GrowGeneration (NASDAQ:GRWG) shareholders are still up 731% over 3 years despite pulling back 26% in the past week

The GrowGeneration Corp. (NASDAQ:GRWG) share price has had a bad week, falling 26%. But over three years the performance has been really wonderful. Indeed, the share price is up a whopping 731% in that time. Arguably, the recent fall is to be expected after such a strong rise. The only way to form a view of whether the current price is justified is to consider the merits of the business itself. We love happy stories like this one. The company should be really proud of that performance!

Although GrowGeneration has shed US$614m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for GrowGeneration

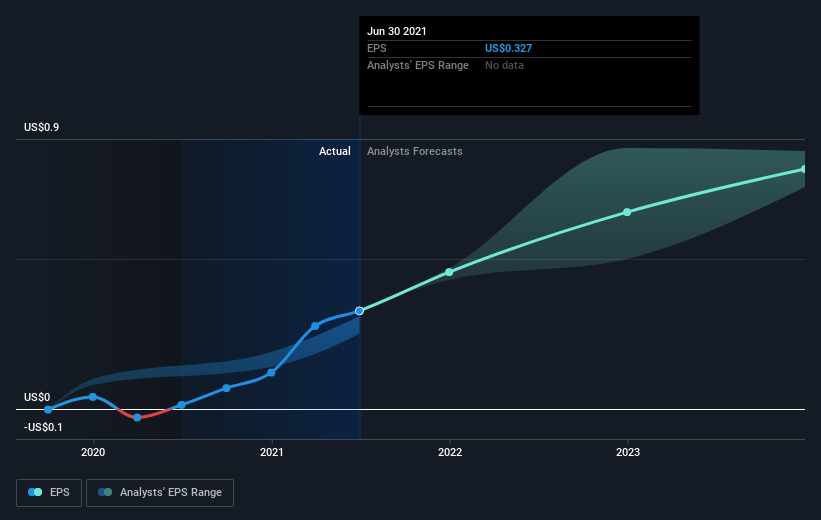

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, GrowGeneration moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on GrowGeneration's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that GrowGeneration rewarded shareholders with a total shareholder return of 138% over the last year. That gain actually surpasses the 103% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - GrowGeneration has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course GrowGeneration may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance