A Guide to Investing in New Zealand

In his excellent book, One Up One Wall Street, Peter Lynch explains that he loves 'dull' companies in 'no-growth' industries. “I get even more excited when a company with a boring name also does something boring”. Could the same perhaps be said for countries? If I asked you to name a dynamic growth economy, you'd probably mention one of the BRICs, like China or India. New Zealand would probably be the last country to spring to mind. One of our Directors at Stockopedia is a Kiwi, but despite the risk of getting fired I think it is safe to say that New Zealand meets Lynch's criteria - it’s a pretty boring place. It may have a great rugby team, but it doesn't have the growth story of an emerging market and it isn't particularly well known as a hub for glamorous industries, like Silicon Valley is for tech. So would Lynch think there is a strong case for investing there? Let's take a look…

International Value Investing

The reason Lynch likes boring companies is that they may to be overlooked by most investors and could therefore be cheap or undervalued. Cheaper stocks often beat expensive stocks. Research by Meb Faber also suggests that cheaper countries outperform more expensive ones. Faber recently calculated a composite valuation rank for 43 nations (see here). For each country he calculated the:

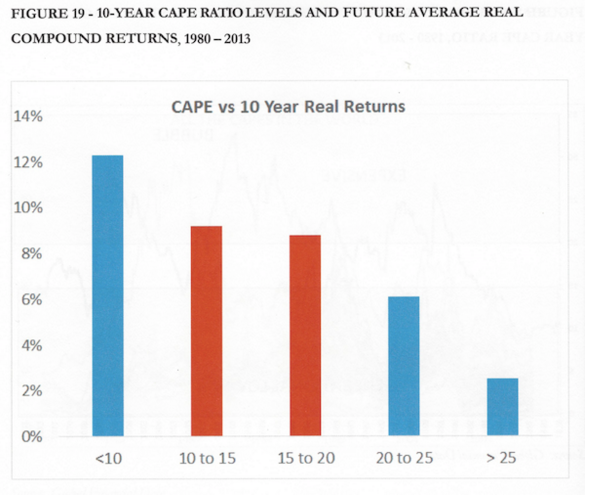

'Blue chip' economies like the US, Germany and Japan were amongst the more expensive countries. Emerging markets like China and South Africa were also more expensive. Cheaper stocks may be riskier, with a higher chance of bankruptcy. So it is interesting to see that Greece and Portugal were amongst the cheapest countries. We can see from the chart below, extracted from Faber's excellent book, Global Value, that nations with lower (ie. cheaper) CAPE ratios beat more expensive countries between 1980 and 2013.

So where does New Zealand fit into all this? Figures from Meb Faber's Idea Farm suggested that in early 2015 New Zealand was the 14th cheapest country in the world - out of a possible 43 (see here).

Exposure to Emerging Markets

So is New Zealand one of the cheaper countries because there are no bullish points whatsoever? Perhaps not. New Zealand is well placed to take advantage of growth in emerging markets given that it is located between Asia and South America. China is one of the country's largest trading partners and economic growth in emerging markets could stimulate demand for consumer goods. This is exciting news for New Zealand given that the country's temperate climate, high rainfall, clean waters and fertile land make it an ideal location for producing quality food and beverages. Indeed, one third of global trade in dairy products is generated by New Zealand. According to the country's government website, there are nearly 4000 food and beverage firms in New Zealand. Amongst those that are publicly listed are the A2 Milk Company, Cooks Global Foods and he Fonterra Co-operative Group. Two of these companies simply produce and commercialise milk. Sound boring? You bet! But that is why someone like Peter Lynch might take a second look.

Booming Oil and Gas Industry

New Zealand is also a fast-emerging oil and gas producer, with large underexplored basins in the Taranaki, West Coast and Southland regions. Between 2002 and 2013, petroleum and mineral exports grew at a computed annual rate of 10.5% per annum. The government also aims to increase petroleum exports ten-fold, from $3 billion to $30 billion a year by 2025. There are currently 890 petroleum and mineral firms in New Zealand. Publicly listed firms include the New Zealand Energy Corporation, New Zealand Oil & Gas Limited and New Zealand Refining Company Ltd.

What are the main stock exchanges and indices?

The main stock exchange in New Zealand is the New Zealand Exchange (NZX). Around 260 companies trade on this exchange, with a total market capitalisation of NZ $99.3bn (or £42.6bn). To list on the New Zealand Exchange, a company must be expected to have an overall market capitalisation exceeding $5m. Furthermore, unlike other major exchanges, there is no trading history requirement for listing on the NZX.

The main stock index in New Zealand is the S&P/NZX 50, which is a market cap weighted index, designed to measure the performance of the 50 largest stocks on the New Zealand Exchange. It covers around 90% of New Zealand equity market capitalisation. S&P/NZX ALL INDEX is considered to be the total market indicator for the New Zealand equity market. It comprises of all eligible securities quoted on the exchange. Investors wanting to track a smaller number of shares may be interested in either the S&P/NZX 10 or the S&P/NZX 15, which respectively measure the performance of the largest 10 and 15 companies within the S&P/NZX 50.

Do UK investors need to pay tax on New Zealand shares?

Dividends paid to non-resident shareholders are typically subject to the deduction at source of a 30% withholding tax. This rate usually reduces to 15% where a double tax agreement has been signed between New Zealand and the shareholder's country of residence. Such an agreement has been signed with the UK, as you can see here.

Non-residents would not normally need to pay taxation on the sale of shares. New Zealand does not have a formal capital gains tax regime. Furthermore, gains derived by non-residents from the sale of shares in New Zealand companies are not normally subject to income taxation. Investors would of course still need to pay tax to HMRC, unless they invested using an ISA or SIPP.

Which brokers provide access to New Zealand stock markets?

Unfortunately only three of the main UK brokers enable clients to trade stocks on the New Zealand stock exchanges. These are AJ Bell Youinvest, Redmayne Bentley and Killik & Co (see trading costs below). The Dutch broker, DeGiro have said that New Zealand will be ‘available soon’.

AJ Bell | Redmayne Bentley | Killik & Co | |

Commission per trade | £29.95 | £30 | £120 |

Forex Fee (% of trade value) | 1% | n/a | 0.5% |

Summary

New Zealand could be a major play on economic growth in the emerging markets. Investors may be particularly interested in the country's consumer goods and oil and mining sectors. We are in the process of adding New Zealand stock market data to the Stockopedia service and are likely to sell New Zealand and Australia as a bundle (ie. both countries within the same subscription package). If any investors have any experience in the New Zealand markets do please feel free to leave your own opinions below.

Read More about BHP Billiton on Stockopedia

Discuss BHP Billiton on Stockopedia

Yahoo Finance

Yahoo Finance