GuruScreen Movers - April 21st: Investing during the election

Within three weeks, the UK could have a new government. Parliament has already been dissolved and Britain will go to the polls on 7 May. Immediately after the last general election, the FTSE 100 fell by nearly 11%, as the major political parties vied to form a coalition government. Political uncertainty was not good news for markets back in 2010, and the 2015 election results could usher in another period of uncertainty.

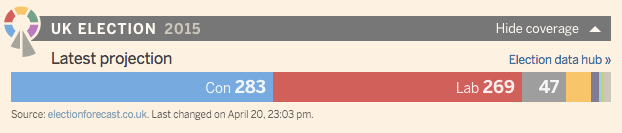

A recent poll, published on the Financial Times website, predicts that the Conservative and Labour Parties will secure 283 and 269 seats respectively (see below). This could mean that neither Mr Cameron nor Mr Miliband will be able to form a government with an absolute majority. Another coalition government - with either the Lib Dems or the SNP - could well be on the cards.

What will this mean for investors?

A coalition government could make investors nervous. The Lib Dems have revealed plans to increase the capital gains tax paid on shares from 28% to 35%.

A successful Conservative showing at the election could also spell a period of uncertainty for markets, given that Cameron has promised to hold a referendum on Britain's EU membership.

Furthermore, Mr Miliband has threatened to break up the 'big five' UK banks, and freeze gas and electricity prices until 2017. This could spell bad news for FTSE 100 giants, like SSE and HSBC.

Will the market overreact to this uncertainty, and could that present buying opportunities? Let's take a closer look at SSE and HSBC. Both companies qualify for Stockopedia's GuruScreens.

HSBC (HSBA)

HSBC qualifies for the Dividend Dogs Screen. To qualify, a company must have one of the highest dividend yields in the FTSE 100. HSBC supported a 5.3% yield in 2014 and is expected to support a 5.7% yield in 2015. However, it must be noted that HSBC has underperformed the market by 6% over the last twelve months, as earnings fell by 12% in 2014. At the extreme, HSBC could , be a dividend trap - a company that pays a high dividend as a result of a substantial fall in the share price, but may ultimately have to cut the dividend..

A Labour victory could bring bad news for HSBC, not only because of Miliband's threats to break up big banks, but also because the Labour Party has pledged to fund social projects by increasing taxes on the financial sector. HSBC's chairman, Douglas Flint, has hinted that the bank may relocate its London headquarters. He noted that:

"We are beginning to see the final shape of regulation [in the UK], the final shape of structural reform and as soon as that mist lifts sufficiently, we will once again start to look at where the best place for HSBC is."

SSE (SSE)

The energy giant, SSE, also faces political risk. Back in March, Deutsche Bank warned that UK energy companies face the riskiest election since 1992. This is partly because Miliband has promised that a Labour Government would reduce energy prices by 10%. These plans were revealed in mid-March. Since then, and perhaps ironically, SSE's share price has risen by 7%. That being said, the company has underperformed the market over the last month.

SSE, like HSBC, qualifies for the Dividend Dog Screen. The company trades on a 5.5% historic dividend yield and is also expected to support 5.8% yield in 2016. Does the company has enough cash to pay this dividend? In 2014, SSE generated £2.28 in operating cash flows per share. This is well above the 91p dividend that it is expected to pay in 2016. Furthermore, SSE's dividend cover is expected to increase from 0.4 (2014) to 1.3 (2015).

Conclusions

My own humble opinion is that the Con-Dem Government may remain in power. Opinion polls show that the Tories are just ahead of Labour, and opinion polls are usually biased against the incumbent government. A coalition government may take office. Having tasted power, the Lib Dems are unlikely to turn down the chance to stay in power. A coalition with the SNP may be possible, but the uncertainty surrounding the negotiations of such a deal could be beyond the pallet of some Tory MPs. Another Con-Dem Government could bring economic uncertainty, as the prospects of an EU referendum, coupled with higher capital gains taxes, may make investors jittery.

Want to learn more?

Stockopedia subscribers can filter the FTSE 100 and other major indices using our powerful screening tools. Alternatively, users can hone in on good quality companies trading at bargain prices by exploring the StockRanks Portal. If you wanted to learn more about valuation tools, then Stockopedia's free ebooks are a good place to start.

Read More about HSBC Holdings on Stockopedia

Discuss HSBC Holdings on Stockopedia

Yahoo Finance

Yahoo Finance