A guide to investing in Singapore

Back in 2008 Jim Rogers, who co-founded Quantum Fund with financier George Soros, wrote that ‘Asia is the future’. So at the age of 65 he, his wife, and two daughters packed their bags and moved East - not to China, but to Singapore which is exposed to the Chinese economy and has been described by Rogers as ‘an open and vibrant place to be.’

Indeed, a growing number of investors wanting to gain exposure to the emerging markets have started to target Singapore. In the coming months, Stockopedia will be expanding its data coverage to include Singaporean equities and we have put this guide together to help investors get started.

Why?

Investors that were hoping to invest in an economic miracle may want to take a closer look at Singapore. The tiny city-state does not have much to offer in terms of natural resources, but it was able to transform itself from a ‘third world’ to a ‘first world’ economy in the decades after the second world war. Singapore now boasts amongst the highest GDP and employment levels in the world. The city is also home to second highest number of millionaires by capita in the world. Let’s take a closer look at the factors driving this success story.

The Switzerland of Asia

Commerce is in Singapore's blood. The city was founded in the early nineteenth century as a trading outpost by the East India Company. The island was ideal for trading. Lee Kuan-Yew, the country’s Prime Minister from 1959 to 1990 pointed out that “this is not Jamaica or Bahamas or Fiji. This is a little island strategically placed at the southernmost end of Asia, connecting the sea routes between the Indian Ocean and the Pacific.” The island’s location helped Singapore evolve into a global trading hub - the world’s third-busiest port in terms of cargo tonnage and the fourth biggest centre for foreign exchange.

Vibrant finance and infrastructure industries have sprung up around this commercial hub. Singapore has around 20% of the world market for ship repair and the country’s ports can accommodate around 1,000 ships at a time, including oil tankers as long as three football fields (see here). It is perhaps unsurprising that some of the biggest infrastructure firms in the world, including Hutchison Port Holdings, which until recently was the world’s largest port operator, are listed in Singapore. Global Logistic Properties, a global leader in the provision of logistics facilities, also trades on the Singapore Exchange

Looking beyond infrastructure, Singapore is a global currency and derivative trading hub. According to the SGX website the island state is home to more than 600 financial institutions and is ‘consistently ranked as the world’s fourth most active trading centre, after London, New York and Tokyo’ (see here). In addition, the country’s low-taxation regime has helped Singapore become one of the fastest growing wealth management centres in the world, described by some as the ‘Switzerland of Asia’.

Political & Legal Framework

Singapore has benefited from a prolonged period of political stability. Lee Kuan-Yew was in office for 31 years until 1990 and one-party rule meant that the country’s highly educated technocrats could plan economic affairs with long-term goals in mind. Over the decades the city’s bureaucrats worked to create a political and legal framework which many reputed financial institutions now agree is conducive to economic growth. The World Bank points out that "it takes an entrepreneur just over six working days to get a new business going in Singapore, with low start-up costs. Overall, taking into account other factors, including business licensing, taxes, credit legal rights and investor protection, Singapore has about the most business-friendly regulation in the world."

Indeed, the World Economic Forum ranked Singapore as the most open economy in the world, while Transparency International ranks it as the 7th least corrupt in the world. It was these factors which helped make Singapore an attractive destination for foreign direct investment, ranking first in the Asia Pacific Investment Climate Index in 2014 (see here). Furthermore, according to The Economist’s ‘Business Environment Rankings’ Singapore ‘looks set to remain the world’s most investor-friendly location in 2014 - 2018.’

UK investors should also consider investing in Singapore because international diversification reduces risk. This partly because international stock markets are less closely correlated. The chart below shows that the STI Index massively outperformed the FTSE during the bull run leading to 2008 and is currently around 20% higher than its 2000 starting point, while the FTSE is in negative territory.

So the case for investing in Singapore is strong, but what exactly would readers be investing in?

What?What are the main Singaporean stock exchanges?Singapore Exchange (SGX)

The main exchange in Singapore is the Singapore Exchange (SGX) which has a total market cap of around US$751 billion. 768 companies are listed on its exchange. Current listings include Singapore Airlines - the flag carrier of Singapore and the launch customer of Airbus A380, the world's largest passenger aircraft.

Many other famous brands that we see all around us have listings in Singapore. If you’ve ever travelled abroad you may have been lucky enough to stay in a Mandarin Oriental hotel. These luxury hotels tend to be located at the heart of the world’s most cosmopolitan cities and have been rated as five star by Forbes Travel Guide. If you’ve travelled to the Far East, the chances are that you’ve shopped at a supermarket operated by Dairy Farm International - one of the largest retailers in Asia. Both Dairy Farm and Mandarin Oriental are listed in Singapore. Singapore’s capital markets serve not only the domestic economy, but also a wide range of Far Eastern companies, with around 40% of listed firms hailing from beyond Singapore's shores. For example Thai Beverage, one of the largest beverage companies in the Far East has headquarters in Thailand and is listed in Singapore.

Mainboard vs. Catalist

The SGX has two main listing boards: the Mainboard and Catalist. The Mainboard caters for larger, more established enterprises, while Catalist caters for younger companies that seek to accelerate growth. The listing requirements for the Mainboard are tighter. Companies seeking to IPO must have generated pre-tax profits of at least S$30m (£13.75m) during the latest financial year, or list with a market capitalisation over S$150m (£68.7m). Companies do not need to pass a profitability test or have a minimum market cap to list on the Catalist board (see here). Companies listed on Catalist could potentially carry higher investment risk when compared with larger or more established companies listed on the Main Board. This is not only because companies can list on Catalist without a track record of profitability, but also because Catalist stocks can be less liquid and harder to trade.

What are the major Singaporean indices?The main indices

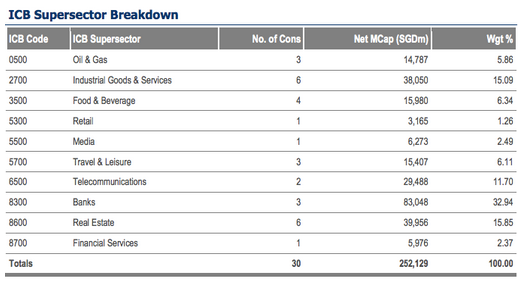

The FTSE Straits Times Index (STI) is regarded as the main benchmark index for the Singapore stock market. It tracks the performance of the 30 largest SGX companies by market cap and covers around three-quarters of the Singaporean equity market. Although it represents such a large chunk of the Singapore stock market, the index is heavily weighted towards a narrow range of industries. Banks, real estate, and industrial goods and services respectively take up 33%, 15.9% and 15.1% of the index's weighting (see below).

Investors who want to compare their performance against a wider range of companies may take a look at the ST All Share Index, which represents around 98% of Singapore market capitalisation and is of course comparable to the FTSE All Share in the UK.

Many private investors in the UK try to identify hidden gems amongst smaller cap companies. A good place to hunt for similar opportunities in Singapore could be the FTSE ST Small Cap Index, which covers smaller companies and represents approximately around 12% of Singapore's market capitalisation. Large and Mid Cap stocks are covered by the ST Large & Mid Cap Index and the ST Mid Cap Index respectively.

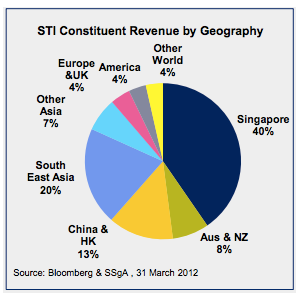

We can also see from the pie chart that STI companies generate revenues from a wide range of regions and geographies. 40% of revenues are generated in Singapore, while around 23% are generated in China and the Far East. A further 8% are generated in Australia and New Zealand.

Regional & industry indices

Investors who wanted to increase (or limit) their exposure to Chinese stocks that are listed in Singapore may want to include (or exclude) companies that are constituents of the ST China Index and the ST China Top Index - the two 'China' themed indices in the ST Index Series. The ST China Index covers stocks that ‘have the majority of their sales revenue derived from or operating assets located in China’. The ST China Top Index is a subset of the ST China Index and tracks the performance of the 20 largest Chinese-listed companies on the SGX Mainboard.

Given that Singapore is one of the world’s largest trading ports, investors who want to take advantage of this can look for investment opportunities within the ST Maritime Index. This aims to ‘capture the performance of companies that earn a substantial proportion of their revenue from maritime related activities.’ To be included ‘in the index a company is required to have greater than 55% of total revenue from maritime related activities.’

How?Which brokers provide access to Singaporean markets?

To access these investment opportunities, UK investors will of course need to use a broker that provides access to Singaporean stocks. The list is quite short unfortunately, but some of the brokers that trade Singapore are:

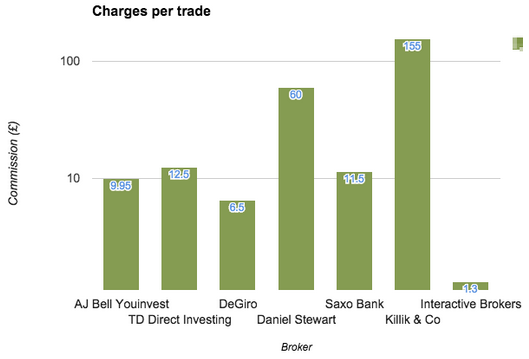

One of the more expensive brokers is Killik & Co, who charge £70 as a standard dealing commission, plus another £75 for 'local agent charges' and £10 'as a contribution towards regulatory compliance'. Cheaper brokers include DeGiro who charge €10.00 per trade (in addition to 0.05% of the trade’s value) and Interactive Brokers who levy a minimum commission of US$2. We’ve put together these charts to help readers compare the commissions and forex charges levied by each broker on the list above.

Do UK investors pay tax on Singaporean shares?

Singapore is a low-tax jurisdiction and in most cases nonresident shareholders would not need to pay taxes to local authorities. There is no capital gains tax in Singapore. Therefore resident and non-resident investors are not charged capital gains tax when they sell stocks. Furthermore, there is no withholding tax levied on dividends paid by Singapore companies, so investors usually receive the dividend in full, without a tax deduction at source.

We are not saying that Singapore is a tax haven. UK investors would still need to pay UK Capital Gains Tax. The only way to shelter from UK capital gains tax is to invest in a tax-efficient wrapper, either an ISA (individual savings account) or a SIPP (self invested personal pension).

Alternatively, investors could gain exposure to Singaporean equities using a spread betting account. Gains made on trading stocks are classed as betting gains and are usually exempt from UK stamp duty, while profits are exempt UK capital gains tax (unless betting is your profession, in which case you do have to declare gains as income for tax purposes).

Of course, we are not tax experts and investors should seek appropriate professional advice before getting started.

Conclusions

As we go forward, we hope to provide investors with the essential information needed to make decisions on stocks that trade in Singapore. We will produce StockReports and StockRanks for Singaporean stocks and also show which companies qualify for the GuruScreens. This article was put together to provide a basic overview of the investment scene in Singapore and explain how investors can get started in the ‘Switzerland of Asia’. Nevertheless, we are just starting out in these markets and are keen to hear everyone’s views. If investors have any experience of investing in the Far East, do please leave your own opinions below.

Read More about Emerging Markets on Stockopedia

See the latest Stockmarket News, Commentary & Analysis on Stockopedia

Yahoo Finance

Yahoo Finance