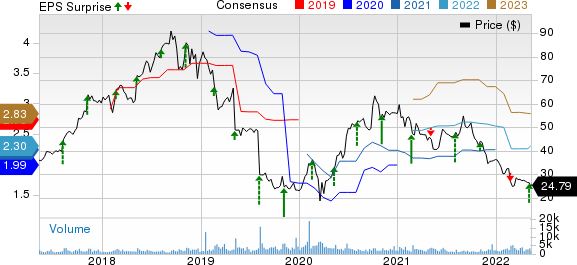

Green Dot Corporation Price, Consensus and EPS Surprise

Green Dot Corporation price-consensus-eps-surprise-chart | Green Dot Corporation Quote

Key Metrics

Gross dollar volume decreased 15.5% year over year to $17.4 billion. Purchase volume fell 31% from the prior-year quarter’s level to $7.2 billion. GDOT ended the quarter with 4.93 million active accounts, down 22.4% year over year.

Operating Results

Adjusted EBITDA of $90.3 million rose 23% on a year-over-year basis. Adjusted EBITDA margin of 22.9% was up from the year-ago quarter’s level of 19.3%.

Balance Sheet

Green Dot exited the first quarter with unrestricted cash and cash equivalents balance of $1.32 billion, flat with the end figure of the prior quarter. GDOT had no long-term debt. GDOT generated $115.6 million of cash from operating activities while capex was $19 million.

Currently, Green Dot carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2022 Guidance

Green Dot expects full-year non-GAAP earnings per share (EPS) between $2.32 and $2.46 (prior view: $2.22 and $2.35). The midpoint of the guidance ($2.39) is above the current Zacks Consensus Estimate of $2.30.

Adjusted EBITDA is expected in the band of $230-$240 million (prior view: $225-$235 million).

Earnings Snapshots

Within the broader Business Services sector, ManpowerGroup Inc. MAN, Omnicom Group Inc. OMC and Equifax Inc. EFX recently reported first-quarter 2022 results.

ManpowerGroup reported impressive first-quarter 2022 results, with both earnings and revenues beating the Zacks Consensus Estimate. Quarterly adjusted earnings of $1.88 per share beat the consensus mark by 20.5% and improved 69.4% year over year. Revenues of $5.14 billion surpassed the consensus mark by 0.7% and inched up 4.5% year over year on a reported basis and 9.8% on a constant-currency (cc) basis.

Omnicom reported impressive first-quarter 2022 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate. Earnings of $1.39 per share beat the consensus mark by 8.6% and increased 4.5% year over year, driven by a strong margin performance. Total revenues of $3.4 billion surpassed the consensus estimate by 5.4% but declined slightly year over year.

Equifax reported better-than-expected first-quarter 2022 results. Adjusted earnings of $2.22 per share beat the Zacks Consensus Estimate by 3.3% and improved 13% on a year-over-year basis. Revenues of $1.36 billion outpaced the consensus estimate by 2.4% and improved 12.4% year over year on a reported basis and 13% on a local-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance