A guide to investing in Australian Stocks

Back in June Warren Buffett told the world that he was making his first investments in Australia. The Oracle of Omaha has already announced plans to build up an equity stake in Insurance Australia Group, and has also revealed 'there is a good chance that five years from now, we will have bought one or more positions in Australian banks.' Buffett admitted that he was making these investments at the age of 84, but 'it’s been worth waiting for. Better late than never and better the best than never. So here we are in Australia and I'm delighted to be there.'

Buffett is not the only one getting excited about Australia. A growing number of subscribers have been asking us to introduce Australasian data, so many readers will be glad to know that we will be covering Australia and New Zealand in the very near future. We've put this article together to provide an overview of the investment scene down under and explain how subscribers can get involved…

Why?

In the field of economic history many academics have tried to explain different growth rates across countries by looking at differences in institutions (eg. legal structures) on the one hand and endowments (eg. natural resources) on the other. Australia is fortunate in that it is rich in natural resources and it also has political and legal frameworks that are conducive to economic growth. Natural resources including coal, iron and natural gas have attracted a steady stream of foreign investment since the middle of the 19th century. Between 1992 and 2007 demand for natural resources, particularly from emerging economies, helped Australia’s economy grow at around 3.6% per year, well above the OECD average rate of 2.5%.

These trends were also supported by Australia’s political and legal systems. The Australian Securities & Investments Commission regulates the securities industry, while the Reserve Bank of Australia helps coordinate the country's monetary policies. These institutions have worked to promote an environment where businesses can thrive and investors can feel safe. According to the World Bank, Australia ranks 10th in the world when it comes to ease of doing business - just two places behind the UK. The World Bank also ranks Australia as the fastest place in the world to start a business, with regulatory procedures taking just two days compared to OECD average of 15 days.

There are other reasons UK investors should be looking to the Australia to broaden their horizons. International diversification is important. Investors can reduce risk by spreading their portfolio across a range of geographies. This is partly because international stock markets are less closely correlated. Some zig when others zag. We can see from the chart above that during the dotcom crash (2000 through to 2002) Australia’s ASX 200 suffered less than the FTSE 100 and the S&P 500. The ASX 200 then went on to generate higher returns during the bull market leading up to 2008.

Investors can also gain exposure to different industries by investing across geographies. The pie charts below compare the sector breakdowns of the ASX 200 against the S&P UK and the S&P 500. The ASX 200 is generally more exposed to the financial and materials sectors. We can also see that IT stocks constitute less than 1% of the ASX 200, compared to nearly 20% of the S&P 500. This helps to explain why the Australian market performed better than the US when the dotcom bubble burst.

What?

What are the main Australian exchanges?

The two main exchanges in Australia are the Australian Securities Exchange (ASX) and the National Stock Exchange of Australia (NSX).

Australian Securities Exchange (ASX)

The ASX is the world’s 8th largest equity market by market capitalisation. Over 2,000 companies are listed on this exchange, including Woolworths Limited, Australia’s largest food retailer, Coca-Cola Amatil, one of the world’s five major Coca-Cola bottlers, as well as Australia’s mining giants - two of which BHP Billiton and Rio Tinto are very familiar to UK investors. Investors can take comfort from the fact that companies wanting to list on the ASX must meet minimum admission criteria relating to structure, size and number of shareholders.

Full listing requirements are clearly outlined on the ASX website. In terms of trading hours, the ASX has pre-market session from 7:00am to 10:00am (Sydney time) while normal trading takes place from from 10:00am to 4:00pm (see here).

National Stock Exchange of Australia (NSX)

The National Stock Exchange of Australia (NSX) is the second largest stock exchange in Australia. It is a much smaller exchange with over a hundred listed securities and a combined market capitalization in excess of $4.0 billion. The NSX tries to cater for less established companies and the listing requirements are less strict than the ASX. The NSX has no minimum price rule. The asset test only requires companies to have a $5million minimum market cap (vs. $10million on the ASX). The profitability test only requires companies to have a ‘two-year adequate track record’, or the IPO must be ‘underwritten by an approved underwriter’. Other key differences in listing criteria can be found on the NSX website.

What are the major Australian indices?ASX benchmarks

Many investors like to assess their own performance by comparing the returns of their portfolio against a market benchmark. UK investors usually compare their portfolio against the one of the well known FTSE indices (eg. the FTSE 100). The main benchmark in Australia is the S&P/ASX 200, which measures the performance of the 200 largest stocks on the ASX by market capitalisation. Readers may assume that the index is exposed to a wide range of industries, as it covers approximately 80% of Australian equity market. However, the index is actually highly exposed to Australia’s financial sector (see above). The four largest companies are all banks and constitute 27% of the index’s market capitalisation (see here). Australia’s mining giants, including BHP Billiton and RIO Tinto, are also part of this index, taking up 5.4% and 1.5% of the index’s weighting respectively.

If investors wanted to compare their performance against a wider range of stocks, they may want to take a look at the S&P/ASX 300, which includes up to 300 of Australia’s largest companies by market capitalization. ‘Narrower’ indices include the S&P/ASX 20 and the S&P/ASX 50. These comprise of the largest 20 and 50 companies by market cap respectively.

ASX Sector indices

Investors interested in a particular sector or industry can gauge whether they are beating the market by comparing their performance against one of the ASX sector indices. These indices group companies according to their business activity. For example, the S&P/ASX 200 Energy Index comprises companies that operate in the oil and gas sector, while the S&P/ASX 200 Health Care Index encompasses companies that manufacture health care equipment and supplies or provide health care related services.

ASX Strategy indices

Investors like to devise their own investment strategies. For example, they may have stock picking methods designed to hunt down high yield dividend stocks. Investors may want to compare their portfolios against the ASX strategy indices, which have been designed to track the performance of a particular investment strategy. For example, the ASX Dividend Opportunities Index offers exposure to 50 high yielding common stocks from the Australian equity market.

When do Australian companies file financial reports?

The Australian Securities Exchange requires companies to file financial reports on a half yearly and annual basis (see here). Certain companies with no track record of revenue or profit must also prepare and file quarterly cash flow statements. In addition, mining and oil & gas exploration companies file quarterly reports on activities including changes in tenement interests, issued and quoted securities.

Many UK investors use the LSE’s Regulatory News Service (RNS) to keep track of developments in the financial markets. Investors can use the ASX company directory to follow events in Australia. Investors can pull up a list of company announcements simply by clicking on a company’s ASX code (see image below). Alternatively, investors can search for company specific news by using ASX website’s search engine (see here). The ASX website also enables investors to filter company announcements to hone in on ‘Financial & Periodic Reports’ as well as the ‘Chairman’s Address’, ‘Price sensitive’ information, and other useful reports.

How?Which UK brokers trade Australian shares?

Investors will of course be wondering which UK brokers provide access to Australasian markets. Sadly, the UK’s very biggest DIY platform - Hargreaves Lansdown - does not provide access to Australian markets which is a considerable oversight.

We’ve put together this list for UK investors seeking to trade down under:

Readers should of course remember that brokers usually make money regardless of whether clients' shares go up or go down, mainly through fees and commissions. Investors should therefore take care to ensure that trading costs do not eat into profits. When it comes trading commissions, one of the cheapest brokers for trading Australian shares is the Dutch based DeGiro. They charge the equivalent of €10.00 per trade, in addition to 0.05% of the trade’s value. Many readers will be disappointed to learn that DeGiro does not offer ISA or SIPP accounts just yet, though they claim these will be available soon.

Two other brokers which levy low commissions are Saxo Bank and Interactive Brokers. They charge minimum commissions of AUD15 (£6.90) and AUD6 (£2.76) respectively. At the other end of the spectrum are brokers like Killik & Co who charge more than £100 per trade. The standard dealing commission is £70, and they charge another £30 for 'local agent charges', plus £10 'as a contribution towards regulatory compliance'. Many brokers state their rates in foreign currencies, so we’ve converted the fees into sterling to help investors make a meaningful comparison (see below).

Watch the forex charges

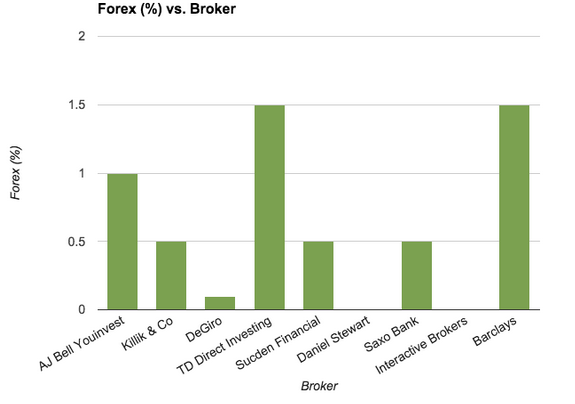

Brokers skim even more money through foreign exchange fees. Investors can't buy Australian stock unless they have Australian dollars. Brokers usually convert your hard earned pounds into dollars behind the scenes and charge you a variable rate of commission in the process (see below).

Do UK investors pay tax on Australian shares?Capital gains tax:

In many cases non-residents would not need to pay capital gains tax in Australia. Non-residents may be subject to Australian capital gains tax (CGT) on assets that are classified as 'Australian taxable property' - essentially real property, or indirect investments in real property. Under Australia's CGT regime, equity investments are treated as indirect investments in property if:

Investors may need to pay capital gains tax in Australia if both of these conditions are met. For example, investors could disregard CGT if they invest in 2% of a company that has 60% of its assets in property.

UK investors will be glad to know that no stamp duty is payable on share transactions throughout Australia. That is not to say that Australia is a tax haven. Investors would still be subject to UK Capital Gains Tax when they sell Australian shares. The only way to shelter from UK capital gains tax would be to invest in a tax-efficient wrapper - either an ISA (individual savings account) or a SIPP (self invested personal pension).

Dividends:

The dividends paid by Australian companies can be 'franked' or 'unfranked'.

We do not profess to be tax experts or advisors, so investors should of course do their own research and seek the appropriate professional advice. These resources could help investors get started:

Spread betting is banned in many countries, but it is legal the UK and has many tax benefits. Gains made on trading stocks are classed as betting gains and are thus exempt from UK stamp duty, while profits are not liable to UK capital gains tax. If betting is your profession you do have to declare gains as income for tax purposes.

Conclusions

The Australian economy has been under pressure in recent years. Depressed prices for mined commodities combined with slowing growth in China and other emerging markets has had a negative impact in Australia, where the economy seems to be shifting into a lower gear. Many investors may be scared, but this may create investment opportunities. The great Warren Buffett says that investors should 'be fearful when others are greedy and greedy when others are fearful'. We’ve put this article together to provide a basic outline of the investment scene in Australia, but we are keen to hear your views. If readers have any experience of investing down under, do please feel free to leave your own opinions below...

Read More about BHP Billiton on Stockopedia

Discuss BHP Billiton on Stockopedia

Yahoo Finance

Yahoo Finance