Greif Rides on Rising Demand & Tax Reform Amid Cost Concerns

On Mar 15, we issued an updated research report on Greif, Inc. GEF. The company is poised to benefit from rising demand, favorable price-cost relationship and favorable impact of the U.S. tax reform. However, escalating raw material costs and elevated expenses are expected to dampen results.

Let’s illustrate these growth factors in detail.

Greif to Gain From Rising Demand

Greif maintained its adjusted earnings per share guidance for fiscal 2018 at $3.25-$3.55. The company is expected to benefit in the fiscal from strong demand as a result of improving global macroeconomic conditions and favorable access to credit. In addition, the company’s proposed infrastructure and planned chemical expansion projects will drive growth.

Benefits of Tax Reform

Greif currently anticipates additional financial flexibility as a result of the tax reform changes regarding cash repatriation. The company expects the tax rate will be between 28% and 32% for fiscal 2018, lower than the 33.5% recorded in fiscal 2017. It expects that the legislation will be beneficial for Greif over the long term.

Favorable Price-Cost Relationship a Catalyst

Greif anticipates that its Paper Packaging & Services segment will benefit from a more favorable price-cost relationship. In fiscal 2018, the segment will likely benefit from realized containerboard price increases, implemented over the course of fiscal 2017, and elevated anticipated specialty sales. High customer demand and exceptional mill production rates also remain tailwinds for this segment’s growth.

Adverse Impact of Rising Raw Material Costs

Greif witnessed a 24% increase in raw material cost per steel drum and 11% rise in raw material cost per large plastic drum in first-quarter fiscal 2018, both compared with the prior-year quarter. Moreover, the company will be affected by the persistent raw-material cost inflation in the rest of fiscal 2018.

Elevated Expenses to Mar Profit

Greif has increased its other expense outlook for fiscal 2018 to $15-$20 million from the previously projected $10 million due to increased pension cost related to a change in investment return assumptions. This increase will impact earnings by 8 cents per share in this fiscal.

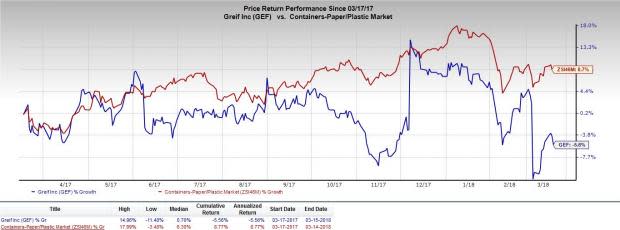

Share Price Performance

Greif’s shares have underperformed the industry with respect to price performance over the past year. The stock has depreciated 5.6%, as against 8.7% growth registered by the industry.

Zacks Rank & Stocks to Consider

Greif currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are AptarGroup, Inc. ATR, Rockwell Automation Inc. ROK and Packaging Corporation of America PKG. All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

AptarGroup has a long-term earnings growth rate of 8.5%. Its shares have rallied 17%, over the past year.

Rockwell Automation has a long-term earnings growth rate of 11.4%. The company’s shares have been up 16.6% during the same time frame.

Packaging Corporation has a long-term earnings growth rate of 8.3%. The stock has gained 27% in a year’s time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Greif, Inc. (GEF) : Free Stock Analysis Report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance