'Grim time' for holidays abroad as Brexit fears send the pound sliding in value

The declining value of the pound in recent weeks over Brexit fears makes it a “grim time” for trips abroad just as families prepare for their summer holidays, according to currency watchers.

Sterling was trading at around $1.70 against the dollar (GBPUSD=X) five years ago, but the currency has slid significantly since the EU referendum as markets have taken fright over the impact of Brexit.

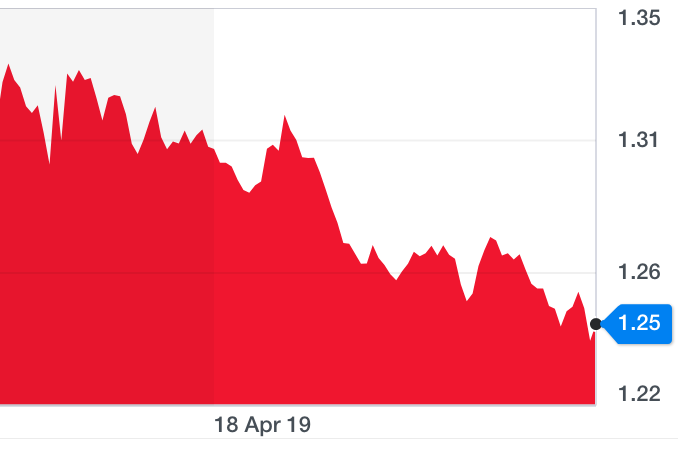

Now the British currency is trading at less than $1.24, meaning British tourists have seen the number of dollars each pound buys them drop by more than a quarter. The pound has also slid against many other currencies, including the euro (GBPEUR=X).

The pound’s decline has escalated as efforts to secure a Brexit deal that would provide a smoother, less disruptive departure have failed over the past year under departing UK prime minister Theresa May.

The US investment bank Morgan Stanley even warned sterling could sink far further to the same value as the dollar, the lowest exchange rate since the mid-1980s.

Sterling was up 0.3% today, but recent weeks have seen it slide even further to two-year lows, down 4% against the euro, 5% against the dollar, and 6% against the Turkish lira since mid-April, according to Bloomberg.

The pound has gone through an unprecedented string of 10 weekly declines against the euro as fears have grown of a no-deal Brexit in recent weeks.

The declining value is linked to growing chances of a Boris Johnson premiership, with the favourite to be the next prime minister looking set to take a hardline stance on Brexit and potentially embrace a no-deal Brexit. Analysts say the pound could slide further as Britain gets closer and closer to exit day.

“It’s a real grim time to look at holidays and obviously we’re coming right into the holiday season,” Phil McHugh, a trader at Currencies Direct Ltd, told Bloomberg.

“We saw high levels back in March this year, it would have been great if people had the foresight to buy their holiday money then. I know I didn’t and I’m going away in a couple of weeks.”

"It will be a big shock for tourists to Europe if they are expecting to get good value this year," James Hickman, the chief commercial officer of travel money firm FairFX, told the BBC.

READ MORE: London property market suffers worst year in a decade

The warnings come as Britain’s budget watchdog also sounded the alarm over a no-deal Brexit’s impact on households on Thursday, predicting it would throw the UK into recession.

Families face a “squeeze” on their incomes from more expensive imported goods as sterling’s value falls sharply and new barriers hit UK trade with Europe, according to the Office for Budget Responsibility (OBR).

Its forecast said house prices could nosedive 10%, with tax receipts falling, government debt spiralling, foreign investment sliding and firms that sell to Europe battered by new limits on previously frictionless trade.

Yahoo Finance

Yahoo Finance