GSK's (GSK) PD-1 Inhibitor Drug Meets Lung Cancer Study Goal

GSK plc GSK announced that its phase II PERLA study, which evaluated the PD-1 inhibitor drug Jemperli (dostarlimab) in non-small cell lung cancer (NSCLC) indication, met its primary endpoint of objective response rate (ORR).

The study evaluated the combination of Jemperli and chemotherapy against the combination of Merck’s MRK Keytruda (pembrolizumab) and chemotherapy in first-line patients with metastatic non-squamous NSCLC. Per GSK, the PERLA study was not designed to demonstrate the superiority of Jemperli over Keytruda in NSCLC indication.

GSK did not share any clinical data on how Jemperli fared against Merck’s Keytruda. The company expects to present the full results from the study later at a medical meeting.

Jemperli was approved by the FDA last year under the accelerated pathway to treat adult patients with mismatch repair-deficient (dMMR) recurrent or advanced endometrial cancer and solid tumors. The drug is yet to be approved by any regulatory authority across the globe for NSCLC indication.

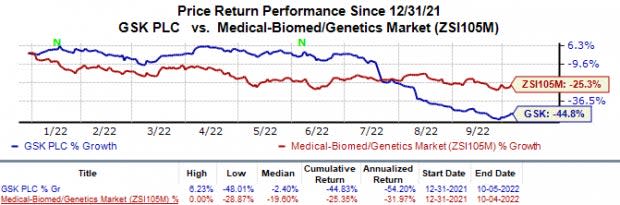

Shares of GSK have plunged 44.8% in the year so far compared with the industry’s 25.4% decline.

Image Source: Zacks Investment Research

Apart from the above news, GSK also announced that it is advancing the phase II/III COSTAR Lung study into late-stage development. The study is evaluating the combination of Jemperli and chemotherapy drug docetaxel, with or without GSK’s investigational TIM-3 inhibitor cobolimab against docetaxel in patients with advanced NSCLC who have been treated with an anti-PD-L1 therapy and chemotherapy.

Jemperli and cobolimab were developed by GSK in collaboration with AnaptysBio ANAB. GSK and AnaptysBio entered into an agreement in 2014 to develop therapies targeting immuno-oncology indications. Jemperli and cobolimab were originally discovered by AnaptysBio and licensed to GSK, which is responsible for the development, commercialization and manufacturing of these inhibitors. Once the first patient is dosed in the phase III portion of the COSTAR Lung study, AnaptysBio is eligible to receive $5 million as a milestone payment from GSK. This payment is expected to be triggered in fourth-quarter 2022.

GSK’s Jemperli is one of the most recently approved PD-1 inhibitors available in the market. The drug faces stiff competition from Keytruda, a blockbuster PD-1/PD-L1 inhibitor drug developed by Merck. A key revenue generator for Merck, Keytruda is approved for the treatment of many cancer indications globally. During second-quarter 2022, Merck recorded $5.3 billion worth of sales from Keytruda. Sales of Keytruda continue to grow driven by continued uptake in lung cancer and increasing usage in other cancer indications.

GSK PLC Sponsored ADR Price

GSK PLC Sponsored ADR price | GSK PLC Sponsored ADR Quote

Zacks Rank & Stocks to Consider

GSK currently carries a Zacks Rank #3 (Hold). Another better-ranked stock in the overall healthcare sector is Novartis NVS, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Novartis’ 2022 earnings per share have increased from $6.06 to $6.07. Shares of Novartis have lost 11.6% in the year-to-date period.

Earnings of Novartis beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 1.39%, on average. In the last reported quarter, NVS delivered an earnings surprise of 3.31%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

AnaptysBio, Inc. (ANAB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance