Group 1 Automotive (GPI) Q3 Earnings Beat Estimates, Up Y/Y

Group 1 Automotive, Inc. GPI reported adjusted earnings per share of $3.02 in third-quarter 2019, beating the Zacks Consensus Estimate of $2.72. The bottom line improved from the prior-year quarter’s $2.47. Results were aided by a stellar performance in the United States, partially offset by weakness in the U.K. market.

Revenues of $3.1 billion rose 7.9% year over year. Revenues beat the Zacks Consensus Estimate of $2.9 billion.

Reportedly, the company’s net income rose 9.2% year over year to $38 million.

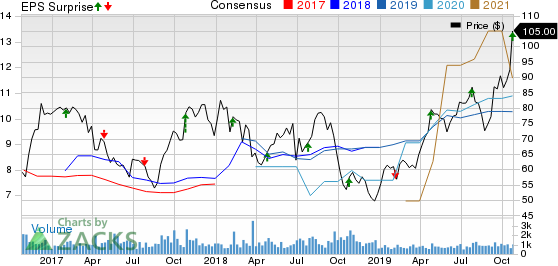

Group 1 Automotive, Inc. Price, Consensus and EPS Surprise

Group 1 Automotive, Inc. price-consensus-eps-surprise-chart | Group 1 Automotive, Inc. Quote

Q3 Highlights

Revenues from new-vehicle retail sales rose 7.3% to $1.65 billion. The same from used-vehicle retail sales improved 9.8% to $869.7 million. However, revenues from wholesale used-vehicle sales declined 1.5% to $85 million.

For the Parts and Service business, the top line improved 8.2% to $383.5 million. Revenues from the Finance and Insurance business rose 9.9% to $127.6 million.

Segments in Detail

Revenues in the U.S. business segment grew 10.1% year over year to $2.42 billion. The segment’s gross profit rose 9.8% year over year to $387 million. In the reported quarter, retail new-vehicle and used-vehicle, and wholesale used-vehicle units sold were 33,041; 31,505 and 7,565, respectively.

Revenues fell 0.2% year over year to $584.6 million for the U.K. business segment. Gross profit was $65 million, marking a 5.4% fall from the third quarter of 2018. In the quarter, retail new-vehicle and used-vehicle, and wholesale used-vehicle units sold were 9,329; 8,573 and 4,894, respectively.

Revenues for the Brazil business segment grew 7.7% year over year to $110.9 billion. However, the segment’s gross profit declined 2.2% year over year to $13.6 million. In the reported quarter, retail new-vehicle and used-vehicle, and wholesale used-vehicle units sold were 2,262; 1,219 and 430, respectively.

Financial Details

Group 1 Automotive’s cash and cash equivalents grew to $41 million as of Sep 30, 2019, from $15.9 million as of Dec 31, 2018. Long-term debt was $356.8 million as of Sep 30, 2019, marking a decline from $366.7 million recorded as of Dec 31, 2018.

Zacks Rank & Stocks to Consider

Group 1 Automotive currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Auto-Tires-Trucks sector are BRP Inc DOOO, currently sporting a Zacks Rank #1 (Strong Buy), and Lithia Motors, Inc LAD and America's Car-Mart, Inc CRMT, carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BRP has an expected earnings growth rate of 18.4% for 2019. The company’s shares have gained 68.1% year to date.

Lithia Motors has an estimated earnings growth rate of 13.2% for 2019. Its shares have gained 102.1% year to date.

America's Car-Mart has an estimated earnings growth rate of 21.2% for 2019. Its shares have gained 24.2% year to date.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

America's Car-Mart, Inc. (CRMT) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance