Guess? (GES) Gains on Q4 Earnings Beat, Strategic Plan Update

Guess? Inc. GES reported fourth-quarter fiscal 2021 results, with the bottom line cruising past the Zacks Consensus Estimate. However, both earnings and revenues declined year over year. Revenues continued to bear adverse impacts from the pandemic-induced reduced demand, temporary store closures as well as capacity constraints. However, the company somewhat compensated for the revenue softness with reduced SG&A expenses, thanks to its expense savings. Certainly, gross margin expansion and robust expense management was an upside.

Also, Guess? is benefiting from customers’ solid response to its assortment as well as strength in its digital business, which performed well in the fourth quarter. Apart from this, the company has been focused on its five-year strategic plan that was unveiled in December 2019. Impressively, shares of the company gained 6.8% during the after-market trading session on Mar 31. Further, this Zacks Rank #3 (Hold) stock has surged 83.5% in the past six months compared with the industry’s growth of 22.3%.

Talking of the strategic plan, the company is committed toward its six key strategies and has made remarkable progress against each of them in fiscal 2021, amid the pandemic. The core strategies include organization and culture, functional capacities, brand relevance, customer focus, product brilliance and international footprint. Management targets achieving operating margin of 10% by fiscal 2025. Net revenues are expected to be $2.9 billion, indicating a CAGR of 2% from fiscal 2020. Further, management intends to double its earnings per share to $3 by fiscal 2025, from $1.33 recorded in fiscal 2020.

Quarter in Detail

Guess? posted adjusted earnings of $1.18 per share, which came significantly ahead of the Zacks Consensus Estimate of 57 cents. However, the bottom line declined 3.3% from earnings of $1.22 recorded in the year-ago quarter. Notably, share repurchases had a positive impact of 7 cents on adjusted earnings per share.

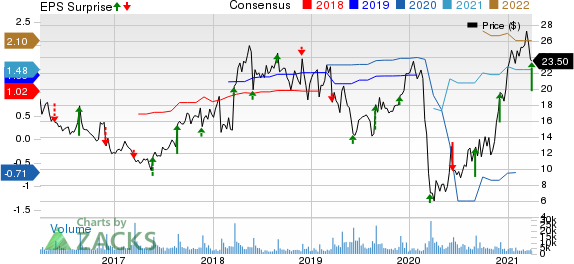

Guess, Inc. Price, Consensus and EPS Surprise

Guess, Inc. price-consensus-eps-surprise-chart | Guess, Inc. Quote

Net revenues amounted to $648.5 million, which missed the consensus mark of $657 million. Also, the metric tumbled 23% year over year. On a constant-currency (cc) basis, net revenues declined 25.9%.

The company’s gross margin expanded 240 basis points (bps) to 42.6%. As a percentage of sales, SG&A expenses increased from 28.1% to 31.1%.

During the quarter, adjusted earnings from operations slumped 27% to $74.2 million. Adjusted operating margin contracted 70 bps to 11.4% on account of overall expense deleverage stemming from adverse COVID-19 impacts on the company’s revenues and global operations. This was somewhat compensated by reduced expenses.

Segment Performance

Revenues in the Americas Retail segment declined 24.2% (or 24% at cc) year over year. Retail comp sales including e-commerce fell 15% (also at cc). Operating margin expanded 640 bps to 12.8% thanks to reduced store occupancy costs and store selling expenses along with lower markdowns. This was somewhat negated by deleveraging impact of negative comp sales stemming from reduced traffic amid COVID-19.

Net revenues in the Americas Wholesale segment dropped 15.3% (or 14.1% at cc) year over year. Further, operating margin expanded 390 bps to 23.5% mainly driven by increased selling prices as well as lower sales discounts and allowances.

The Europe segment's revenues tumbled 26.8% (31.8% at cc) year over year. Retail comp sales including e-commerce climbed 2% (fell 5% at cc). Operating margin contracted 620 bps to 12.7% owing to expense deleverage stemming from the pandemic-led soft revenues, together with unfavorable timing shift of wholesale shipments to the first quarter of fiscal 2022. These were partially made up by elevated initial markups, rent concessions and government subsidies.

Asia revenues plunged 16.2% on a year-over-year basis. The metric dropped 20.7% at cc. Retail comp sales, including e-commerce, declined 18% (or 22% in cc). Operating margin expanded 340 bps to 5% on the back of reduced expenses — partly offset by adverse deleverage effect.

Licensing revenues advanced 12% year over year. Operating margin soared 820 bps to 95.3% on reduced expenses.

Other Updates

The company exited the quarter with cash and cash equivalents of $469.1 million as well as long-term debt and finance lease obligations of $68.5 million. Further, stockholders’ equity was $543.7 million. Net cash provided by operating activities in fiscal 2021 amounted to $209.1 million.

The company announced a quarterly dividend of 11.25 cents per share, which is payable on Apr 30, 2021 to shareholders as of Apr 14.

COVID-19 Update

Toward the end of the fiscal third quarter, Guess? had begun a new round of government-mandated temporary store closures, mainly in Europe. While the number of temporary closures varied throughout the quarter, on an overall basis, these stores were closed for more than 15% of the total days in the fourth quarter of fiscal 2021. As of Jan 30, 2021, more than 70% of the company’s stores were open, with most of the closed stores being located in Europe and Canada. As of Mar 27, nearly 77% of the company’s stores were open.

Outlook

For the first quarter and fiscal 2022, the company is not offering any detailed view owing to the uncertainty surrounding coronavirus. However, the company offered revenue growth guidance for the first quarter and fiscal 2022 from the pre-pandemic level (fiscal 2020) to offer a relatively normalized comparison.

Guess? envisions first-quarter 2022 net revenues to decline in high single digits from the fiscal 2020 level, owing to the pandemic-induced store closures and reduced traffic. This is likely to be somewhat made up by strength in the company’s global e-commerce business and favorable timing shift of European shipments from the fourth quarter to the first quarter of fiscal 2022.

For fiscal 2022, management expects revenues to decline in high single digits from fiscal 2020, considering that there will not be any pandemic-related closures after the first quarter. Also, the guidance includes expectations of a back to normal pace of product development and shipments in the European wholesale business.

3 Solid Textile-Apparel Picks

Crocs CROX, with a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 15%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gildan Activewear (GIL), with a Zacks Rank #1, has a long-term earnings growth rate of 9%.

G-III Apparel GIII, with a Zacks Rank #, has a long-term earnings growth rate of 11.6%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Guess, Inc. (GES) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance